In the latest ranking of countries on the basis of tax competitiveness, the United States ranks 21st in the developed world – trailing behind countries like Canada and Sweden. Proposals by Joe Biden and the Democrats would make the U.S. even less competitive should they win the November election.

The nonpartisan Tax Foundation tracks competitiveness because “poorly structured tax systems can be costly, distort economic decision-making, and harm domestic economies.” They define a well-structured tax system as one that “is easy for taxpayers to comply with and can promote economic development while raising sufficient revenue for a government’s priorities.”

The United States has an overall ranking of 21 in the foundation’s study, noting the country “has become more competitive in recent years” thanks to a variety of reforms – notably those championed by the Trump administration.

On the other hand, the Tax Foundation study notes the U.S.’s competitive gains could be diminished in future years by:

Proposals like increasing the U.S. corporate tax rate or implementing new, distortive tax policies, such as a wealth tax or corporate surtax, could reduce U.S. competitiveness at a time when businesses are already struggling and countries around the world are making their tax codes simpler and more attractive for investment.

Those, of course, are policies championed by Joe Biden and the Democrats during this 2020 election season. For example, Biden is proposed increasing the corporate tax rate from 21 percent to 28 percent.

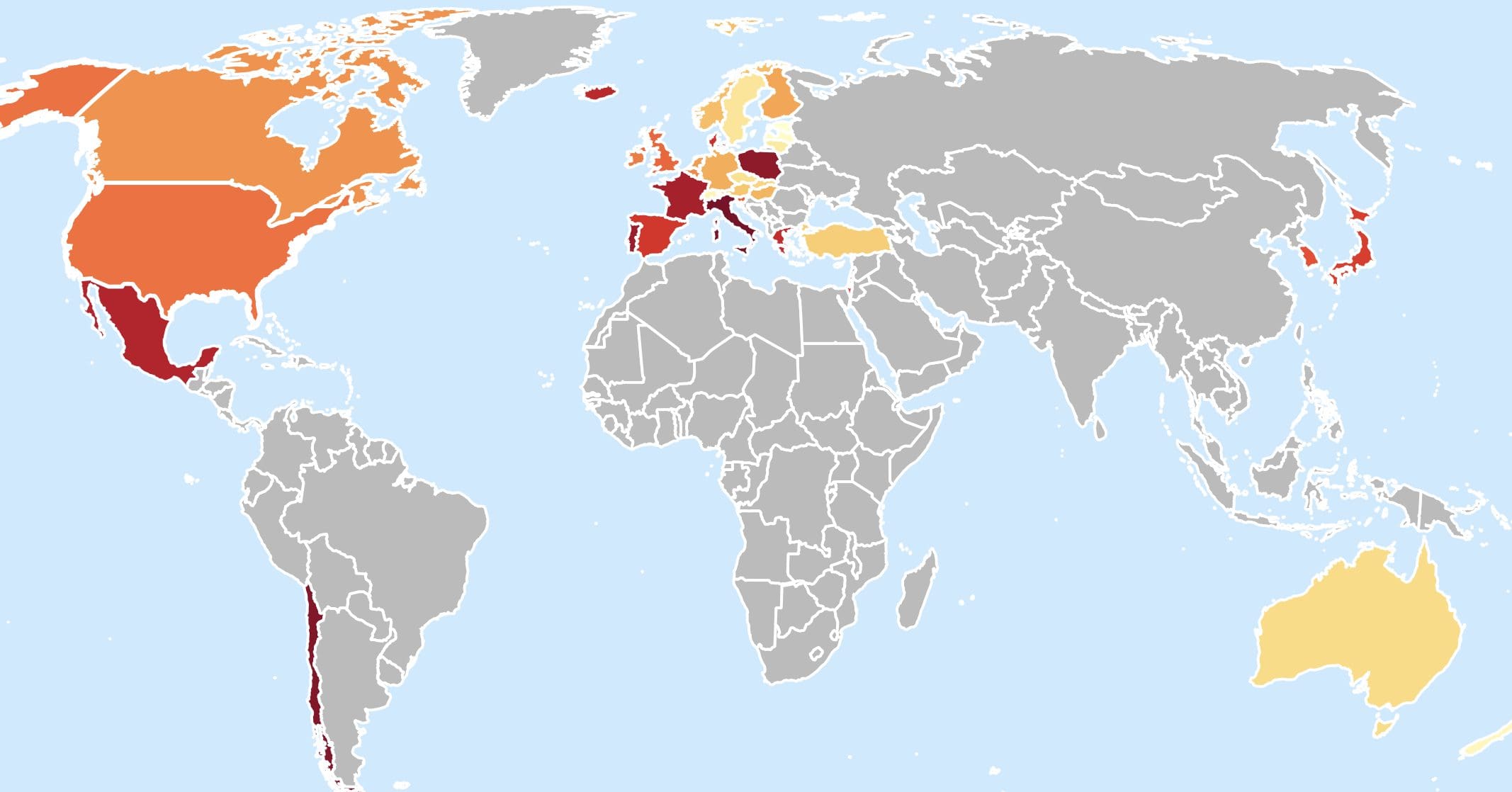

The Tax Foundation’s report is viewable as an interactive map on their website.