Data pulled from the Tarrant County Appraisal District completes Texas Scorecard’s study of the growth of property taxes of cities and schools, providing definitive proof that property taxpayers’ pain is real.

Last week, House Bill 2—which would require voter approval for property tax increases over 2.5 percent for large taxing entities—was watered down to exclude school districts from the lowered rollback rate, among other changes.

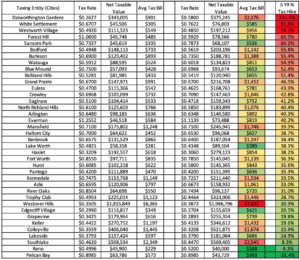

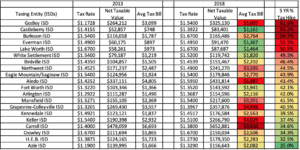

Texas Scorecard has been analyzing property tax data for taxing entities in the metroplex, calculating the average property tax bills of cities and school districts within the area and tracking the changes in those bills over the course of time. For Tarrant County, we were able to study the growth of these taxes for a period of five years, from 2013-2018.

Some Tarrant-area cities and school districts cross over to other counties, so this report only contains data for the taxpayers of that local taxing entity who reside within the Tarrant County Appraisal District. For example, most of the City of Fort Worth is in Tarrant County, but part of it is also in Denton County. Therefore, the data contained herein only refers to the taxpayers who live in the portion of Fort Worth within Tarrant County.

While we found two cases of property tax reductions, we also found some of the sharpest increases in property taxes yet.

Homeowners in Fort Worth and Dalworthington Gardens saw the city portion of their property tax bills increase 36.3 percent and an outrageous 141.5 percent, respectively. Independent school districts also saw increases for homeowners in Fort Worth ISD and Godley ISD, with increases of 42.1 percent and 61.6 percent over the same time period.

The highest average property tax bills came from the City of Westover Hills and Carroll ISD, which in 2018 were $7,693 and $9,010.

We did find some bright spots in Tarrant. One of them was the City of Colleyville, which had one of the lowest growths in property taxes during this time period at 15.9 percent, thanks in no small part to their mayor and city council adopting the effective tax rate for the fiscal year of 2018-2019.

Two of the taxing entities showing an actual reduction in property taxes are Reno and Pelican Bay, with reductions of 9.3 percent and a substantial 31.4 percent.

A chart containing all the data in full can be found below:

This is the fourth in a series of articles by Texas Scorecard analyzing property tax data for taxing entities in the DFW metroplex. Previous articles looked at data from Dallas, Denton, and Collin counties.