Because of a cited change in guidance of how to use federal taxpayer coronavirus relief funds, the City of Dallas is seeking to burden federal taxpayers as much as possible with their spending, while reallocating local taxpayer cash from the police department to other programs. There was very little discussion on Wednesday of making serious cuts in the budget and delivering maximum relief to hurting taxpayers.

Government-mandated economic shutdowns in response to the Chinese coronavirus have left millions of Texans unemployed and caused state sales tax revenues to plummet.

According to data from the Dallas Central Appraisal District, the city’s average property tax bills for homeowners were 56 percent higher last year than they were in 2013, rising from $1,100 to $1,723. In 2019, they jumped over 9 percent from just the year prior—from $1,580 to $1,723.

The current city budget is $3.8 billion, up from the 2013-2014 Fiscal Year budget of $2.8 billion—a 35 percent increase.

City of Dallas Chief Financial Officer Elizabeth Reich told councilmembers on Wednesday that they faced an almost $50 million revenue shortfall for this fiscal year. So far, they’ve managed to lower their budget black hole to $10 million.

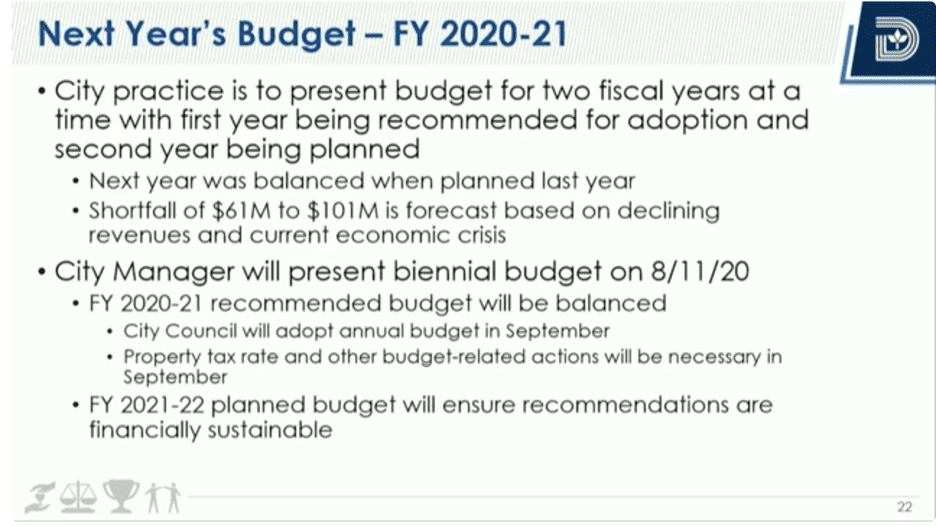

Reich said they’re expecting anywhere from a $61 million to $101 million shortfall next year.

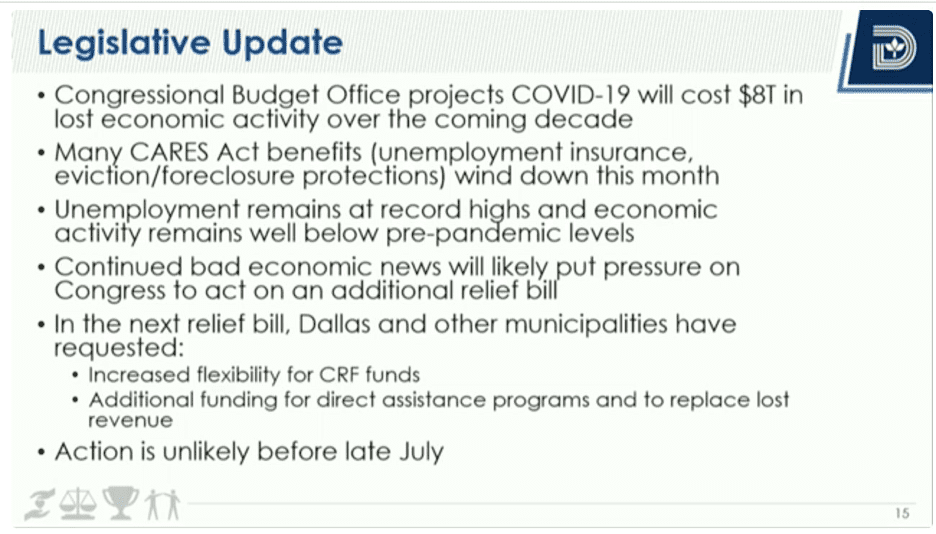

At the end of March, in response to the economic catastrophe from shelter-in-place orders, the U.S. Congress passed the $2 trillion Coronavirus Aid, Relief, and Economic Security (CARES) Act, of which the City of Dallas received $234 million in federal taxpayer money.

On Wednesday, Reich told councilmembers they’ve been able to offload more spending to federal taxpayers via the COVID aid.

“Those allocations have really filled some of our budget holes, wouldn’t you agree?” Councilman David Blewett asked.

“Well, certainly, because we have staff,” Reich answered in part. “The effect is to partially fill some of the holes we have this year and next year […].”

“In year one, I expect we will balance the budget with federal money,” she added.

She claimed the U.S. Department of Treasury recently adjusted their guidance to allow for more flexibility in the use of CARES Act taxpayer funds, and she hopes for more changes to the guidance so the city won’t have to make budget cuts.

She added the city is seeking even more money through taxpayer-funded grants, private entities, and future congressional action—including more flexibility on how to spend CARES Act funds.

However, Councilwoman Cara Mendolsohn questioned if Dallas really has a revenue problem.

“We’re actually talking about adding $39 million in revenue, is that right?” she asked Reich.

“If we’re talking about property taxes, yes,” came the reply.

“We haven’t taken a big hit on property tax,” Blewett added. “We got all this COVID relief funding.”

“Are we really in a serious budget crunch?” he asked.

“I believe the recession will continue to affect revenue beyond the period we have federal funding for,” Reich replied.

How is Dallas spending these federal taxpayer dollars right now? In addition to public health costs and assistance for families and businesses, some of it is being spent on things like “bridging the digital divide,” “animal care,” and “assistance for immigrants and refugees.”

Then there’s the discussion of Dallas taxpayer dollars. Political organizers in Dallas have been exploiting the George Floyd tragedy to push for “reallocating” funds from the police department—not back to taxpayers, but to growing government elsewhere. Some on the council, like Councilman Adam Bazaldua, have joined forces with these organizers, and taxpayers would be made to foot the bill for their plans to “reimagine public safety.”

In these discussions, city councilmembers have claimed they can make cuts to the police—an about-face from what they told the Texas Legislature during the 2019 legislative session. They used police officers as a shield in their attempt to stop property tax reform.

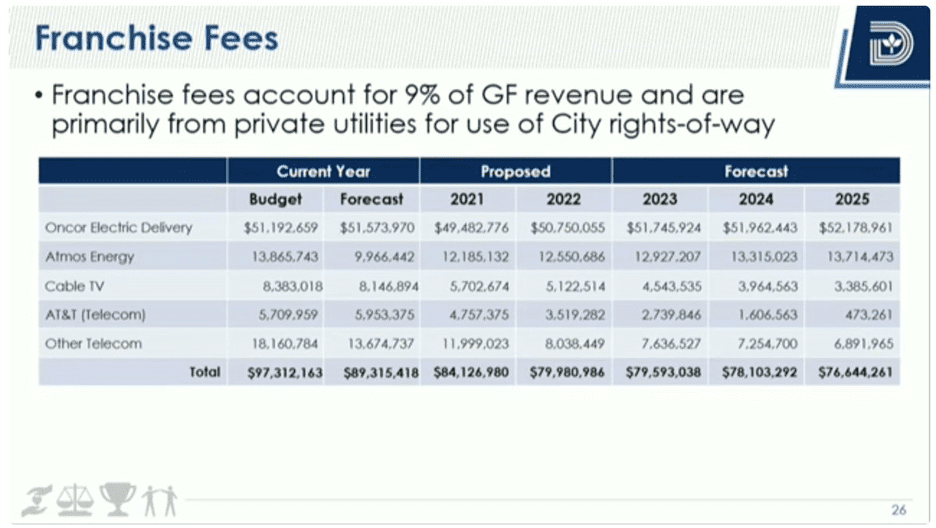

In the future, it’s likely property taxpayers will be shouldering even more of the burden for Dallas’ spending habits. Reich said franchise tax revenues—taxes on businesses like cable companies and telecommunications firms—are on the decline.

In light of this, instead of cutting spending appropriately, Reich hinted that property taxpayers may be on the hook for paying more of the city’s budget. “When those other revenues sources go down, it’s very possible [we will see] property tax increases as a percentage of the budget,” she said.

Dallas has a spending problem, not a revenue problem, and taxpayers are hurting. Instead of debating how much of the pie should go elsewhere, the conversation needs to be about cutting spending and delivering property tax relief. “We don’t have the budget to solve every social need in the city,” Mendolsohn said. “I encourage you to reimagine everything,” she told City Manager T.C. Broadnax.

Mayor Eric Johnson recently signaled he wants to move on cutting spending, and Councilwoman Paula Blackmon appeared to agree with him. “We do need to bring in spending,” she said at Wednesday’s meeting.

There has not yet been a serious discussion about delivering property tax bills lower than those of last year. Even though the city council recently decided against trying to hike tax bills to a maximum of 8 percent without voter approval, taxpayers shouldn’t be satisfied with a small tax hike.

“I’ll be very disappointed if I see a request for a tax raise come September,” said Councilman Chad West.

“I wouldn’t be surprised if we pass another tax increase,” said Councilman Lee Kleinman.

“When we’re trying to keep renters, we know that increasing property taxes is going to increase their rent,” Mendolsohn added.

The city council is scheduled to adopt the budget and tax rate on September 23. Concerned voters may contact the Dallas City Council and Mayor Johnson.

Lee Kleinman: sophia.figueroa@dallascityhall.com; 214-670-7817

Adam Medrano: adam.medrano@dallascityhall.com; 214-670-4048

Tennell Atkins: maria.salazar2@dallascityhall.com; 214-670-4066

Adam Bazaldua: Yesenia.Valdez@dallascityhall.com; 214-670-4689

David Blewett: david.blewett@dallascityhall.com; 214-670-5415

Adam McGough: adam.mcgough@dallascityhall.com; 214-670-4068

Chad West: Chad.West@dallascityhall.com; 214-670-0776

Casey Thomas: richard.soto@dallascityhall.com; 214-670-0777

Carolyn King Arnold: District4@DallasCityHall.com; 214-670-0781

Jaime Resendez: jaime.resendez@dallascityhall.com; 214-670-4052

Tennell Atkins: maria.salazar2@dallascityhall.com; 214-670-4066

Paula Blackmon: District9@DallasCityHall.com; 214-670-4069

Adam McGough: adam.mcgough@dallascityhall.com; 214-670-4068

Cara Mendelsohn: cara.mendelsohn@dallascityhall.com; 214-670-4067

David Blewett: david.blewett@dallascityhall.com; 214-670-5415

Jennifer Gates: jennifer.gates@dallascityhall.com; 214-670-7057

This article has been updated since publication.