With few exceptions, the average homeowners’ 2019 property tax bills from school districts in Dallas County grew, even though Texas lawmakers passed reforms last year that allotted roughly half of the state’s surplus tax revenue to reducing school property taxes. School districts—which have not had in-person classes since mid-March—are now setting their budgets and tax rates for the upcoming school year.

For years, Texas homeowners’ property tax bills have continued to grow, and roughly 60 percent of their total property tax bill is from school districts. In 2019, the Texas Legislature passed House Bill 3, which poured $5.1 billion of the over $10 billion tax revenue surplus into compressing independent school districts’ property tax rates.

Lawmakers claimed their school finance reform plan in HB 3 “lowers school property tax rates by an average of 8 cents in 2020 and 13 cents in 2021,” or an implied total of 21 cents over two years. However, according to the Texas Education Agency, this was inaccurate.

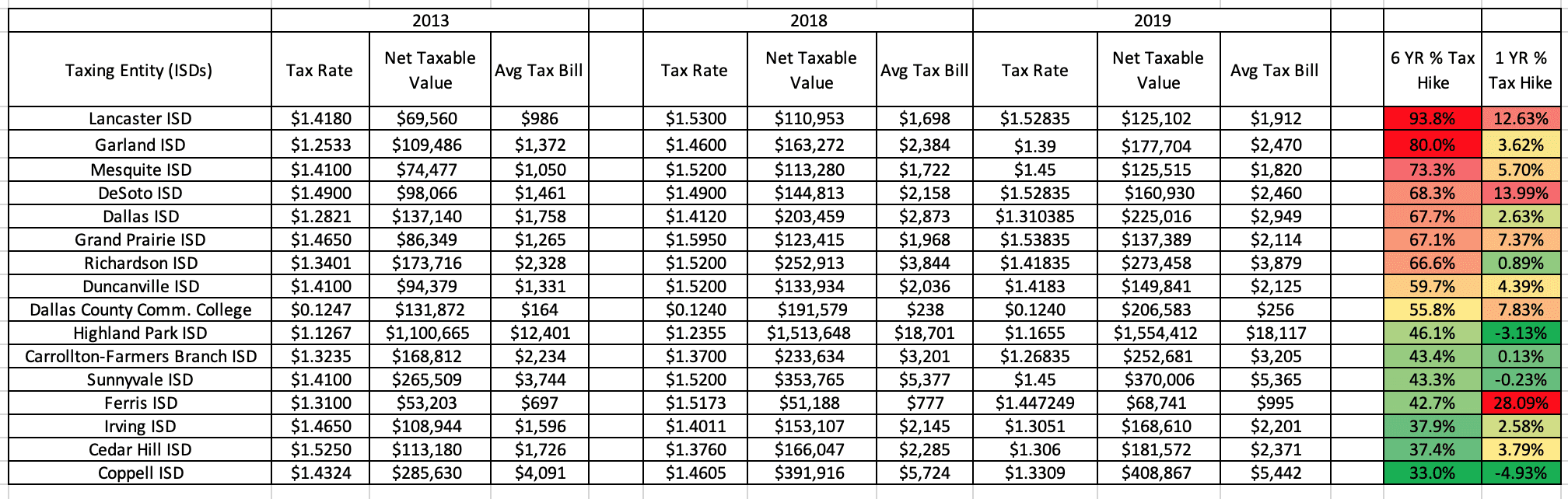

Last year, Ferris ISD’s board members approved the highest one-year growth in their average tax bills for homeowners at over 28 percent—from $777 to $995. This growth happened even though their property tax rate was lowered over $0.07 per $100 property valuation—from $1.5173 in 2018 to $1.447249 in 2019.

Year-to-year comparisons of tax rates are meaningless, as the average taxable value of properties fluctuates every year. Ferris’ rate wasn’t lowered enough to offset the 34 percent increase in the average taxable value of single-family homes—from $51,188 in 2018 to $68,741 in 2019.

The no-new-revenue rate is the property tax rate that, in the aggregate, offsets increases in the taxable value of properties. If adopted, homeowners’ property tax bills would not, on average, significantly increase from the previous year.

Three school districts actually approved one-year decreases in their average property tax bills for homeowners. Coppell ISD approved a 4.93 percent decrease ($5,724 to $5,442), Highland Park ISD a 3.13 percent decrease ($18,701 to $18,117), and Sunnyvale ISD a 0.23 percent decrease ($5,377 to $5,365). The rest of the districts showed one-year increases, and all showed increases from tax bills in 2013.

Lancaster ISD board members approved the highest six-year increase at over 93 percent from six years ago—from $986 to $1,912.

Coppell ISD board members approved the lowest six-year increase at 33 percent—$4,091 to $5,442.

The TEA confirms there will be a tax rate cut in 2020, the amount of which will vary from district to district, but says it will be provided via a different mechanism—a 2.5 percent cap on property tax revenue. Regardless of what appraisal assumptions are used, this change cannot mathematically result in a tax rate cut of 13 additional cents.

Between 2.3 and 2.6 million Texans lost their jobs in 2020 as a result of government policies that shut down the Texas economy in response to the Chinese coronavirus.

Below is the data tracking the changes in the average homeowners’ property tax bills from school districts in Dallas County. School districts in Dallas tend to vote on their budget and tax rates sometime between May and June. Concerned taxpayers may contact their elected school board members.

Click the image below for details.

This article has been updated since publication.