At a Senate hearing yesterday, Dallas officials called for sales price disclosure. This would raise appraisal values, resulting in $4 billion in additional school property taxes plus billions more in other local property taxes. As the new Texas GOP platform declares, school property taxes should be abolished, but disclosure without a revenue cap would be disastrous.

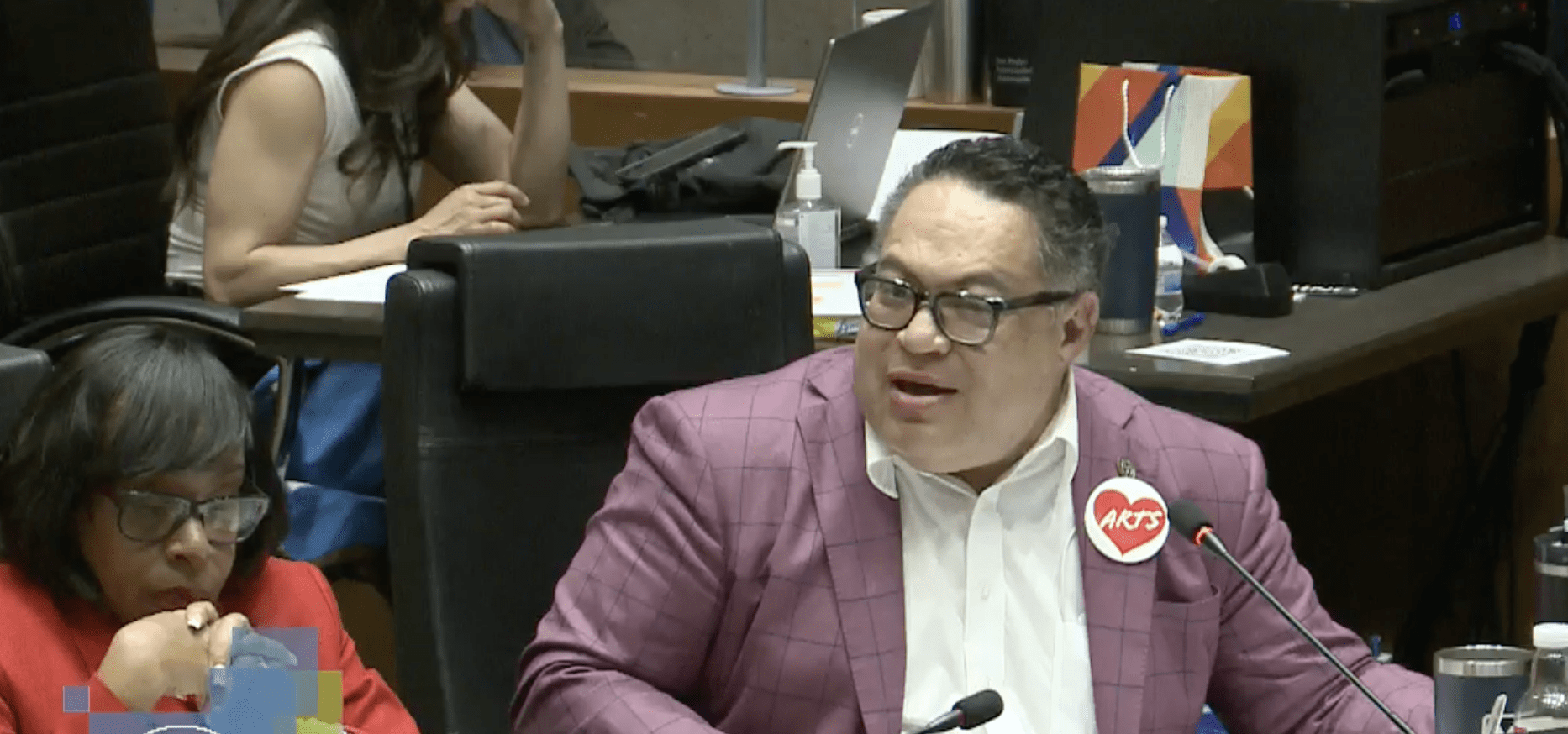

At the hearing, Dallas City Councilwoman Angela Hunt and Dallas Central Appraisal District Director Ken Nolan pitched the equity argument for sales price disclosure, but is it any more fun to pay higher taxes just because others are paying even higher taxes? More importantly, taking another $5 billion out of the private sector will be a drag on the economy and the brunt of the increase on commercial property will be passed along to consumers in higher prices for goods and services, a double whammy on top of the new margins tax.

A Texas Association of Appraisal Districts study claims that commercial property is undervalued by an average of 40 percent, residential property by 15 percent, and multifamily property by 25 percent. Also, the largest homes are thought to be the most undervalued because they have unique features and there are fewer comparable homes to compare them to.

Fiscal conservatives should emphasize several points on sales price disclosure. First, and most importantly, the goal should be to get rid of school property taxes over the next 16 years, which can be accomplished simply by limiting spending increases to population plus inflation and using the surpluses to buy down property taxes.

Second, price disclosure should only be considered if accompanied by a revenue cap of no more than 5 percent. This would require rate decreases to offset the rise in values caused by disclosure while at the same time redistributing the tax burden among various properties to be more commensurate with market value.

Additionally, to offset the impact on commercial property owners, the ten percent cap on annual homestead increases should be extended to commercial property and rented property.

Finally, we should also reduce the tax burden on businesses by repealing the new margins tax.

Sales price disclosure with no other changes would merely be a back-door way for local governments to eviscerate the property tax savings that Texans have been promised by their elected officials.

Today’s, Dallas Morning News story on the hearing is at: https://www.dallasnews.com/sharedcontent/dws/news/localnews/stories/DN-appraisals_17met.ART.State.Edition2.4d4d092.html.