A measure to prohibit the Lone Star State from implementing a state income tax is headed to the Texas Senate after passing out of the Texas House Thursday.

House Joint Resolution 38 by State Rep. Jeff Leach (R–Plano) would amend the state’s constitution to ban a state income tax from being collected. “The legislature may not impose a tax on the net incomes of individuals, including an individual’s share of partnership and unincorporated association income,” the bill’s language reads. A hard line would be in place for future lawmakers to cross should they decide they want to go to Texans’ paychecks for more money.

Leach pointed out during his layout that the legislature could at any time approve an income tax with a simple majority vote which would then be sent to the voters for approval under current law. Leach’s proposal, however, would increase that threshold up to two-thirds of both chambers of the legislature, or the requirement to pass a constitutional amendment.

Leach shared with members information from a recent survey showing over 70% of Texans believed the State should not consider instituting an income tax.

“Let’s send a strong message that the money earned by hard-working Texans is best secured in their own pockets and best spent by their own volition,” said Leach.

Many Democrats weren’t pleased with the proposal, however, as liberal politicians have often seen a state income tax as a goal to increase state revenue.

Democrat State Rep. Eddie Rodriguez (Austin) was unsuccessful at killing the bill on procedural grounds, and Democrat colleague State Rep. Trey Martinez Fischer (San Antonio) spoke against its passage, saying the legislature should look at all avenues of revenue generation.

Not all Democrats were opposed to the effort, however. State Rep. Richard Raymond (D–Laredo) urged his fellow Democrats to vote for the measure, saying “it’s the right thing to do.”

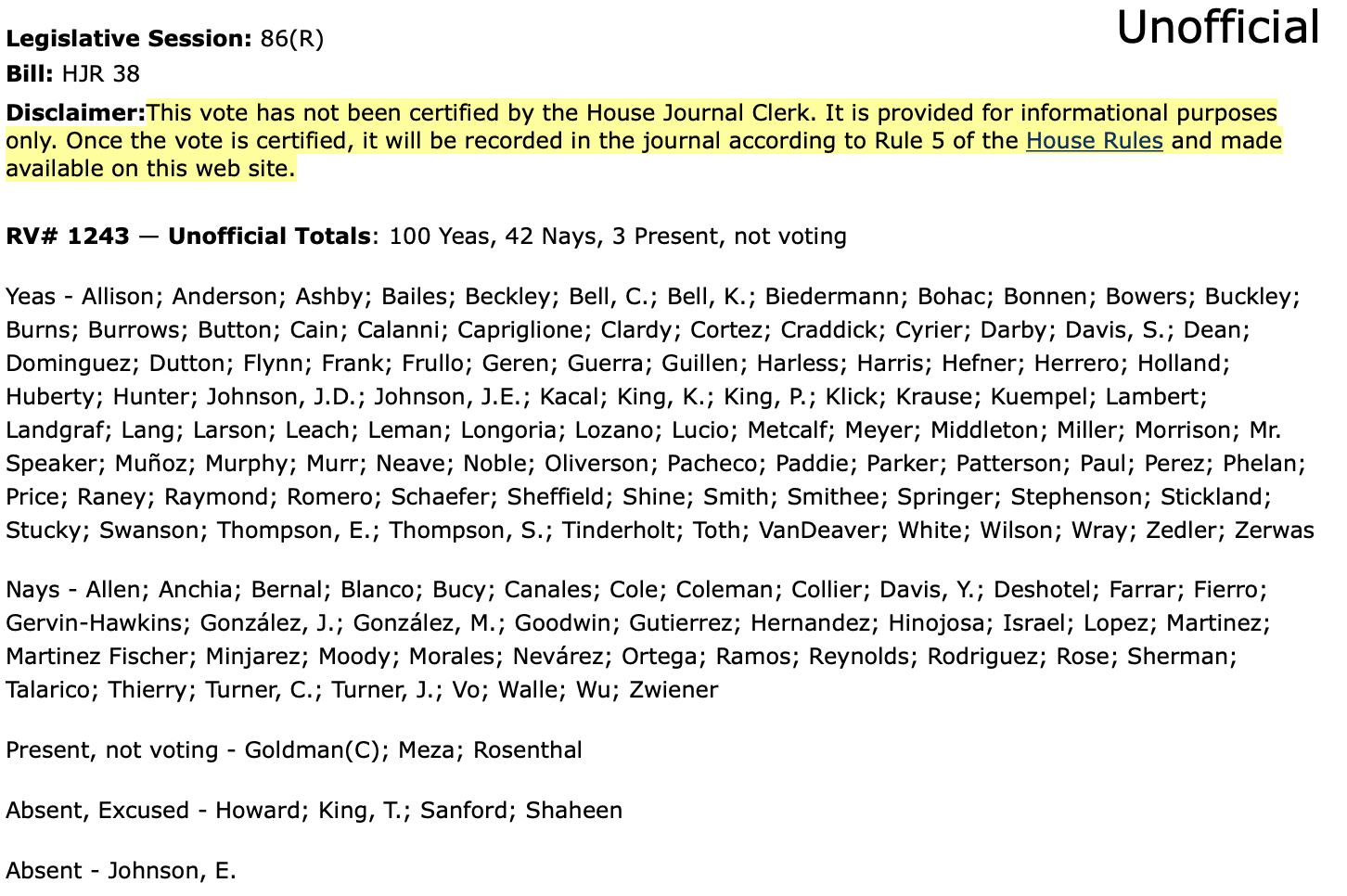

When the gavel fell on the bill’s record vote, the bill passed 100 to 42, narrowly satisfying the two-thirds vote with every Republican supporting the measure.

Before being placed on the November ballot for voter approval, the bill will need two-thirds support in the Texas Senate.