Texas is one of just seven states not to impose an income tax, despite the efforts of liberal legislators to impose one. Legislation filed on Tuesday could make that task a lot harder.

House Joint Resolution 38 by State Rep. Jeff Leach (R–Plano) would amend the state constitution to ban an income tax from being collected, with the language reading, “The legislature may not impose a tax on the net incomes of individuals, including an individual’s share of partnership and unincorporated association income.”

“Texas is the best state in America to live, work and raise a family. Due to the hard work and ingenuity of our citizens, and the commonsense, conservative policies advanced by our state’s leaders in recent decades, our population is booming, our economy is robust, and new jobs are being created every day,” said Leach. “We must continue to pursue and advance policies that protect and strengthen the Texas Miracle, starting with ensuring that Texans can keep and control more of their hard-earned tax dollars in their own pockets.”

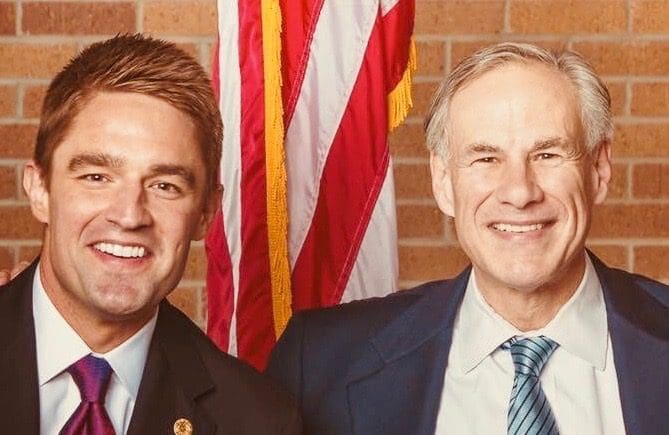

“I am proud to file House Joint Resolution 38 and look forward to working with Governor Abbott, our next Speaker, Dennis Bonnen, and all of my colleagues in the House and Senate to ensure that Texas taxpayers are protected from the possibility of the creation of a personal income tax – which would have disastrous effects on the future of our great state,” he added.

The idea of constitutionally safeguarding Texans from a state income tax had been floated by Gov. Greg Abbott in September. After HJR 38 was filed, Abbott applauded Leach for leading on the issue.

“Texans know far better than government how to spend their own money. That’s why I applaud Representative Jeff Leach’s proposal to amend the Constitution and forever eliminate the possibility of a state income tax. I look forward to working with Representative Leach to ensure Texas remains the best place to live and work,” said Abbott.

The resolution requires a two-thirds vote by both the House and the Senate, as well as the approval of a majority of voters in a constitutional referendum election. If the bill passes the legislature during the upcoming session, that vote would take place on November 5, 2019.

Currently, Article 8 Sec. 24 of the Texas Constitution requires any potential income tax to be subject to voter approval and stipulates the money must be used for “the support of education.”