At an April pension event cosponsored by The Civic Federation and the Federal Reserve Bank of Chicago, a speaker from the Chicago Fed drew audible gasps from the audience.

He did so after proposing a special property tax, levied on top of the existing Illinois property tax, of about 1 percent of actual property value each year for 30 years.

Mark Glennon of the Chicago Daily Observer reports that in south Cook County many working class minority homeowners are already shelling out over 5 percent on their homes, in addition to the state’s income tax.

The tax would address five state pensions, leaving hundreds of other pension programs to figure out untold billions in shortfalls.

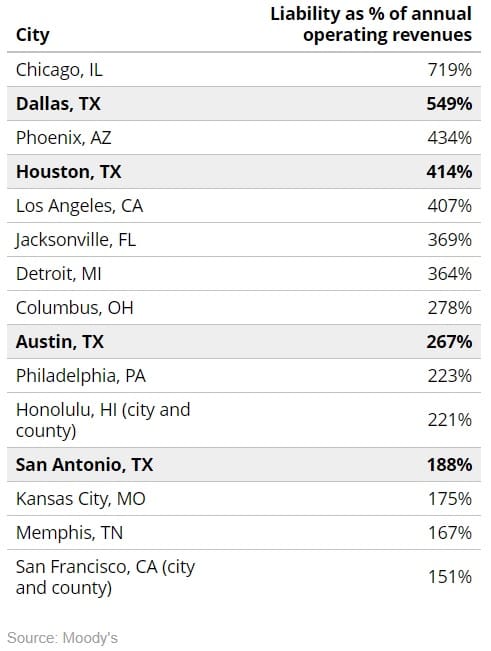

Meanwhile, a late 2016 Moody’s report placed four Texas cities in the top 15 for total unfunded pension liabilities. Soon after, a Fiscal Times ranking of the nation’s worst municipal finances put Dallas and Houston near the top.

Just last week, S&P Global Ratings downgraded the rating on Fort Worth’s general obligation debt from AA+ to AA due to it’s growing pension problem.

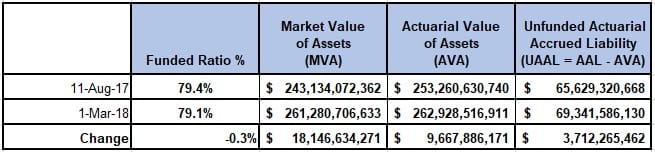

Credit downgrades and threats of bankruptcy finally forced reform in Texas’ two largest cities, but the latest figures published by the Pension Review Board still show $69 billion in liabilities for the 93 state and local funds overseen by the board.

This figure represents a $3.7 billion spike over the prior seven-month period.

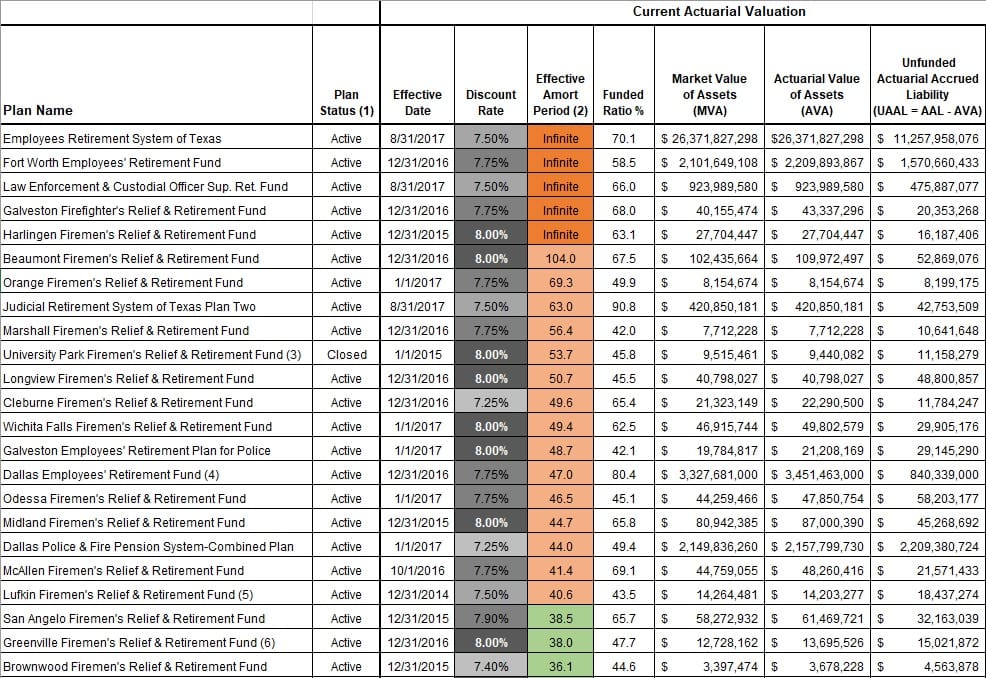

Per PRB’s data, the fund with the largest liability ($11.3 billion) and an infinite amortization period is the Employees Retirement System of Texas (ERS). The Employees Retirement System handles benefits for about 240,000 active and retired state employees, elected officials, law enforcement and prison officers, and judges. The funding ratio for ERS has dropped to 70 percent and continues to fall.

Per PRB’s data, the fund with the largest liability ($11.3 billion) and an infinite amortization period is the Employees Retirement System of Texas (ERS). The Employees Retirement System handles benefits for about 240,000 active and retired state employees, elected officials, law enforcement and prison officers, and judges. The funding ratio for ERS has dropped to 70 percent and continues to fall.

PRB’s guidelines for actuarial soundness recommend amortization periods between 15 and 25 years and a funded ratio of 80% or more.

A summary of ERS and its liabilities from the Texas Comptroller’s website notes that, “While the obligations of Dallas and Houston won’t affect Texas’ state government balance sheet, both the Moody’s and Standard & Poor’s (S&P) rating agencies have warned Texas its credit rating could be in jeopardy if the state’s own pension liability isn’t addressed adequately.”

Another thorn in the side of state lawmakers is the Teacher Retirement System (TRS), which administers two health benefit programs (TRS-Care and TRS-ActiveCare). Even after state infusions of cash in 2005, 2013, 2014, and 2015, a November 2016 Joint Interim Committee report projected TRS-Care shortfalls up to $1.5 billion in 2018-19 and up to $6 billion in the following biennium.

The Dallas pension fix included raising the retirement age, ending cost-of-living increases, slowing benefits accrual, and raising worker contributions. It also safeguards against runs caused by lump-sum withdrawals.

Houston, on the other hand, reduced secondary pension benefits, like DROP (lump-sum withdrawals) and cost-of-living adjustments (COLA), in exchange for better funding. Should Houston’s problem persist, the new law shuts down the defined-benefit plan and switches to a hybrid cash-balance plan.

The Comptroller’s office goes on to highlight what it believes to be the reason Texas has held on to it’s AAA-stable credit rating. Among these are expectations that state leadership will maintain budget and cash management discipline, address potential future budget gaps in a timely manner, and maintain sustainable UAAL (unfunded liability) levels by making the necessary contributions.

The primary factors the Comptroller identifies as leading to ERS uncertainty are: unrealistic assumptions about investment returns, inadequate contributions, demographic pressures, fewer contributing members, and early retirements.

Policy options put forth in the summary include changing to a defined contribution plan or hybrid plan, similar to the back-up plan they provided Houston.

The two largest weaknesses of defined-benefit (DB) plans are generational (demographic) differences and the assumption of unrealistically high rates of return. Defined benefit plans promise current and future retirees a lifetime of monthly income without knowing whether money will be in the fund.

Demographic differences occur when there are fewer people contributing to the pot of benefits in relation to the pace of baby boomers receiving more in benefits than they contributed. Meanwhile, unrealistic assumptions of 8 to 8.5 percent return on investment creates much of the instability, where over the short term, funds like Houston’s are averaging returns closer to 3 or 4 percent.

What Houston did, namely revising return estimates down to a more plausible 7 percent, is another tool the Texas legislature can employ to stabilize troubled funds.

Many point to conversion from DB plans to defined-contribution plans (DC), much like your average 401(k), as a necessary solution. As explained by Dr. Vance Ginn and James Quintero of the Texas Public Policy Foundation:

“DC-style plans resemble 401(k)s in the private sector and the optional retirement programs available for higher education employees in Texas. With DC-style plans, retirees will finally have the opportunity to determine how much risk they are willing to take. They also reduce the risk that the government will default on their retirement or fund those losses with dollars from taxpayers …”

While calls for pension reform ramp up in political subdivisions like Fort Worth, the state has plenty of work to do to shore up ERS and TRS-Care. Though the fiscal health of the state is roundly lauded by conservative leadership, the status quo cannot continue.

How willing lawmakers and appropriators are to look in the mirror and make tough decisions to fix the state’s ongoing pension problems, possibly including where to trim an already conservative budget in order to stabilize state retirement funds, will be a large part of the ongoing narrative heading into the 86th Legislature.