Texans who eagerly awaited consideration of the omnibus property tax reform bill in the House will have to wait a few more days, as the bill’s author State Rep. Dustin Burrows (R–Lubbock) has postponed consideration of the legislation to Monday, April 15th.

As originally filed, House Bill 2 would have given taxpayers increased control over their tax burden by requiring local taxing entities to hold elections when they want to spend over a 2.5 percent increase. As filed the bill applied to cities, counties, school districts, and special taxing entities such as hospital districts and community college districts.

But that was as filed.

When the bill was brought up for a vote in the House Ways and Means Committee last month, Burrows gutted the measure in the dead of night by removing school districts, who make up the bulk of the average Texans’ property tax burden, as well as all other taxing entities, save cities and counties, from the voter approval requirement.

House members were reportedly told by Burrows that the school district property tax reform element would be added when the chamber considered House Bill 3, the chamber’s school finance “reform” spending bill.

And as the day of HB 2’s floor debate began to draw closer, lawmakers were reportedly assured by Gov. Greg Abbott and others that school districts would ultimately not be left out of the voter approval measures in the bill.

Abbott repeated that claim today when he said he “absolutely” wanted schools to be included, with a spokesman giving a statement to a Dallas newspaper saying that the governor believed “in order to achieve real property tax reform, there must be a cap on school districts ability to raise taxes.”

What he did not commit to, however, was which bill the trigger would be placed in, or whether it would remain at 2.5 percent as he had campaigned on since last January.

But as some Republican members threatened to vote against the legislation without an amendment to add school districts back in, it began to appear that the votes necessary for the legislation to pass had not been solidified, leading to a standoff in which negotiations and discussions took place behind the scenes in the House to try to whip enough members to support the bill without school districts being included.

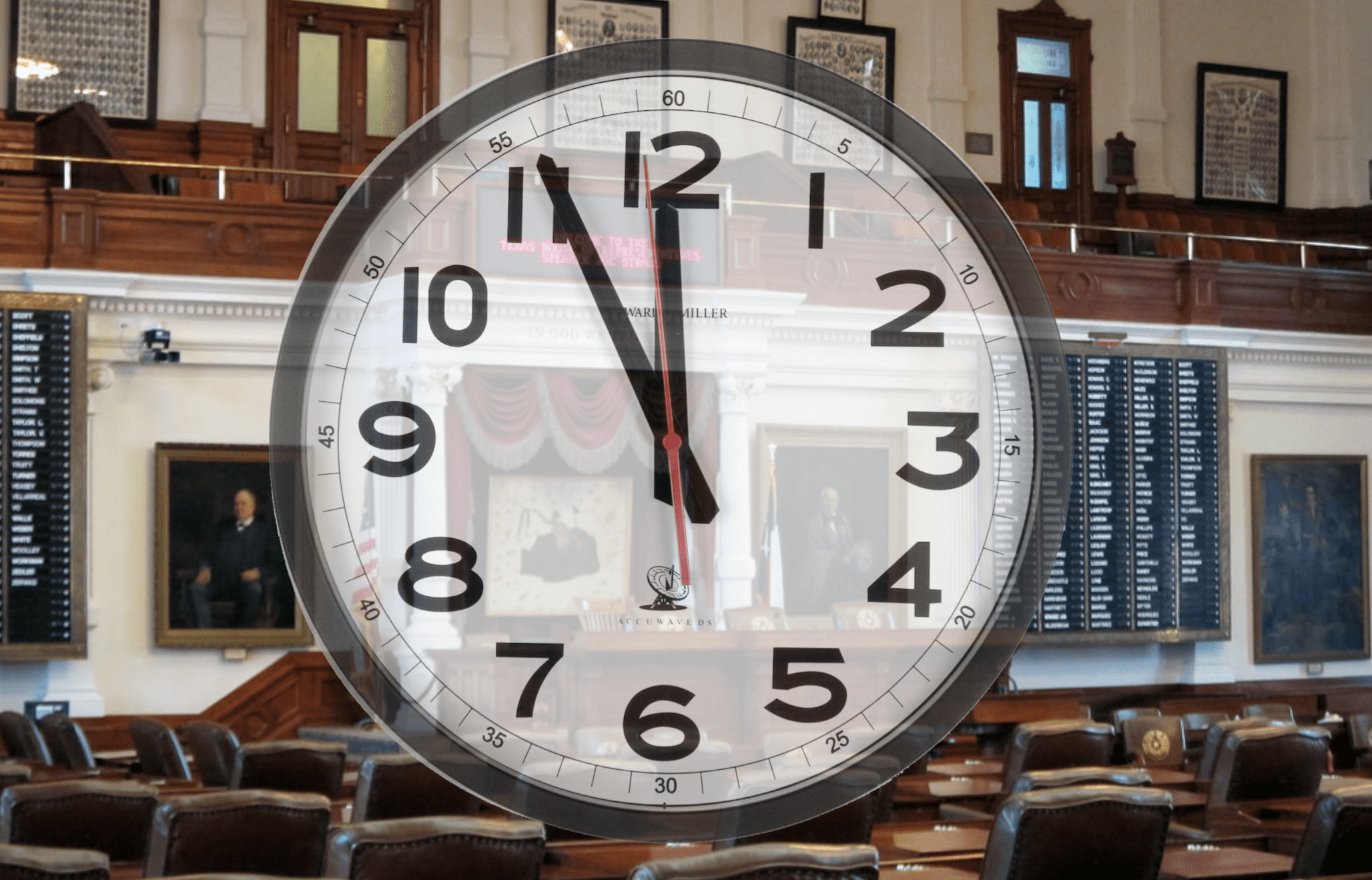

After hours of procedural delay in the House, Burrows and House Speaker Dennis Bonnen announced they would postpone consideration of the bill to Monday April 15, in order to work with the Senate on a solution.

Indeed, in the Senate, where their bill does not currently exempt school districts, State Sen. Kel Seliger (R–Amarillo) has been the lone Republican holdout, according to Lt. Gov. Dan Patrick, making the bill one vote shy of the three-fifths necessary to bring to the floor for a vote.

All the while, the state’s three top leaders are continuing to tease their yet-to-be-released sales tax increase as the end-all solution to the problem, saying they need an additional revenue stream to provide any property tax relief after budgeting nearly all of the state’s surplus revenue towards education and increased teacher pay.

With 46 days left in the session, lawmakers are on the clock to deliver the property tax reform and relief they promised.