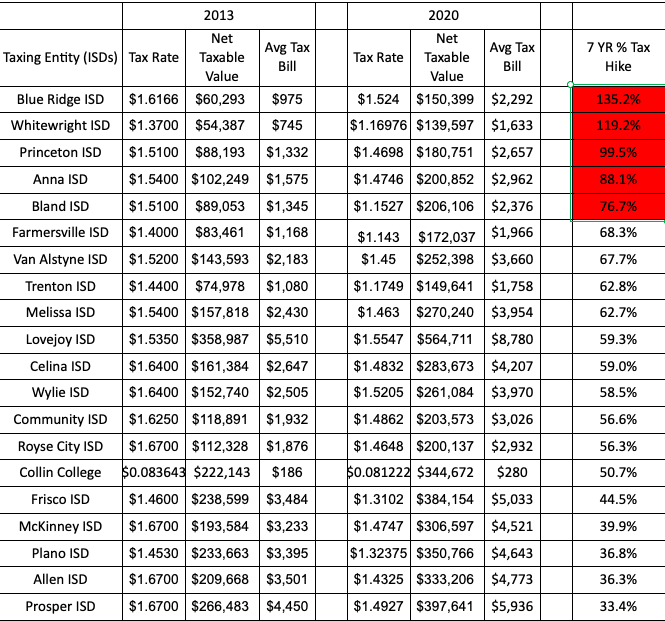

Collin County, located in North Texas, is part of the fastest-growing area in the state. Also growing quickly is the tax bill to pay for the county’s school districts. All five Collin County school districts with the largest tax hikes have fewer than 5,000 enrolled students.

Bland Independent School District, which serves mostly Hunt County and part of Collin County, has 721 students attending; 56 percent of the district’s students are on a free or reduced-price lunch plan. The average teacher’s salary in Bland ISD is $42,759. From 2013 to 2020, this small, rural district has seen its net taxable value go from $89,053 to more than $206,000, resulting in a school tax hike of 76.7 percent.

Anna ISD, located in northern Collin County, has 3,597 students and spends $11,622 per student. Anna ISD has raised taxes between 2013 to 2020 by 88.1 percent, increasing the average tax bill to $2,962.

Princeton ISD, located in eastern Collin County, is a growing area with roughly 4,887 students; 58 percent of the students qualify for free or reduced-price lunch. The average teacher is making just more than $54,000 a year. Princeton ISD’s tax rate saw a seven-year hike of 99.5 percent, with an average tax bill of $2,657 in 2020.

While only a small portion of Whitewright ISD is located in Collin County, property taxpayers in the district have seen their tax bills skyrocket. With only 852 students, the district is paying slightly more than $11,300 per student enrolled in the district, and teachers’ salaries average $41,444 per year. From 2013 to 2020, the next taxable value went from $54,387 to $139,597, and the average tax bill went from $745 to $1,6333 (a seven-year hike of 119.2 percent).

Blue Ridge ISD is a small district of 252 students located northeast of McKinney; 44 percent of the district’s students are on a free or reduced-price lunch plan. Yet between 2013 and 2020, the district increased property taxes by 135.2 percent, and the net taxable value went from $60,000 to $150,399. The average tax bill in 2020 was $2,292.

“What is true in Collin County is true in Dallas, Tarrant, and almost every other local governing entity,” Tim Hardin, executive director of Texans for Fiscal Responsibility, told Texas Scorecard.

If you don’t place restrictions on local governments, they will continue to raise taxes to give themselves more money. This problem we are seeing across the state is not something that is localized in a particular city or county, but rather is systemic of their entire property tax system and how we fund our schools.

One suggestion that Hardin gave would be to eliminate the maintenance and operating tax that school districts currently charge citizens.

“The M&O tax needs to be eliminated; however, this is difficult to do in a special session,” Hardin said. “The state Legislature has an opportunity to provide significant relief to homeowners by using the $7.85 billion budget surplus to buy down school property taxes.”

This would result in a 10 percent decrease for Texans over the next biennium. The Legislature can then begin the process of phasing out the M&O portion of property taxes over the next few years. This should be possible through the spending limit passed in the 87th [Legislative Session] that will ultimately result in repeated surpluses in the coming decade.

“We have never had such a golden opportunity to begin the process of eliminating the property tax once and for all,” Hardin added.

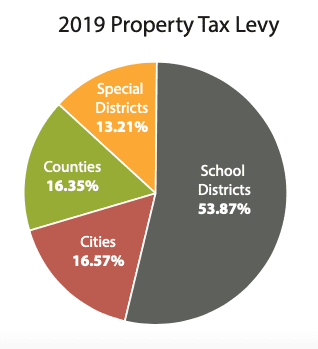

In 2019, 54 percent of taxes were from school districts, according to the Texas comptroller.

The district with the lowest tax increase was Proper ISD, with a 33.4 percent increase over the last seven years.

Citizens may contact their local state representatives to ask if there is a plan to eliminate the tax burden on citizens.