Big city officials are always eager to borrow and spend big bucks, and send the bill to taxpayers.

The city of Dallas is no different. Dallas City Council wants to tax and spend over a billion dollars on a huge wish list of city projects.

On November 7, they’re asking the city’s voters to approve ten separate bond propositions totaling $1.05 billion that will ultimately cost Dallas taxpayers an estimated $1.425 billion with interest.

City council approved the mixed bag of needs and wants back in June – completely ignoring both its own previously agreed cap of $800 million and input from a citizens’ committee that worked for weeks on spending recommendations.

The billion-dollar-plus proposal also pushes up against the city’s $1.2 billion borrowing capacity – the only thing besides voters that can put a hard limit on municipal spending sprees.

Only two of 15 council members, Philip Kingston and Lee Kleinman, opposed the measure.

Kingston said the propositions had been “larded” with too many unapproved projects. Kleinman said the bonds would put too much new debt on taxpayers.

According to the bond election order, city taxpayers are already on the hook for around $2.6 billion in debt principal and interest.

Council member Jennifer Staubach Gates, who strongly supports the bond package, said what big-city officials usually say about their big-spending plans: “It’s going to be improving the majority of all citizens’ life in the city of Dallas and helping us grow in the city.”

An overview of the bond propositions and a detailed list of specific projects included in each spending package are on the city’s website. Below is a summary of each proposition:

Proposition A

Principal Amount of Bond: $533,981,000

Estimated Cost to Taxpayers (Principal plus Interest): $724,650,750

For: Streets and Transportation

The proposition includes traffic signals, alley reconstruction, bridge repair, railroad crossing quiet zones, sidewalks, street reconstruction, and street resurfacing projects.

Proposition B

Principal Amount of Bond: $261,807,000

Estimated Cost to Taxpayers (Principal plus Interest): $355,610,250

For: Parks & Recreation

The proposition includes funding for Downtown Parks, Circuit Trail, and the Aquatics Master Plan, as well as rehabilitation of recreation centers, trails, and neighborhood park projects. This bond issue is contingent on the city receiving $73 million in private grants/donations.

Proposition C

Principal Amount of Bond: $50,000,000

Estimated Cost to Taxpayers (Principal plus Interest): $67,781,500

For: Fair Park

The proposition covers rehabilitation of some Fair Park facilities.

Proposition D

Principal Amount of Bond: $48,750,000

Estimated Cost to Taxpayers (Principal plus Interest): $66,088,750

For: Flood Protection and Storm Drainage

The proposition includes local flood protection, storm drainage, and erosion control projects throughout the city and will fund the Vinemont Channel Improvement Project.

Proposition E

Principal Amount of Bond: $15,589,000

Estimated Cost to Taxpayers (Principal plus Interest): $21,124,500

For: Library Facilities

The proposition funds three projects: replacement of the Forest Green Branch Library, construction of the new Vickery Meadow Branch Library, and roofing/plumbing improvements at the J. Erik Jonsson Central Library.

Proposition F

Principal Amount of Bond: $14,235,000

Estimated Cost to Taxpayers (Principal plus Interest): $19,294,500

For: Performing Arts Facilities

The proposition includes projects to rehabilitate existing cultural and performing arts facilities.

Proposition G

Principal Amount of Bond: $32,081,000

Estimated Cost to Taxpayers (Principal plus Interest): $43,491,250

For: Public Safety (Police and Fire) Facilities

The proposition includes security enhancements to the Jack Evans Police Headquarters and seven police substations, replacement of two fire stations, one new fire station, and rehabilitation of multiple fire stations throughout the city.

Proposition H

Principal Amount of Bond: $18,157,000

Estimated Cost to Taxpayers (Principal plus Interest): $24,608,750

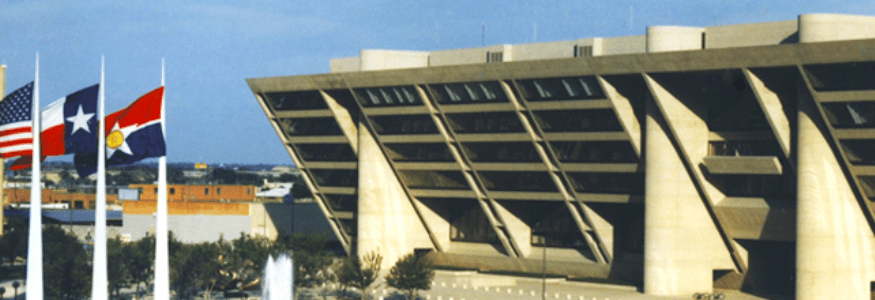

For: City Hall and Administrative Facilities

The proposition includes projects to conduct rehabilitation and major maintenance at City Hall and multiple city facilities, plus expansion of the West Dallas Multipurpose Center.

Proposition I

Principal Amount of Bond: $55,400,000

Estimated Cost to Taxpayers (Principal plus Interest): $75,109,500

For: Economic Development

The proposition funds projects that support commercial corridor revitalization, transit-oriented development, mixed-used development, mixed-income housing, and neighborhood revitalization.

Proposition J

Principal Amount of Bond: $20,000,000

Estimated Cost to Taxpayers (Principal plus Interest): $27,115,750

For: Homeless Facilities

The proposition funds permanent supportive and transitional housing projects.

In addition to the ten bond propositions, city voters who live within Dallas County will be able to vote to shut down the county’s dangerous bus bureaucracy. A vote “against” Dallas County Schools Proposition A will start an orderly wind-down of the troubled agency.

All Texas voters will also be asked to weigh in on seven proposed amendments to the state constitution.

Election Day is November 7. Early Voting starts October 23.