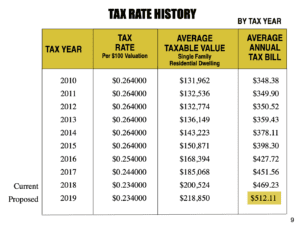

Tarrant County commissioners are proposing a new property tax rate that would raise the county’s average property tax bill for homeowners over 9 percent from last year.

Even worse, data published from Tarrant County concurs with data from the Tarrant Appraisal District, stating that from 2013-2018 the county’s average property tax bill for homeowners increased over 30 percent, from $359 to $469. The county’s proposed property tax rate, $0.23400 per $100 valuation, is above their “effective” tax rate, $0.218852 per $100 valuation, and would result in a 9.2 percent increase, $469 to $512, in the county’s average property tax bill for homeowners from just a year ago and 42.5 percent from just six years ago.

The “effective” rate, also called the “no-new-revenue” rate, adjusts as property values change to keep taxpayers’ bills more or less the same from one year to the next, in the aggregate, though individual results vary based on valuations and exemptions.

Texas’ Truth in Taxation laws require taxing entities to calculate and publish their effective rate each year to ensure the public is informed of any property tax increases because year-over-year rate comparisons are meaningless as they don’t account for changing property values.

Taxpayers still have time to voice their opinion on these proposed tax rates.

Tarrant County’s tax raise comes in the midst of their software boondoggle, where they have plundered county taxpayers for tens of millions of dollars for a failed computer software program.

Taxpayers still have time to voice their opinion on these proposed tax rates. The county is hosting a second public hearing on September 3 at 10 a.m., and commissioners will meet to vote on the tax rate on September 10 at 10 a.m.