Starting on June 29, voters in Fort Worth will be presented with the option of either renewing a controversial sales tax that’s ostensibly for their police department or ending it and thereby lowering their total sales tax burden. This sales tax has previously faced questions about how it’s being used and audited.

In 1995, Fort Worth established the Crime Control and Prevention District: a half-cent sales tax “to fund crime and control prevention initiatives.” This tax keeps the total Fort Worth sales tax within its highest legal limit set by the state at 8.25 percent.

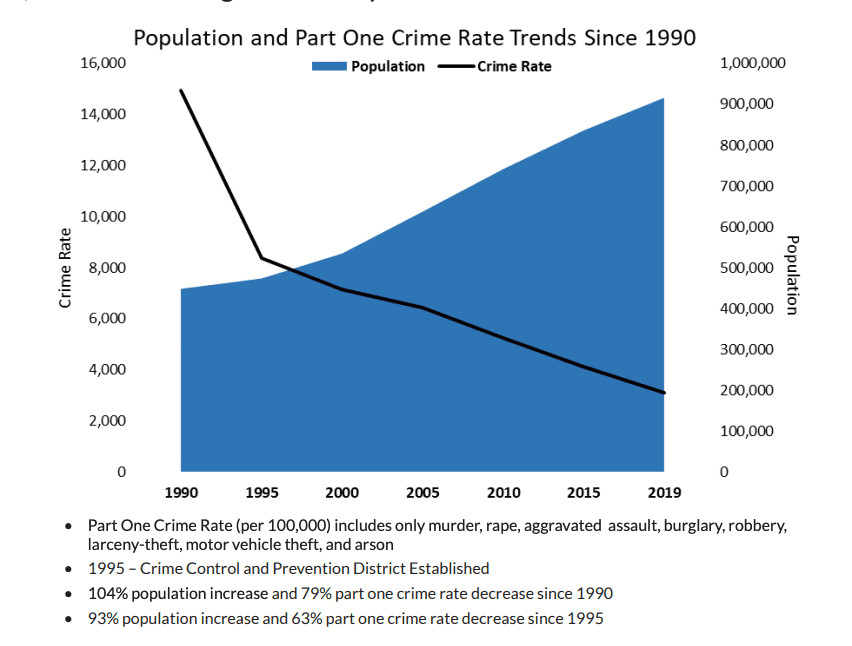

Promotional materials supporting the tax—put together by the city—say this special sales tax was created in response to crime waves in the latter half of the 1980s. Since its creation, data from the city says crimes such as rape, arson, robbery, and murder have gone down 63 percent.

Other promotional materials from the city claim these funds went toward police programs such as their Special Weapons and Tactics team (SWAT), neighborhood police officers, a Police Athletic League, new officer recruitment, and a DNA crime lab.

However, this tax has not been without controversy. In 2010, then-Mayor Mike Moncrief successfully eliminated the CCPD’s board and had it replaced with the city council, giving them control over the money collected by the tax.

Richard Van Houten, the president of the Fort Worth Police Association at the time, opposed the move, and critics expressed concern about the possibility of council using the tax dollars to paper over any shortfalls in the city’s budget.

“Here’s a pot of money for the council facing a big budget shortfall to dip into with no oversight,” an unnamed source said at the time.

In that year, there had not yet been an outside forensic audit of the CCPD, despite it being required by state law.

“I have chaired the FW internal audit since 2018,” Councilman Cary Moon said in response to an inquiry from Texas Scorecard. “We have uncovered millions of dollars of missing revenue, corrected millions of dollars in accounting entries, and identified millions of misappropriated dollars for contracts and spending.”

“Despite all our successes in the last two years, there are city departments that have not been audited internally in a decade and functions of those departments that may have never been audited.”

Moon was asked if the CCPD has ever received an outside forensic audit and if funds have ever been transferred from it to the general fund. “Components of CCPD have been included in the external audit completed annually,” he wrote in his reply.

He stated that an internal audit in 2007—before the CCPD board was replaced with council—found the CCPD fund “well-managed” by the police, with “no evidence of mismanagement or significant misapplication of funds.”

Another audit in 2009 found: “Purchasing transactions didn’t have the authorization form or an IOC for those >$3K as required by the General Orders at that time.” A follow-up audit in 2012 found “corrective actions taken” to address issues raised in the 2009 audit.

No other member of council has yet answered the same questions Texas Scorecard posed to Moon.

Critics question if taxes like the CCPD are even necessary in order to fully fund public safety. They argue special taxes such as these allow local governments to spend more taxpayer dollars in the general fund elsewhere while shifting the burden to fund core services of government onto the people via newer taxes.

And, thanks to the government-mandated shutdown in response to the Chinese coronavirus, sales tax revenues in the state have plummeted. Fort Worth sales tax revenues this April were down over 13 percent compared to April of last year, triggering cuts being made to compensate.

Millions of Texans are now unemployed, leaving critics wondering if tax relief—including reducing sales taxes—should be a priority. There is concern that if the CCPD sales tax were eliminated, rather than making cuts in the budget to fill the gap left by sales tax, city council would just hike property taxes instead.

Fort Worth’s current budget, which includes all taxes and other sources of revenue—is at $1.9 billion—$500 million more than its 2013 budget.

Data from the Tarrant Appraisal District shows that from 2013 to 2019, the average Fort Worth homeowner’s city property tax bills increased over 42 percent—from $835 to $1,193.

Voters have renewed the CCPD tax four times and are being asked this July to renew it for a 10-year period. Early voting runs from June 29 to July 10.

Election Day is July 14.

This article has been updated since publication.