Taxpayers in Keller are joining a North Texas revolution as their city seeks to adopt a budget that would lower the average homeowner’s city property tax bill by nearly a full percent from last year.

From 2013 to 2018, data from the Tarrant Appraisal District shows that the average city property tax bill from Keller for homeowners grew nearly 20 percent, from $1,197 to $1,432.

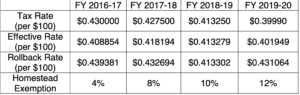

The proposed 2019-2020 property tax rate, $0.39990 per $100 valuation, combined with a proposed increase of the homestead exemption to 12 percent would see the average homeowner’s city property tax bill drop from $1,432 to $1,422, almost a full percentage lower when compared to the previous year.

The proposed property tax rate is below the “effective” tax rate, the rate at which roughly the same revenue would be collected from property taxes in both years. Regardless of the tax rate adopted in any given year, a taxing entity would still collect new tax revenue from growth and economic development.

Despite a lower tax rate in 2019, Keller expects a 1.8 percent increase in property tax revenues from the previous year, with over $520,000 from new properties. The budget would also increase spending $723,307 more than the previous year’s budget.

The proposed budget, if passed, would see Keller join other cities in North Texas such as Southlake, Plano, and others in leading a property tax revolution. These cities are seeking to adopt property tax rates low enough to offset rising appraisal values. Collin County officials have adopted an effective property tax rate for the fourth year in a row.

Taxpayers will have an opportunity to voice their opinions at the August 27 city council meeting. City council will vote on the budget on September 17.