As Texans prepare to vote on a combined $25 billion in school bond propositions, two Republican state lawmakers sparred over whether bonds that must be repaid with property taxes are property tax increases.

The debate was sparked by legislation proposed in both the state House and Senate that would weaken school bond ballot transparency requirements that warn voters about the property tax impact of approving new bond debt.

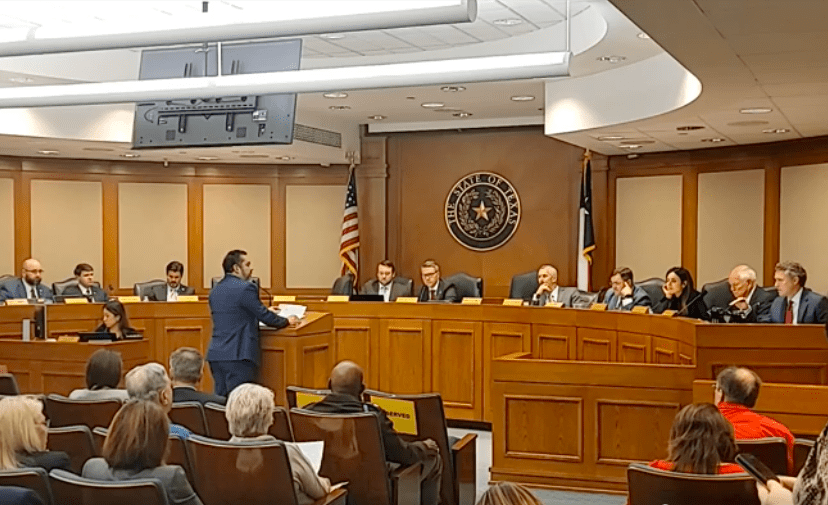

State Rep. J.M. Lozano (R–Kingsville) said Thursday during a House Public Education Committee hearing that “not all bonds are going to lead to an increase in taxes paid.”

State Rep. Brian Harrison (R–Midlothian), who serves on the committee, questioned Lozano.

“I hear this, that bonds don’t increase taxes,” Harrison said. “But I mean, are buildings free?”

“Somebody’s paying for the buildings, right?” he asked.

“Yeah, everyone that’s paying taxes,” Lozano answered.

“Right,” said Harrison. “If the building is X dollars, taxes have to go up by X to pay for the building. Unless the implication is that the building is free, somebody is paying for the building.”

“That’s correct,” Lozano acknowledged.

“So taxes are higher than if there was no bond,” Harrison concluded. “So every bond effectively is a tax increase.”

Proposed Legislation

Currently, school bond ballot propositions must include the statement “THIS IS A PROPERTY TAX INCREASE.”

Lozano’s House Bill 4522 would change the required statement to “THIS IS A PROPERTY TAX RATE INCREASE,” but only if the district determines a rate increase would be needed to pay bond debt principal and interest the following year. Otherwise, the property tax impact would not be mentioned.

Lozano said during Thursday’s hearing that the change was intended to reduce confusion.

Hill County resident Gary Teal disagreed.

“There is no confusion with the current language,” said Teal, who also testified against the anti-taxpayer measure in a Senate committee hearing the previous day. “The problem with it is that it’s very clear: It says this will be a tax increase.”

“To my way of thinking, you can’t borrow $100 million and not tell the taxpayers that they’re going to need to pay it back,” he said.

Ellis County resident Amy Hedtke, an activist who’s spearheaded dozens of “Vote No” campaigns against bonds, also testified against the House and Senate bills.

Hedtke explained that all bond propositions authorize property tax hikes. She said the “fine print” in bond ballot language approved by voters includes allowing school districts to levy property taxes “without limit as to rate or amount” to repay the bond debt, with interest.

Hedtke explained that all bond propositions authorize property tax hikes. She said the “fine print” in bond ballot language approved by voters includes allowing school districts to levy property taxes “without limit as to rate or amount” to repay the bond debt, with interest.

“A lot of people don’t like fine print,” she said during Thursday’s hearing. “What they hate worse is when we point it out.”

On Wednesday, the Senate Education Committee debated an identical measure to Lozano’s, Senate Bill 2205 by State Sen. Tan Parker (R–Flower Mound).

They also discussed Senate Bill 2117 by State Sen. Brandon Creighton (R–Conroe) that would change the required tax impact statement on school bond propositions to read “THIS AUTHORIZES THE DISTRICT TO TAKE ON ADDITIONAL DEBT,” removing any acknowledgement that more spending means more taxes.

Creighton said the bills were intended to “start a conversation” about whether the ballot language should be changed.

Like Lozano, Parker said “not all bonds result in a tax increase.”

“We’re not trying to make it easy for districts to build crazy water parks,” he said. “We just want to reduce confusion.”

Parker said some school districts have been “advised to raise their tax rates” in response to the current ballot language. That advice was shared by school bond promoter and profiteer Huckabee, Inc. during an education conference last year.

Only one school district official, Gregory-Portland ISD Superintendent Michelle Cavazos, showed up to testify in favor of the bills, though other school officials have said they support changing the ballot language.

In contrast to the weaker ballot language proposed by Lozano, Parker, and Creighton, Harrison’s House Bill 3717 would make the warning “THIS IS A PROPERTY TAX INCREASE” even more prominent on voters’ ballots.

Harrison’s bill has not been scheduled for a committee hearing, but Lozano agreed to work with him on a mutually acceptable revision.

Any changes approved by the Legislature would not affect the upcoming bond elections.

Early voting runs April 24 through May 2. Election Day is Saturday, May 6.