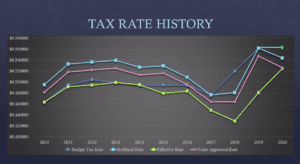

Tuesday evening, Bedford City Council voted 6-0 to continue their pattern of hiking property taxes, choosing to raise the average city homeowner’s property tax bill over 9 percent from just last year, from $1,142 to $1,252.

Even worse, data from the Tarrant Appraisal District shows Bedford’s adopted tax rate will be a 70.8 percent hike in the average city homeowner’s tax bill since 2013, from $733 to $1,252.

“I think it’s unfortunate that we get so tied up around the axle with respect to the tax rate,” said City Manager Brian Bosshardt, defending the higher taxes on Tuesday. Bosshardt, hired from Los Alamos County in New Mexico by a unanimous vote in 2017, presented information before council illustrating that since he was hired, Bedford began rapidly raising taxes more than they had in recent history by adopting tax rates well above the “effective” tax rate—also called the “no-new-revenue rate.” This rate adjusts as property values change to keep taxpayers’ bills roughly the same, in the aggregate, though individual results vary based on valuations and exemptions.

“He is a good fit for us,” then-Mayor Griffin said when Bosshardt was hired.

Griffin also voted in favor for each increase in 2017 and 2018. Since being elected in May 2012, Griffin oversaw Bedford’s over 55 percent increase in the average homeowner’s tax bills from 2013 to 2018, $733 to $1,142.

Griffin resigned at the September 3 council meeting to run for the seat of retiring State Rep. Jonathan Stickland (R-Bedford), but is still mayor until the November 5 special election is held. Though still mayor, Griffin avoided Tuesday’s vote on the budget and property tax increase. But the city manager he fully supported hiring in 2017 worked all summer preparing this budget and the accompanying tax increase.

Councilmembers defended the tax hikes, arguing that any cuts to the budget would affect core services, including police, fire, and the city’s reserve fund.

“My question to all the conservatives out there who come up and blast us all as liberals and [say] we’re just spending all their money is, ‘What’s more important? Is it the lower rate or is it the lower [reserve] fund balance?’” asked Place 6 Councilman Roger Fisher.

“I just don’t see how we can cut anything out of this budget,” said Place 5 Councilwoman Ruth Culver before moving the council to adopt the nearly $36 million budget, which is over $2 million higher than just two years ago. “I’m not in favor of raising taxes. I understand the issues that go along with that, what each and every homeowner is facing, but it just happens to be a fact of reality … .”

“I don’t like to sit here and raise taxes,” added Place 1 Councilman Rusty Sartor before voting for the 9 percent increase. “My taxes are going to go up, too. My home value is more than the average home in this city.”

The final vote Tuesday was 6-0, with Bedford Mayor Pro-Tem and current mayoral candidate Michael Boyter also voting in favor. The average homeowner can now expect an over 9 percent hike in their city’s tax bill.