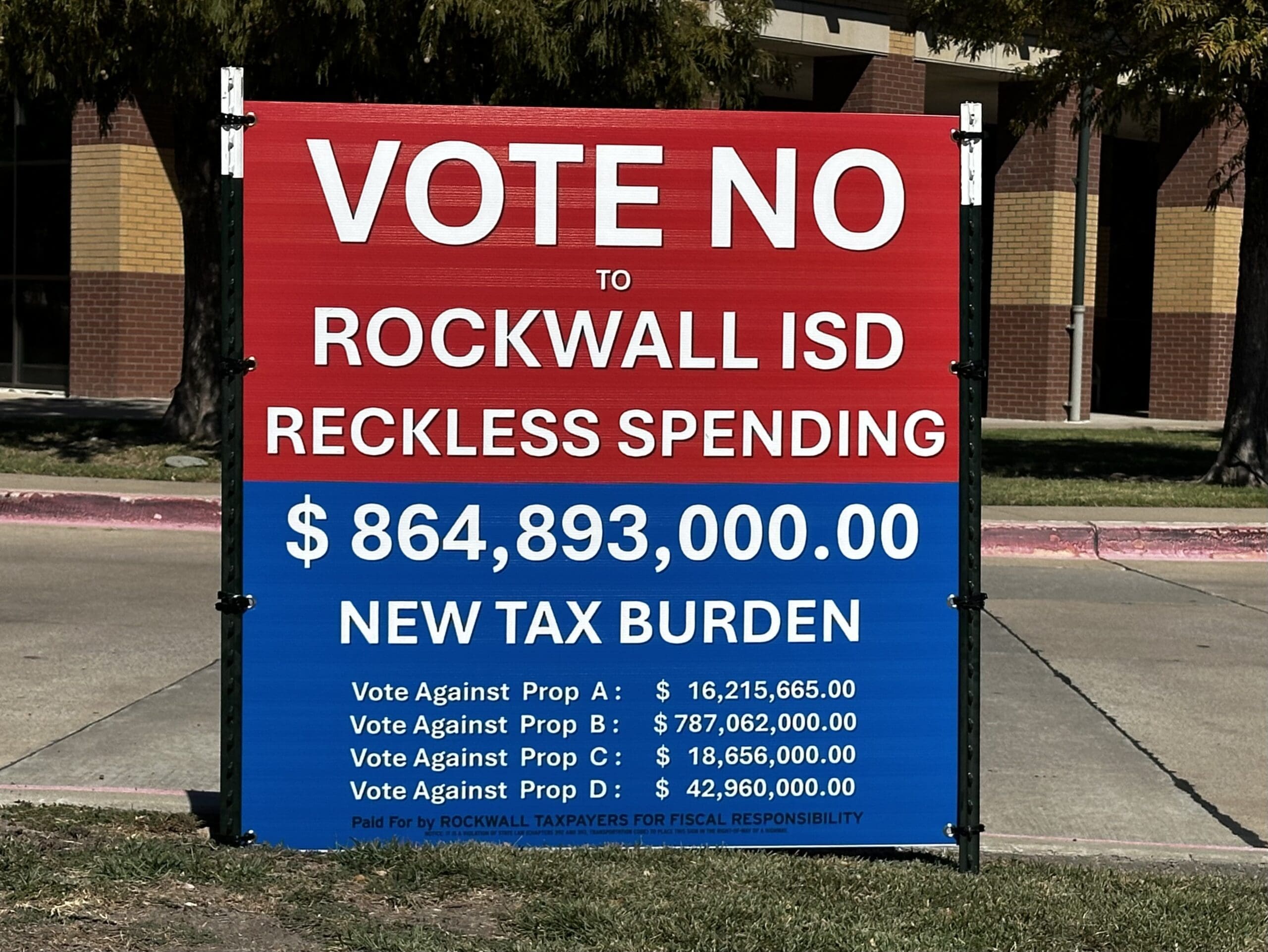

Local residents are urging their neighbors to “Vote No” on ballot propositions being pushed by Rockwall Independent School District that would result in big property tax increases.

School trustees are seeking voters’ approval of a double-digit tax hike and a huge bond package that would be repaid with property taxes.

Trustees are required to hold a Voter-Approval Tax Ratification Election (VATRE) when they want to raise property tax rates higher than the maximum allowed by state law without a public vote—generally a 2.5 percent increase in the maintenance and operations (M&O) rate.

Rockwall ISD’s proposed property tax rate is a 17.5 percent increase in the M&O rate.

The average Rockwall homeowner will pay $877 more in taxes—a 25 percent increase.

The district calculates the new rate would collect an additional $16 million in property tax revenue this year.

On top of a permanent increase in the M&O tax rate—which is used to pay for school operating expenses, primarily employee compensation—Rockwall ISD trustees are asking local taxpayers to fund $848 million in new bond debt.

According to the district’s calculations, with interest the three bonds on the November ballot would cost local property taxpayers $1.53 billion—80 percent more than the amounts voters will see on the ballot.

Rockwall ISD taxpayers currently owe $1.65 billion in bond debt principal and interest.

Organizers of a new advocacy group, Rockwall Taxpayers for Fiscal Responsibility, are urging their neighbors to “Vote No” on all four November ballot issues.

District parent Eric Bott started the group to push back against the unchecked use of school bonds, and he’s now heading a campaign against Rockwall ISD’s bonds and tax increase.

“Bonds are not free money. They are taxpayer-funded loans that voters must repay with interest,” Bott told Texas Scorecard. “Our concern is that districts like Rockwall ISD are habitually using bonds to address issues that could have been resolved with better financial planning.”

Compounding the problem, ISDs including Rockwall spend taxpayers’ money to promote their tax increases and tax-funded bonds.

“One thing has become abundantly clear: school districts have weaponized taxpayer dollars against the very citizens who fund them,” said Bott. “Our grassroots efforts have uncovered how these districts wield immense financial and institutional power to promote bonds while making it extraordinarily difficult for concerned residents to offer an alternative voice.”

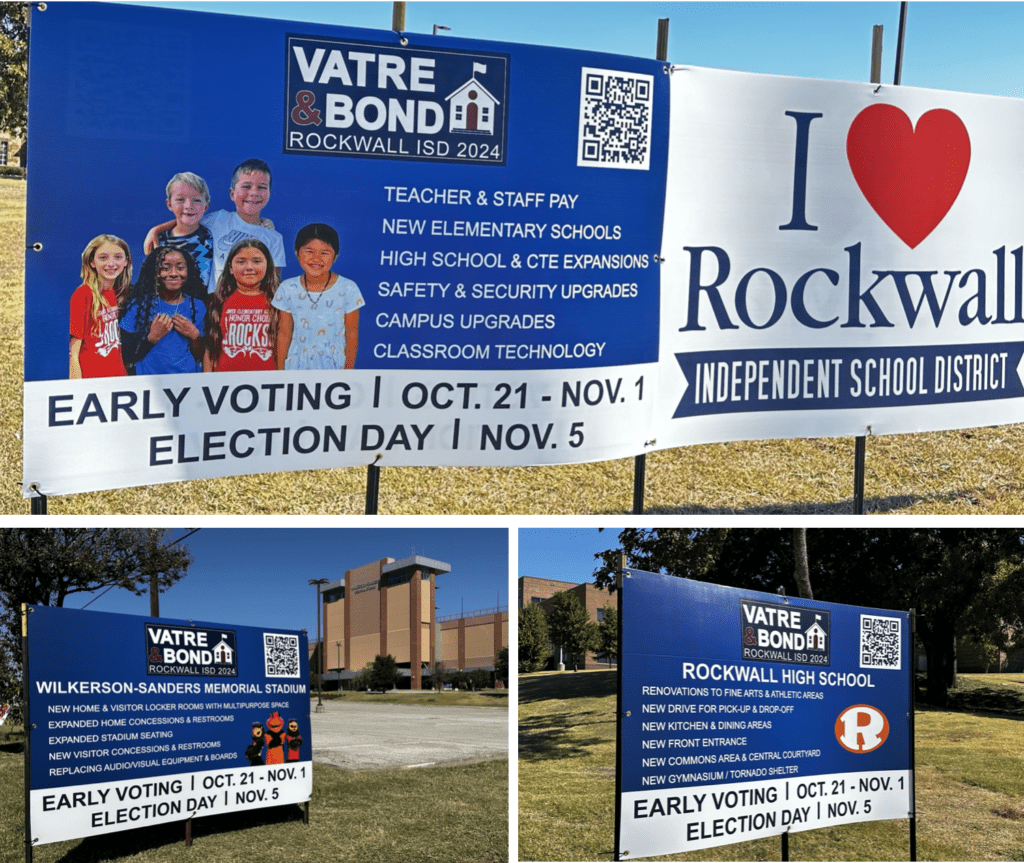

Rockwall ISD officials have spent an undisclosed amount of tax money promoting their bonds and tax rate increase via a dedicated website, multiple mailers, large signs posted on school campuses, and several videos featuring school employees—plus one video using students to promote the bonds.

State law prohibits spending school resources on political advertising that supports a ballot issue, but district officials maintain that their tax-funded “information” is not electioneering.

Bott notes the “big money” behind the pro-bond campaign doesn’t just come from the school district using tax dollars.

He found that a political action committee called Vote For Rockwall ISD is funded by contributors connected to the “education-industrial complex:” architects, construction companies, consultants, and other businesses that stand to gain financially from bond projects.

As of September 30, the pro-bond PAC had raised $123,000, including $50,000 from Dallas-based architecture firm Corgan and contributions ranging from $3,300 to $10,000 from nine other construction-related companies.

The PAC has spent the vendors’ money on signs and mailers promoting the bond and tax increase.

“We are up against a well-funded machine with deep pockets, chasing billions in taxpayer-funded projects,” said Bott. “Meanwhile, we citizens—ordinary working people—must raise every dollar ourselves and fight against an institution that is using our own tax dollars to campaign against us.”

Rockwall ISD taxpayer Thomas Marchetti is a vocal opponent of runaway property taxes, which he says hurt everyone: homeowners, renters, businesses, and consumers.

Marchetti told Texas Scorecard he believes Rockwall ISD’s one-sided promotional mailers, videos, and posts on the district’s official social media accounts have crossed into taxpayer-funded advocacy for the property tax hike and bond measures.

“Clearly, without offering opposing views and opinions, it’s not educational and does not feature both sides,” he said. “They are using the school’s facilities, website, and X feed to advocate for a side in the tax hike and bond debate. This is so wrong and should be considered electioneering.”

“This needs to be addressed by the state legislature,” added Marchetti.

One future lawmaker has spoken out on social media on behalf of district taxpayers.

“The residents of Rockwall are not a piggybank,” posted Katrina Pierson, who defeated State Rep. Justin Holland of Heath in the May Republican primary runoff and will represent Rockwall in the Texas Legislature starting next year.

During a time of record inflation and skyrocketing costs for everyday life, Rockwall ISD is running an aggressive political campaign in support of nearly a BILLION dollars of new debt and an explosion in HIGHER property tax rates. Rockwall ISD’s proposal pushes beyond the limits of what our community and families can bear, and we must send a resounding message: No!

State Sen. Bob Hall (R–Edgewood), whose district includes Rockwall, also weighed in. Hall told Texas Scorecard that Rockwall ISD’s proposed tax hike shows a “disconnect” between district officials and local families.

Raising enrollment by 1.6% and requesting an increase in the tax rate by 17% shows a disconnect from the financial struggles that families face when trying to balance their budgets. The only good thing about the issue is that the taxpayers have the opportunity to tell the district “no” and vote these increases down.

A group of Rockwall families who are protesting how district officials handled sex abuse allegations involving a pre-K teacher and student have said they will oppose the bonds and tax increase unless their school safety demands are met.

So far, trustees have agreed to extend surveillance video to 120 days, but parents also want cameras inside classrooms to better protect children and teachers.

According to the district’s promotional materials, the bond-funded projects are needed to relieve overcrowding and accommodate the projected growth of 6,600 students over the next 10 years.

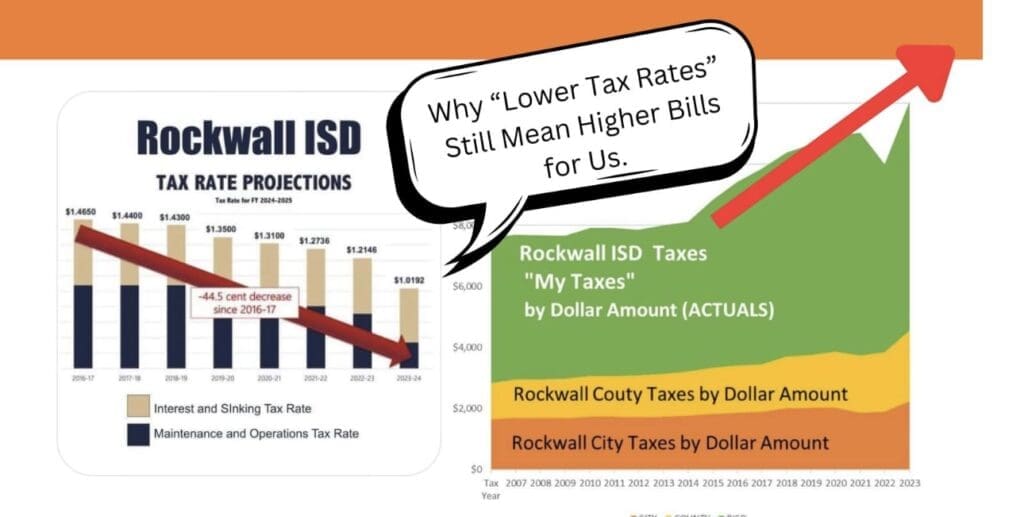

The district also touts a low tax rate, but Bott said state-mandated M&O rate reductions have been more than offset by rising property values, pushing his tax bills higher every year.

Rockwell ISD’s four propositions on the November ballot are:

Proposition A: VATRE would increase the total property tax rate by 12.5 percent to $1.14 per $100 of valuation, costing the average homeowner an additional $877.

Proposition B: $787 million ($1.4 billion with interest) would be spent on new school buildings and additions, renovations of existing schools, and new buses.

Proposition C: $18.6 million ($20.1 million with interest) would pay for technology devices and infrastructure.

Proposition D: $42.9 million ($78.4 million with interest) would be spent on renovating and expanding the district’s football stadium.

While the total cost to taxpayers isn’t disclosed on the ballot, state law requires school districts to warn voters of the tax impact of bonds by including in the ballot language, “THIS IS A PROPERTY TAX INCREASE.”

Trustees can raise the debt tax rate as needed to repay the bonds without further voter approval, but even if the rate stays the same, rising property values will result in higher tax bills. Regardless of tax rates at any given time, the total tax burden on district property owners is increased by the amount of the bond debt.

Voters will find the school bond and tax increase propositions at the bottom of their ballot.

Early voting is ongoing until November 1. Election Day is Tuesday, November 5.