Voters in Denton ISD will decide in November whether to permanently raise school property tax rates for district residents and businesses above the maximum increase allowed by state law.

In August, Denton Independent School District trustees unanimously approved placing a Voter-Approval Tax Rate Election on the November 4 ballot as Proposition A.

A VATRE is required if elected school board officials adopt a property tax increase that exceeds the district’s voter-approval rate as calculated according to state laws.

Denton ISD trustees are asking for a permanent increase in the district’s maintenance and operations (M&O) tax rate that is 5 cents higher than the voter-approval rate.

Texas law requires the ballot proposition to state: “THIS IS A PROPERTY TAX INCREASE.”

The ballot will also inform voters that the proposed tax rate of $1.2069 per $100 of assessed taxable value will result in a 13 percent increase in M&O tax revenue compared to last year.

The total tax rate includes a debt service rate of $0.48, which is set annually by the board, and an M&O rate of $0.7269, which according to the district’s election order is the legal maximum under current Texas law and if approved will be levied “each year hereafter.”

If the VATRE fails, the tax rate for 2025 defaults to the voter-approval rate of $1.1569, which includes an M&O rate of $0.6769 (the same as the current rate).

Without the proposed rate increase, the average Denton ISD homeowner will pay about $3,448 in school taxes, a savings of $340 over last year.

If voters approve the tax increase, the average Denton ISD homeowner with a taxable value of $298,000 would pay about $3,596 in school property taxes for 2025—still a $192 decrease compared to 2024, but some of the savings state lawmakers sought to return to taxpayers will be eaten up by the higher tax rate

The district’s calculations take into account the anticipated voter approval of additional homestead exemptions that are also on the November ballot.

Denton ISD estimates that the higher tax rate would generate an additional $26 million this year for the district’s daily operations and help offset a $15 million budget deficit.

According to the district’s bond website, the extra tax revenue will be spent on teacher and staff support ($16 million), safety and security ($5 million), and student programs and enrichment ($5 million).

However, the district is not obligated to spend the money on specific items.

State law requires school districts to complete an efficiency audit before asking voters to approve an excessive tax rate increase. Denton ISD trustees publicly presented an Efficiency Audit Report during their September 23 school board meeting. Findings were based on data from the district’s 2023-24 fiscal year.

The report noted that Denton ISD held a tax rate election in 2017 in which voters approved a permanent 2-cent increase in the M&O rate that was “offset” by a temporary 2-cent decrease in the debt service rate.

District officials are being careful to share “factual information only” about Proposition A, after Denton ISD was sued last year by the Texas attorney general for electioneering with school resources during the 2024 primaries.

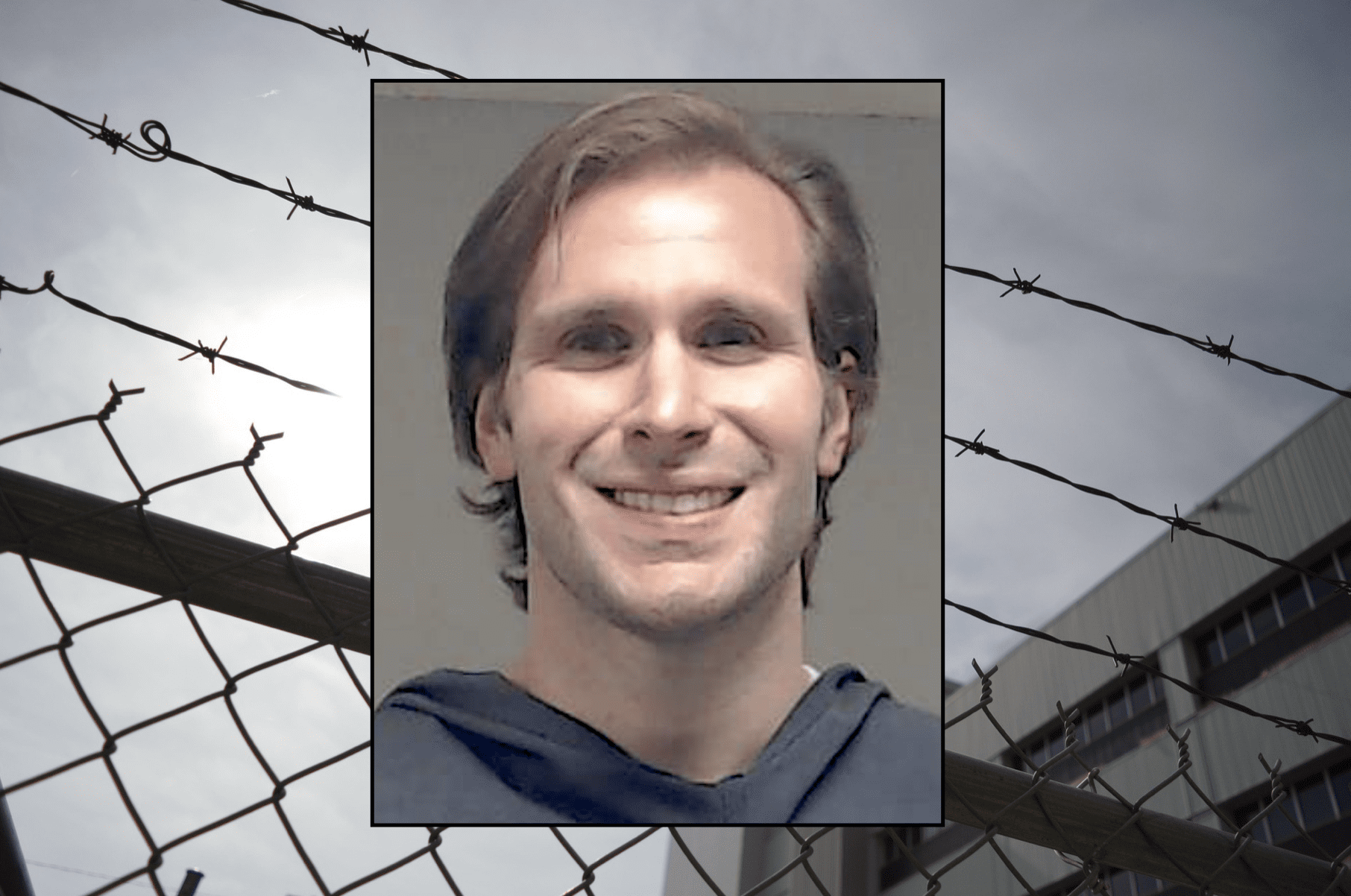

Two Denton ISD administrators, Jesus and Lindsay Lujan, were criminally charged for electioneering. Both admitted guilt but avoided criminal penalties after prosecutors offered them pre-trial diversion.

Denton ISD has posted videos about the VATRE that show students and teachers on district campuses and describe how the higher taxes would be spent on staff salaries and security updates.

A political action committee, Vote for Denton ISD Kids, is directly promoting the VATRE.

“The district’s role is to provide our community with clear, accurate, and accessible information about Proposition A,” stated Superintendent Susannah O’Bara in an announcement about the tax increase vote. “We encourage residents to review the resources we will share in the weeks ahead to understand what is being presented on the ballot.”

The district hosted two “community information sessions” on Proposition A in September. Two more are planned for this month:

- Tuesday, October 7, 6:30–7:30 p.m. at Braswell High School

- Wednesday, October 15, 6:30–7:30 p.m. at Guyer High School

Seventeen Texas constitutional amendments are also on the November ballot statewide. Several relate to property tax exemptions.

Early voting will be held October 20-31. Election Day is Tuesday, November 4.

No ads. No paywalls. No government grants. No corporate masters.

Just real news for real Texans.

Support Texas Scorecard to keep it that way!