Chinese Communist Party-backed manufacturing companies came to Texas, and were not only welcomed by public officials, but e extraordinary efforts were made to ensure one of these companies arrived. Totally missing was any consideration of the economic warfare China is waging against America, and highlights the need for citizen vigilance.

Over the last month,Texas Scorecard has reported on the various ways the Chinese Communist Party (CCP) has infiltrated the Lone Star State. We have focused on four main theaters of operation where we’ve identified CCP activity: education, land, politics, and commerce.

In education, they did it using the name of an ancient Chinese philosopher as a trojan horse while promising exports of Chinese culture and language. In land, by acquiring acreage in South Texas near a military installation through companies financed with CCP money, and gaining access to our food supply. And in politics by making connections at the state and local levels, promising greater economic access.

In commerce, the Chinese Communist Party accomplished infiltration through connections between major Chinese corporations and American industries. In Texas, they successfully infiltrated our industries, such as energy and real estate. As established in previous articles, the Chinese government views their state-controlled companies as conduits of CCP influence into American industries, and so they support and encourage such investments.

J. Kyle Bass, founding member of the Committee on the Present Danger: China, told Texas Scorecard how the CCP uses greed to grease the skids for their infiltration of the United States.

“China creates cheerleaders, like Ray Dalio and Steve Schwarzman, by giving them special access and them becoming evangelical about the benefits of doing business with the Chinese, without seeing the risks to allowing them to infiltrate our financial institutions, our supranational institutions, our learning and educational institutions.”

Since the reach of CCP influence in Texas commerce is a major security concern, it is necessary to explore yet another critical sector that has been hurting for some time in our country: manufacturing.

A Tale of Two Cities: Tianjin, China and Gregory, Texas

In November 2014, the Paulson Institute published a case study chronicling one particular Chinese Communist Party backed company that made its way into the Lone Star State.

It started in 1989, when the Tianjin municipal government in China created a new state entity: the Tianjin Pipe Corporation (TPCO). Since its incorporation, the company has received significant taxpayer funds and subsidies from the communist government. The initial government funding used to jumpstart the company was funneled through the “Big Four” state banks.

Ten years after its inception, TPCO was restructured through the creation of a new “limited liability entity,” and half of its newly capitalized debt was held by the four Asset Management Companies of the Communist government. At this time, even though many state-owned enterprises failed or were shut down, the CCP protected certain key companies that were seen as “strategic state assets” and shielded by local governments. TPCO, which “held an exalted place in China’s macroeconomic development plans,” was among these companies, and deemed too valuable to fail.

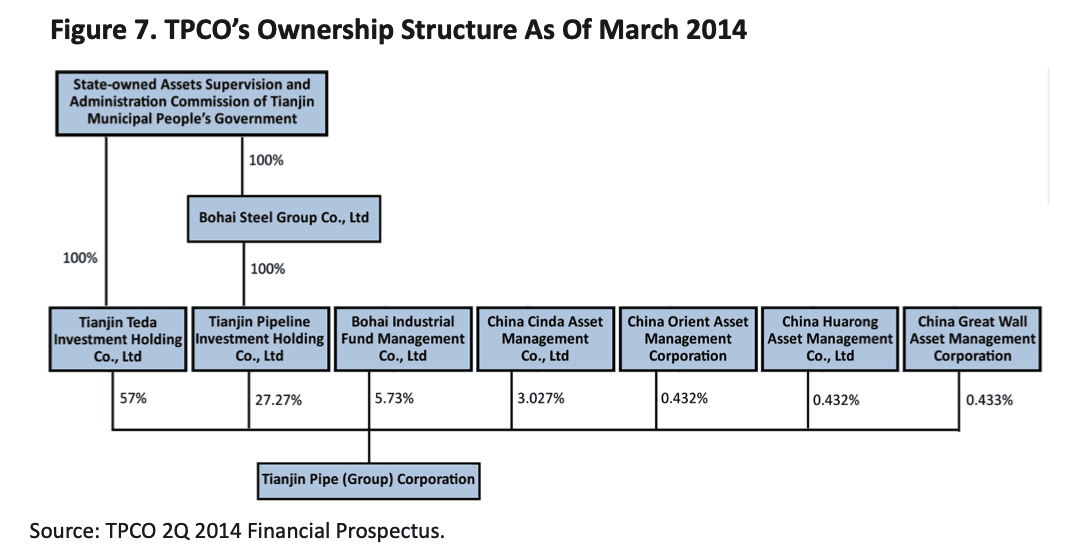

In 2006, the Chinese Communist Party transformed TPCO into a joint stock corporation with stakeholders consisting of various holding companies controlled by the State-owned Assets Supervision and Administration Commission (SASAC) and the national asset management companies, as illustrated in the chart below, found in the Paulson Institute’s case study. This “effectively [made] TPCO a fully state-owned firm.”

The special treatment Tianjin Pipe Corporation received from the Chinese government was a major motivation for the U.S. government to impose tariffs on imports from TPCO and other state-owned enterprises in 2009. The European Union had done the same earlier that year, arguing that “cheaper Chinese steel pipes were flooding the EU market,” particularly during The Great Recession of 2008. TPCO had already been losing market share across the globe, and these decisions closed huge export markets for them.

“It needed to either find new markets internationally or else figure out another way to access old markets,” the case study reports. TPCO chose the latter option. “In fact, TPCO trained its gaze on the Lone Star State.”

But how to get in? Tianjin Pipe Corporation had an operation in Houston since 1993, but that merely facilitated its pipe exports to America, which the tariffs had shut down. To counter this, the company sought ways to produce their pipes inside the U.S. They found the state and local governments more than willing to help them do it.

In 2007, the state economic development office requested a proposal from the City of Corpus Christi and County of San Patricio development offices for the TPCO investment. Rather than competing, the two local governments decided to join forces, and with the assistance of San Patricio County Judge Terry Simpson, further convinced TPCO to invest in the area by providing them with tax incentives.

In 2009, TPCO announced the establishment of a manufacturing plant in Gregory, Texas, located in San Patricio County. This followed a feasibility study conducted in the area in 2006, which the company did with the city government of Corpus Christi. TPCO promised to invest more than $1 billion in the project, making it the “largest single investment by a Chinese company in a US manufacturing facility.” The plant— a 1.6 million square foot facility on 253 acres of property—would produce pipes for high-pressure drilling (called oil country tubular goods, or OCTG pipes), and standard pipes for gas transportation.

As discussed by Texas Scorecard’s previous reporting on Chinese corporate investments in the energy sector, shale gas production is a key area of interest for Chinese investors. China has a significant amount of shale resources, but they lack the technological skills necessary to extract them. By investing in related shale projects in the United States, they also acquire the knowledge, skills, and infrastructure needed to eventually utilize their own resources in China.

The construction of the facility alone was estimated to bring roughly 2,000 construction jobs to the area, and once completed, the plant aimed to hire 600–800 employees.

However, Tianjin Pipe Corporation didn’t originally pick Gregory, TX for this project. The economic development offices of the City of Corpus Christi and the County of San Patricio, along with the state economic development office in Austin, went to great lengths to convince TPCO to invest in Texas.

“The state authorizes (or provides) local jurisdictions like cities and counties to offer tax abatements and things like that, so there’s some enabling legislation at the state level providing tools,” Corpus Christi Regional Economic Development Corporation President/CEO Roland Mower said in 2014.

These incentives were not particularly generous, and the counties insist that the main reasons TPCO chose to invest in the area was its infrastructure and the relationships it formed with people in those counties. For example, JJ Johnson, the executive vice president of the Corpus Christi Regional Economic Development Corporation, left that taxpayer-funded position shortly after the TPCO investment was announced in order to serve in an external relations and human resources position at the CCP-owned company.

But, the TPCO investment ran into some roadblocks. One of these issues is the lack of qualified personnel to work at the plant, since many of the technical positions require fluency in both English and Mandarin.

The plant’s location in Gregory has proved to be a disadvantage when it comes to recruiting talented employees due to the lack of prominent technical and research universities in the area. Even though local community colleges have pitched in to help train people in the engineering skills needed to work at this facility, TPCO still struggles to hire the needed number of workers. In 2019, TPCO was fined by San Patricio County for not hiring enough employees. They were expected to hire between 400-500 employees, a certain percentage of which needed to be American workers in order to comply with the tax breaks provided by the county. When the county reviewed the work site, there were only 103 employees. They were hit with a $3 million fine, which was considerably lower than what officials would normally fine in these situations. According to San Patricio County Judge David Krebs, “We gave them a break… We were worried that we would run them out of business; we didn’t want to run them out, because we want them to be there. I mean, they are a big part of the county; they need to be big. So, we cut their fine, probably in half. That’s what we did. And they paid it.”

Also, instead of making pipes, like Krebs and others expected them to, TPCO was bringing in pipes from overseas. The Gregory facility would then just alter these pipes before shipping them out.

Zhejiang Hailiang Co

There is another Chinese corporation that has invested in the South Texas region. In 2019, a company called Zhejiang Hailiang Co Ltd. planned to build a copper tube factory in Sealy, Texas, a city in the Houston area. Zhejiang Hailiang planned to invest $165 million into the project, and the factory would be constructed by China Construction America. This is the first Chinese investment in Sealy, and the facility will be its third largest employer, following the school district and Walmart. The plant, to be called Hailiang Copper Texas, was expected to create about 250 jobs, attracting employees from Sealy and Houston.

Zhejiang Hailiang Co Ltd is a subsidiary of Hailiang Group Co Ltd, a private Chinese corporation with strong ties to the Chinese government. The company has received numerous awards and titles, including that of “National Civilization Unit in China,” a designation which is based on the idea of the national civilized city, a concept which “demonstrates the [CCP’s] continuing agenda to guide the socialist ideological development of the urban process in China.”

Some of the Hailiang Group’s most prominent administrators, such as the Group Chairman and the Secretary of the Youth League Committee, were elected as representatives and alternates at the 18th and 17th CCP Congress, respectively.

Like with Tianjin Pipe Corporation, questions abound regarding the current status of The Hailiang Copper Texas facility.

It was expected to be finished by 2022, is still listed on the Hailiang global corporate map, and its announcement remains on the corporate website. However, despite repeated search attempts, Texas Scorecard was unable to find any evidence on if the project is completed or delayed. China Construction America’s website still refers to the project as though it is not yet finished. Texas Scorecard inquired about its progress to both Hailiang and the Sealy Economic Development Corporation.

No response was received before publication.

Conclusion

Chinese companies with ties to the Chinese Communist Party have made significant incursions into Texas commerce, including the energy, real estate, and manufacturing industries.

Although these investments may appear to be positive developments, for representatives of the Communist government, these investments in American commerce serve as valuable footholds in the expansion of CCP influence worldwide. American companies, and public servants in government, would do well to approach these deals with caution and think twice before granting foreign corporations full access to America’s most integral commercial sectors.

Unfortunately, at a national level, America seems all too slow responding to this particular type of infiltration.

“We don’t have a grand strategy for China’s economic war against the United States. We kind of handle things when we think something might be infringing upon our businesses or our society,” J. Kyle Bass said. “We don’t have an economic war department in the United States.”

Texas also seems to have been slow to react, considering the lack of enforcement of the Lone Star Infrastructure Protection Act, and the loopholes in said law.

Noting that the U.S. Government has identified China, Russia, North Korea, and Iran as the top four malign actors at present, J. Kyle Bass calls for Texans to step up to the plate themselves.

“If you know about any of those malign actors engaging in purchasing property, or running influence campaigns, or setting up Confucius Institutes, we should all be working together to raise the awareness level, and interface with law enforcement,” he said. “Now that you kind of have citizen journalists everywhere, everyone should be posting, or sending whatever they know to someone like you that actually cares about these things.”

If you or someone you know is aware of CCP activity in Texas, be it in the educational, agricultural, political, or commerce theaters, please contact us at rmontoya@texasscorecard.com