As Texans seek relief from high property taxes, Michael Berlanga of Texas True Tax gives seminars around the state asking communities to unite and protest local corruption.

A San Antonio-based certified professional accountant, licensed real estate broker, and certified property tax consultant, Berlanga told attendees at a recent meeting, “I am the only tri-licensed guy paid by the city to protest city taxes, despite being in a Democrat-run city.”

Unlike most tax protest seminars, Berlanga highlights systemic issues and needed reforms.

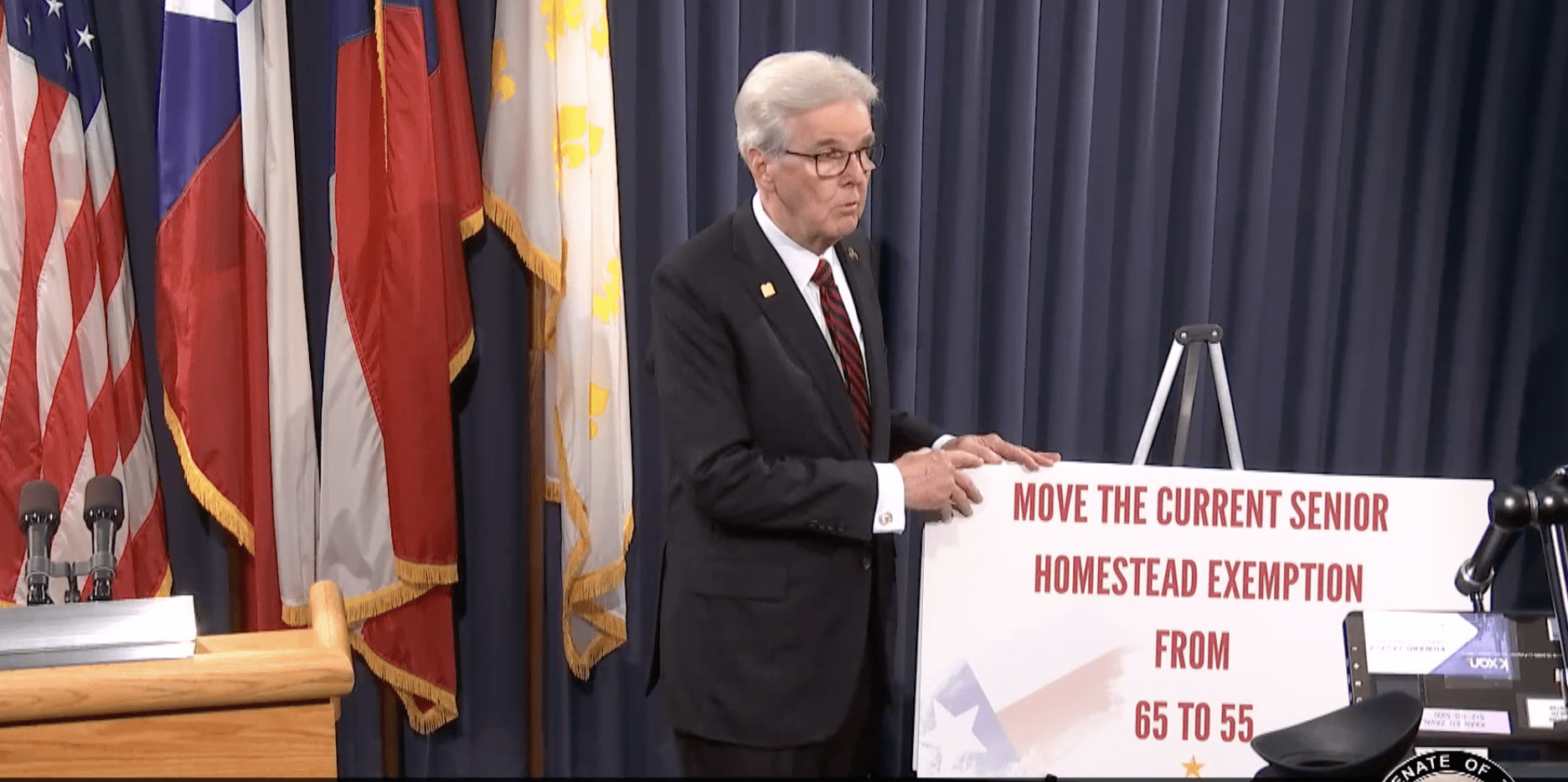

He’s particularly critical of Comptroller Glenn Hegar, noting his lack of formal financial training and his recent statements indicating that he does not care about increased property taxes.

Berlanga narrated how Hegar replied at a February Alamo City Conservatives luncheon when asked, “What impact do you feel the property value study has on local property values and the resulting taxes?”

Hegar’s reply shocked patrons as he stated, “It doesn’t make a damn bit of difference to me because I’m not a property tax collector!”

Hegar’s office disputed the date and accuracy of the quote but wrote, “Regarding the impact of the property value study, the Comptroller is correct.” Several event patrons confirmed his statement.

“The study is backward-looking,” Hegar’s office added, “and results are published long after appraisal notices have been issued and taxes have been paid.”

Countering this claim, Berlanga forwarded Texas Scorecard a March 2023 press release from the Bandera Central Appraisal District. Its language suggests that school districts pressure appraisers to validate Hegar’s study and raise property values:

“The locally appraised values of homes and businesses did not reach the 95% of sales prices, the ratio mandated in state law. The appraisal district and local schools learned of the study results in early February,” Interim Chief Appraiser Maria Garcia wrote. “We just want to get the values correct so that the local schools will be fully funded.”

“Wouldn’t you think that the Chief Appraiser knows the values better than anybody else in the county?” Berlanga asked.

Another patron asked Hegar, “When was the last public school efficiency study done?”

Hegar replied, “It hasn’t been done in twenty-five to thirty years.” His office clarified that in 2003, lawmakers transferred responsibility to the Legislative Budget Board (LBB).

Berlanga commented, “Post-COVID, everything should have been changed.”

While still using protocols from 2014, the LBB produced only two studies in 2023 for specific ISDs, one in 2022, and two studies in 2020. Only one most closely approached a statewide study. It was released in 2021 and dealt with food services.

“Because we have no true [statewide] study, we can’t say we know the true cause of the issues,” Berlanga said.

Under the statute, the LBB “may periodically” review school districts’ effectiveness and efficiency at its discretion. Otherwise, the majority of a school district’s trustee board must adopt a resolution for a study.

The lack of required efficiency reports combined with the comptroller’s use of school districts’ self-reported data allows districts to effectively circumvent legislative accountability, Berlanga argues.

Given the current dysfunction, he endorses Gov. Greg Abbott’s goal to eliminate school property taxes.

“I haven’t seen any of the legislators stand with the governor on that by sponsoring a bill for a study,” he noted.

He realizes that while some legislators might not disclose lest they appear hypocritical, he hopes that publicizing such protests will encourage the over 80 percent of households that do not protest to do so.

One attendee asked Berlanga about recent legislation allowing voters in populous counties to elect three new directors to their county appraisal district board alongside five appointed directors.

“Off the bat, they would appear to be outnumbered just on appearance and simple math. It’s symbolic but not substantive,” he replied. “I pray that in reality, those three voices will bring about more change from the legislature, but the change has to begin with the legislature since it won’t come from the comptroller.”

Berlanga’s seminar concludes with a call to action: “Love thy neighbor.”

Property owners can designate neighbors as agents, or even renters, if taxes are separately stated in their lease contracts, he explains. By raising awareness of systemic dysfunction and encouraging action through taxpayer protests, Michael Berlanga hopes to empower citizens and hold unelected local bureaucrats accountable.

“Property owners should see their tax protest as the first step towards a vote for a better system. The second vote would be at the ballot box.”

No ads. No paywalls. No government grants. No corporate masters.

Just real news for real Texans.

Support Texas Scorecard to keep it that way!