Financial audits of some special taxing districts in Fort Bend County highlight a major issue with the management of property tax revenue.

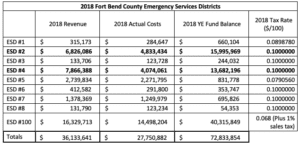

Below is a table that summarizes the 2018 year-end Fort Bend County Emergency Services Districts revenue and spending, based on their annual financial audits that were approved by the Fort Bend County Commissioners Court.

The Emergency Service Districts (ESDs) are allowed by state law to collect a maximum of $0.10 per $100 of assessed value in ad valorem property tax. Six of the nine districts in Fort Bend County collect the maximum allowable tax rate; two of those six spend much less than they collect and have built excessive fund balances.

This gross mismanagement of over-collected tax dollars should be troubling for every resident in Fort Bend County. Taxpayers in Texas have long complained about ever-increasing property taxes, and while the majority of these tax dollars go to the school districts, this illustrates a little-known problem of government entities hoarding and amassing huge tax surpluses year after year.

Taxpayers expect their tax payments are being used—and trust that our elected officials are making sure to spend—wisely, and they expect the tax rates to be kept reasonable and fair.

A budgeted annual contingency is a prudent measure. It can cover unplanned emergencies as well as affect the entities’ ability to borrow funds. But over-collecting an unused contingency year after year results in these massive fund balances. Often, budget contingencies will end up getting used for pet projects or some other “nice to have” item, on the rationale of “since we have the money, let’s spend it.” The state economic stabilization or “rainy day” fund has some very strict requirements for use, but these local surpluses and contingencies do not, and it can make mismanagement very easy.

In 2014, there were approximately 2,326 special districts allowed to collect taxes in Texas (excluding those related to education). Imagine the potential property tax relief if 30 percent of these special districts are hoarding tax dollars and have massive fund balances.

This is a commentary submitted and published with the authors’ permission. If you wish to submit a commentary to Texas Scorecard, please submit your article to submission@texasscorecard.com.