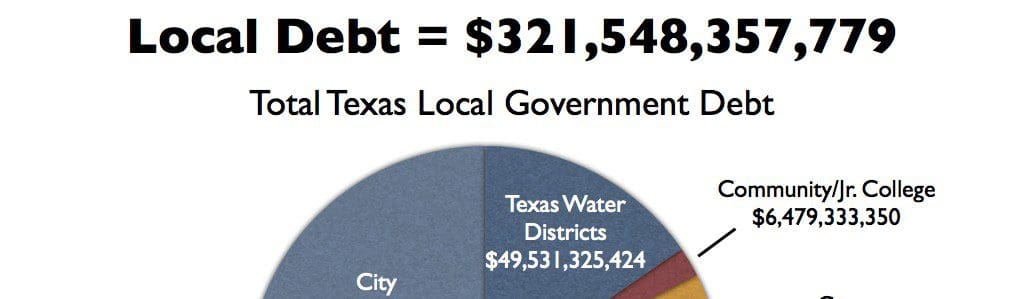

We’ve written extensively regarding Texas’ local debt epidemic. But don’t take our word for it. Both the Texas Public Policy Foundation and the State Comptroller have been analyzing government data in an effort to educate the public regarding the wildly disproportionate growth in government taxing, spending and debt trends.

First a few important facts…

Since 1992, property tax levies from public school districts grew 34% faster than population and inflation. City levies grew 57% faster; counties, 88% faster.

Between 2001 and 2011, local debt in Texas grew twice the rate of population and inflation growth. As a result, Texas now has the second-highest local debt, per person, in the nation. Over one third of all local debt is held by school districts, which place bond propositions before voters to approve in May elections.

Taxpayers in Arlington ISD will face such a proposition this spring…albeit a stupendously large one.

The school board is asking voters to approve a single proposition of $663,129,278 in new debt, or $10,266 per student, to be spent over the next several years. Once fully issued, AISD’s total debt would roughly double, from $567,489,788, to nearly $1 billion, depending on how quickly the debt is retired.

To put those figures in perspective, districts with debt in Texas hold roughly $13,500 per student, on average. If the AISD proposition passes, they would rank approximately 40% higher than average, at $19,000 per student.

Just five years ago, voters approved a $197,000,000 package, of which $17 mil remains unspent.

If the bond passes, it is projected that the I&S tax rate will increase fifteen cents per $100 of valuation by 2020, to be paid by both residents and businesses in the community. Taxpayers should remember that I&S revenue can only be used to repay debt, so an increase in I&S will not provide more money for the districts’ operating budget, including teachers’ salaries and other annual budget items.

Traditionally, local bond proceeds are generally used to finance one-time expenditures that assist school districts in accommodating for enrollment growth, such as the construction of new schools, or renovations to expand existing facilities that maximize utilization or repurpose facilities.

Towards this end, the prudent issuance of debt serves its intended purpose and can easily be justified. But the AISD student population has grown less than 7 percent over the last decade.

Does a 100% increase in debt per student make sense?

According to the district’s website, the plans only call for the construction of two new elementary schools, and a junior high addition.

Also included, however, are;

“A districtwide career and technical center, districtwide agricultural science facility, the renovations of existing career/technical spaces at each high school, districtwide fine arts center, renovations of existing fine arts spaces at each high school, a districtwide athletics complex, the renovation of existing athletics spaces at each high school, and a muti-purpose activity center for athletics and fine arts at each high school.”

If that raises eyebrows, the district plans on replacing over 95 buses with the help of federal tax credits paid to districts who replace diesel powered vehicles, with propane. Over 130 other service vehicles are to be replaced, while 38 new buses and vehicles are to be added to the fleet.

In total, two-hundred and sixty four buses and other vehicles are to be purchased.

Voters should be encouraged to scrutinize the details closely to determine what projects, if any, are a prudent use of long-term debt financing.

Since the debt will be incurred over several years, some concerned citizens are calling for the district to re-evaluate the package, and offer separate propositions for voters to consider over a longer period of time.

The school board doesn’t think it’s necessary.