Voters in Dallas County must soon decide if they want to be saddled with over a billion dollars in new debt, and the property tax bills required to pay it off, for a massive renovation and expansion of the county’s community college system.

Dallas County Community College District trustees agreed in February to put a $1.1 billion debt proposal on the May ballot at the recommendation of DCCCD’s chancellor, Dr. Joe May. County residents are already drowning in ever-increasing property taxes burdens imposed by cities and school districts and are looking for tax relief, not new tax-funded spending.

The bonds would be sold over a period of six years to fund “new facilities, resources, talent and technology.” Over half the money—$535 million—is designated for a downtown “Dallas Education and Innovation Hub” to replace and expand the current El Centro campus.

The rest would go to “student-related instruction and success programs” ($332 million) and “industry-aligned workforce projects and programs” ($235 million). All of the debt is included in a single all-or-nothing bond package; if passed, the board can spend the money on any projects it chooses that fall within the general language of the proposition.

The board’s decision was split 5-2, with trustees Charletta Rogers Compton and Dorothy Zimmermann voting against the proposal. Both are concerned about the amount of additional debt the district wants to impose on taxpayers and the inequitable distribution of the proposed funding. Compton also lodged a complaint about the lack of transparency within the board:

“Timely and complete information is critical to the ability to form substantive questions. It is hard [to] read information given to you at the last minute and listen while someone is speaking. There is no doubt in my mind that some of these actions are intentional.”

“Transparency and abuse of the sunshine laws are a serious problem for me,” Compton added in her statement for the record. “The public has a right to know. They do pay the bills.”

Officials say the bond would not increase the district’s debt service tax rate, currently set at 2 cents per $100 of taxable assessed value—though passage of the bond would authorize the district to raise the tax rate as needed to pay off the debt, without further voter approval.

“Passing the new DCCCD bond program will not increase property taxes under current conditions,” said Diana Flores, chair of the college’s board of trustees, in a press release.

But keeping the same tax rate while property values rise will increase homeowners’ tax bills.

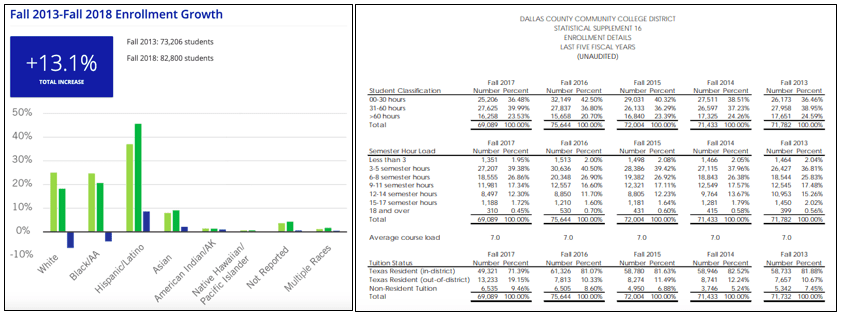

In just the past year, the average Dallas County homeowner’s college district tax bill went up by 10 percent, from $215 to $237. From 2013 to 2018, the average homeowner’s district tax bill increased by over 70 percent. Enrollment during the same five-year period increased a fraction of that amount—if at all.

According to the district’s online bond “quick facts,” enrollment grew 13 percent from 2013 to 2018, from 73,206 to 82,800 students. But the district’s most recent financial statements show the number of students enrolled in credit classes declined by 4 percent from 2013 to 2017, to 69,089 students. Including noncredit students, district data shows enrollment down to 79,219 during the same period—an 8 percent decline.

Texas Scorecard reported in 2016 on the district’s questionable track record. The college’s board has racked up debt, raised property tax bills repeatedly, and doubled the tuition cost for students, all during a period of declining student enrollment.

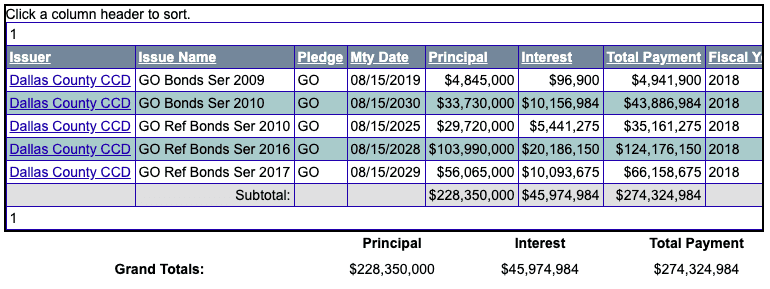

Taxpayers are still paying off DCCCD’s last debt package, approved in 2004 for $450 million. The district currently owes $274 million in bond debt principal and interest, all of which must be repaid with property taxes.

County taxpayers are also still paying off $100 million in debt left by corrupt bus bureaucracy Dallas County Schools. DCS was funded by a 1 cent property tax that will continue to be collected until the now-shuttered agency’s debts are settled.

While Dallas County’s community college district and other taxing entities talk about “keeping rates the same” or “not increasing property taxes,” none are offering taxpayers any relief in the form of reduced tax bills. In fact, average property taxes in the DFW metroplex rose 8 percent last year—well above the national average of 3 percent.

DCCCD and other government entities could choose to lower their tax burdens, allowing local taxpayers to keep more of their own money. They haven’t. Now that choice is up to voters.

Early voting in the May 4 election begins Monday, April 22.