For the first time in years, the city of Allen chose not to raise residents’ property tax bills. Credit for the taxpayer win goes to three new cost-conscious council members—and an active group of conservative citizens who helped elect them.

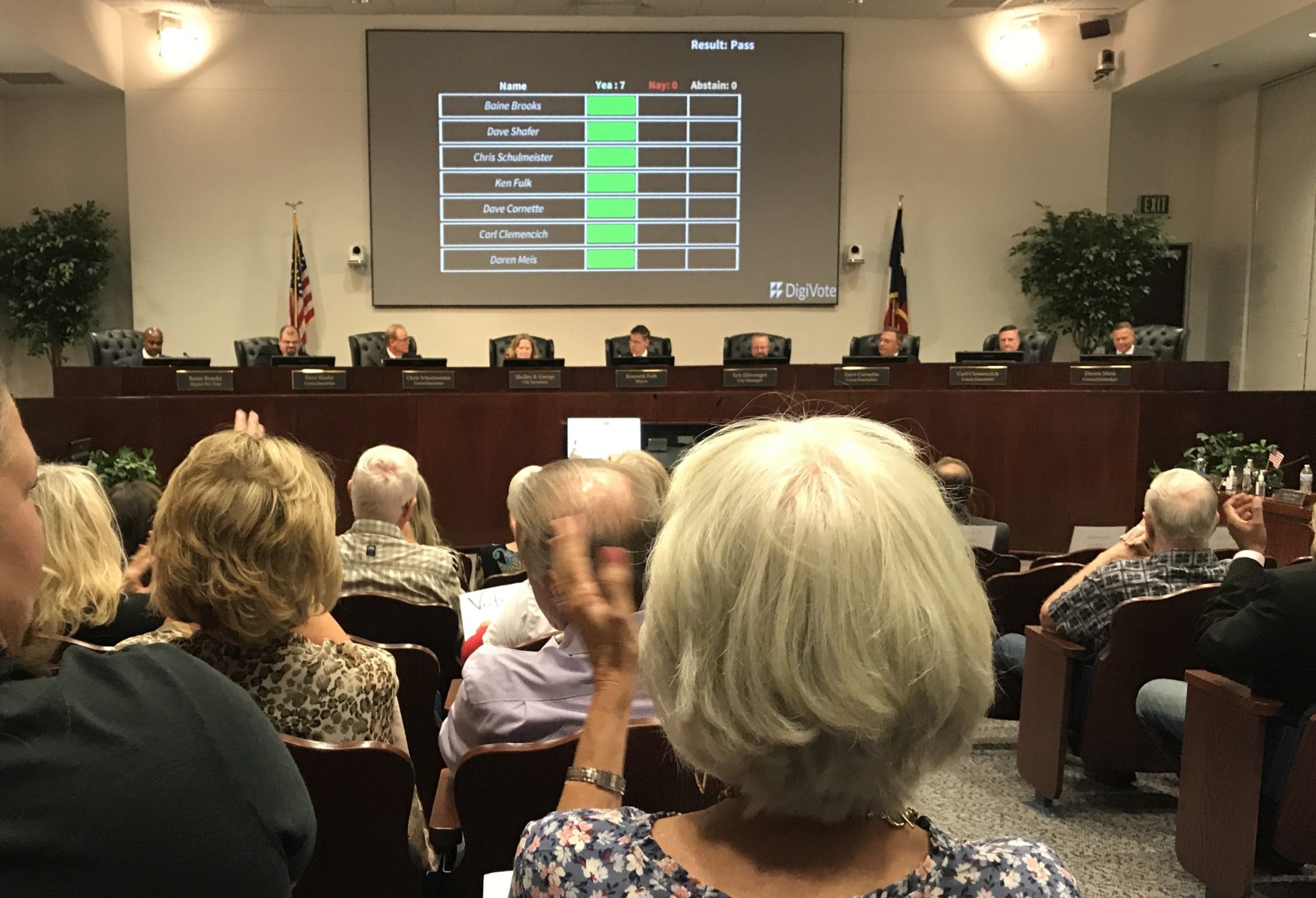

Tuesday night, Allen City Council adopted a 2021-22 spending plan based on the no new revenue rate, meaning the average homeowners’ property tax bills won’t go up.

“For the first time in at least 10 years, a homeowner in Allen is not getting an increase in their city property taxes,” said Councilmember Daren Meis, one of three conservatives elected this year. “When we’re able to do it all—and that’s what this budget does—this type of budget is going to have my support every single time.”

Allen city officials initially budgeted based on a property tax rate above the NNR (in other words, a tax hike).

But the city’s newest council members—Meis, Dave Cornette, and Dave Shafer—all ran on a platform of maintaining city services without raising property taxes.

Citizens who elected the “Triple D” (as the trio are collectively known) held them to their campaign commitments.

“THIS is why we campaigned to have three fiscal conservatives on council,” local grassroots advocacy group We The People Allen posted ahead of Tuesday’s public hearing.

Local Elections Matter

We The People Allen formed early this year and hit the ground running, determined to engage their neighbors in local issues—including local elections.

Meis, Cornette, and Shafer were already running for city council as fiscal conservatives, earning endorsements from the Collin County Republican Party and various conservative officials and organizations.

WTPA backed the trio as a slate, and the growing group regularly put volunteer boots on the ground to block walk, host events, and poll greet for the three.

WTPA backed the trio as a slate, and the growing group regularly put volunteer boots on the ground to block walk, host events, and poll greet for the three.

Their work paid off. Meis was elected in May; Cornette and Shafer won runoffs in June. Allen taxpayers now had three solid conservative voices added to council.

But We The People Allen didn’t stop there.

Local Grassroots Matter

While they continued to block walk and host events to engage their Allen community, WTPA members also stayed on top of city issues. They consistently communicate with city officials and show up to support the Triple D on topics like spending and taxes.

Two weeks before Tuesday’s vote, at least 30 members attended the August 24 Allen City Council meeting and used the time allotted for citizens’ comments to explain why the city should adopt the no new revenue rate instead of raising taxes.

Their input—and the new council members’ unwavering commitment to respect taxpayers by maintaining services without raising property taxes—was reflected in the city’s final budget and tax rate.

Taxpayers Matter

Though this week’s final budget and tax rate votes were unanimous, the mayor and others on council made it clear during the September 14 public hearing they weren’t happy about the outcome.

Mayor Ken Fulk complained the “driver” for not raising residents’ taxes was the new council members’ campaign pledge to constituents, which he said made the decision “political, one aimed at pleasing a small segment of our community.”

He said most people he knows tell him what a great job the city is doing and are okay with paying more taxes to “help Allen achieve the greatness it deserves.”

“My desire is for Allen to be the best as opposed to being mediocre,” Fulk said. “If someone wants mediocre, maybe they ought to go to another city.”

“Consistent deployment of the NNR over time will make Allen mediocre,” he added.

He and Councilmember Chris Schulmeister also said U.S. Rep. Van Taylor (R–TX03), a former state lawmaker rated a taxpayer champion, told them at a local Rotary Club meeting there was “never an intent” for cities to adopt the NNR.

Fulk acknowledged “part of our population has been affected financially by COVID” but said he thought it was “odd” the city received more input on the budget this year than in the past.

WTPA members don’t think it’s odd at all. They’ve encouraged citizens to share their input with the city, and many more showed up Tuesday night to register support for the NNR and speak on why they believe it’s important.

Citizens Speak

“I value my tax dollars being spent wisely and not on unnecessary items,” said Nathan Polsky, who ran for city council in May. He listed an additional $4 million in nonessential spending the city could cut on top of the $1.6 million in spending increases the city rolled back to reach the NNR.

Paula Cheek, a founding member of WTPA, told council members it was “kind of a big deal” that city staff and elected officials had listened to citizens when they asked for more fiscal discipline and to keep more of the money they earn.

“We are especially grateful to Councilmembers Meis, Cornette, and Shafer, who ran last May on a platform of level tax bills for the coming year and have stubbornly represented us taxpayers,” she said.

Cheek also pointed out the proposed NNR tax rate “does not represent a budget cut at all” but still brings in more money for the city to spend from taxes paid on new properties added to the tax rolls.

Several more WTPA members spoke in favor of controlling spending and keeping property tax bills flat.

“I’m asking you to spend only what we can afford and what is needed,” said Rollie Abiog, an Allen resident and father.

“These people’s money is what we are talking about for this budget,” he added, motioning to the roomful of residents behind him.

“I’ve never had the luxury of taxing my way out of a tight budget situation,” said Mary Martin, a retired Allen resident on a fixed income, speaking for the NNR. “I intend to be very watchful of your management and results.”

“Big thanks to the mayor and city council for the revised budget and tax rate,” said Srini Raghavan, a 14-year resident of Allen, noting that many businesses have been “completely ravaged” by COVID shutdowns.

He said the council had listened and taken into account diverse views, and the new members had brought in new ideas, energy, and enthusiasm.

“COVID wasn’t ours, but we have to deal with it,” added Tim Voss, who said he appreciated the council slowing the pace of spending growth.

Ann Mellen-Campbell told council members her Allen home’s assessed value went up by 9 percent three years in a row, driving up her property tax bills.

She said a retired neighbor had recently moved away because he couldn’t afford the property taxes, and her family is now wondering how they will afford to stay in Allen when they retire.

“Let’s continue to look at our budgets and be as fiscally conservative as possible,” she said.

At least a dozen more WTPA members attended the hearing to register their support for the NNR.

At least a dozen more WTPA members attended the hearing to register their support for the NNR.

A few people, including former Councilmember Kurt Kizer, spoke against the NNR and for a property tax increase.

“If you’re establishing the rate first and then asking staff what to cut, you’re doing it backwards,” Kizer said, calling the NNR “a political mantra.”

Council Members Respond

Like Fulk, Schulmeister noted the high level of citizen interest in this year’s budget and tax rate, but he said “it would be much worse if our residents were apathetic and didn’t care about the city.”

He said the gap between the original and NNR-based budgets of about $1.6 million was “not insurmountable,” adding “this seems like a reasonable year” to keep tax revenue flat, given the impact of COVID on residents.

The city also received a $10 million cash infusion this year from federal COVID relief funds via the American Rescue Plan Act (ARPA).

Councilmember Carl Clemencich said the city tries to minimize the financial impact of spending and taxes on residents.

“While we may not always be able to achieve an NNR, we will look for the lowest possible rate to make sure that we can reduce the tax burden on individuals without sacrificing their quality of life in Allen,” he said.

While Fulk and Councilmember Baine Brooks suggested the Triple D should have been willing to “compromise” on their campaign commitments to voters and consider tax hikes, Shafer, Cornette, and Meis made it clear no compromise was needed to properly fund the budget without raising taxes—and that it was the right thing to do.

“I didn’t campaign on the no new revenue rate,” Shafer said. “I campaigned on going below it.”

He said with everybody being affected financially by COVID-related policies, “this is the year to give some kind of relief.”

“Don’t make the mistake of thinking that $4 a month isn’t significant,” he said, referring to experiences shared by WTPA member Elle Holland at the previous meeting. “Because there are families in this city where it very much is significant.”

“We owe it to citizens to give them a little bit of a break,” Cornette agreed. “Just like the citizens have to live within their means, government has to live within their means as well.”

Cornette said the NNR-based budget “maintains and enhances” city services and noted the city is still collecting and spending more money.

“We are not defunding fire and police,” he said. “We’re giving them everything they requested. … We are increasing street repair. … We are not decreasing parks and rec.”

Meis said the revised budget works for all Allen residents. It’s fiscally responsible and properly funds every department of city government (public safety, parks and recreational facilities, the city’s golf course and event center, and a “substantial increase” in street repairs) while maintaining emergency reserves.

He read a statement from city management saying the revised budget provides “the resources necessary to meet the needs of a city that is growing and aging simultaneously.”

“When we’re able to check all the boxes—all the boxes of public safety, all the boxes of proper city maintenance, all of the boxes regarding our luxury activities, all the boxes of being fiscally responsible—checking off all those boxes while not increasing the property taxes on our current homeowners,” he said, “a budget like this has my support.”

WTPA President Michelle Bishop was thrilled citizens’ efforts paid off again for the community.

“Your consistent, conservative voice is a force in Allen,” she told residents who’d spoken up for fiscal restraint. “And a HUGE shoutout to Triple D for standing behind their commitment and due diligence to Allen.”

No New Revenue Rate

Allen’s adopted tax rate of $0.47 per $100 of valuation is slightly below the no new revenue rate.

Formerly called the effective tax rate, the NNR collects the same overall revenue from properties taxed the previous year, keeping tax bills stable even as property values rise (though individual results vary).

Past councils had lowered the tax rate, but not enough to offset rising property values, leaving residents with higher tax bills year after year. The increases compound over time, setting a higher baseline for future taxes.

Fulk and others said the NNR is not sustainable. Yet neighboring Plano just adopted the NNR for the third year in a row (though it also has more commercial development and sales tax). Collin County is using the NNR for the sixth year running, relying on its growing tax base to pay for growth in the county’s tax revenue and budget.

Taxes are driven by spending, so the way to keep taxes in check is to control spending.

Senate Bill 2, the property tax reform passed in 2019, lowered how much most local governments can raise residents’ property taxes without a public vote, from 8 percent to 3.5 percent for cities and counties. But they can “bank” up to three years of unused tax increases and impose them in future years, on top of 3.5 percent hikes, without voter approval.

City taxes make up about 22 percent of Allen residents’ total property tax bill. The school district, which sets its own tax rate, accounts for about 66 percent.

Details of the final city budget and tax rate can be found on the City of Allen website.

More information about property taxes is available on the Texas Comptroller’s Truth in Taxation website.