Fate City Council members are considering a proposed budget for the next fiscal year which would raise property taxes paid by property owners a staggering 26 percent more than the previous year.

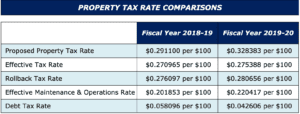

Fate’s proposed budget for Fiscal Year 2020 would dramatically increase residents’ property tax rate to $0.328383 per $100 valuation—significantly higher than the “effective” tax rate of $0.275388, which would keep property tax revenue growth flat.

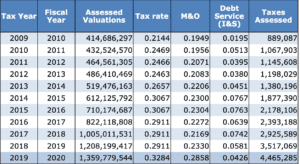

The proposed property tax rate would result in a revenue increase of nearly $950,000, a 26.96 percent increase in property tax revenues compared to last year. About $343,000 of the increase would come from new properties added to the tax rolls this year, and the remainder would come from existing properties.

In total, the city expects to bring in over $4 million—a staggering 502 percent increase in property tax revenues from just 10 years ago.

The amount of debt Fate property taxpayers must repay currently stands at $9,271,552. The city reduced the amount of property tax revenue allocated to debt service (I&S) and increased the amount going to general operating expenses (M&O) by over $1 million (38 percent).

Property taxes make up 44.5 percent of budgeted general fund revenue. Another 9 percent would come from sales tax receipts, which the city says are at “record highs.”

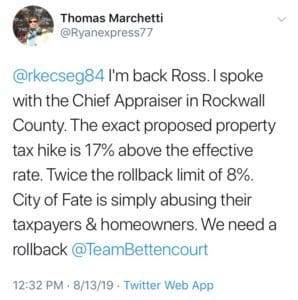

“City of Fate is simply abusing their taxpayers & homeowners,” said Fate property taxpayer Thomas Marchetti in a tweet after learning from Rockwall County’s chief appraiser that Fate’s proposed rate is twice the rollback rate.

Because the proposed tax rate is above the rollback rate that would increase operating tax revenue by more than 8 percent, residents can petition to force a vote on the tax rate.

This new tax hike is being proposed before the property tax reform legislation passed this year takes effect in 2020, when an election trigger will be set for most cities and counties if they propose a budget that would lead to property tax revenue increases of more than 3.5 percent from the previous year.

Taxpayers still have time to make their voices heard regarding this proposed budget and its accompanying tax rate. Public hearings on the tax rate are set for August 19 and 26. A public hearing on the budget will be held on August 26. City council will vote to adopt a final budget and tax rate on September 3.