It’s that time of year for cities and counties across Texas to tell you how wonderful they are for lowering your property tax “rate.”

Don’t be snowed!

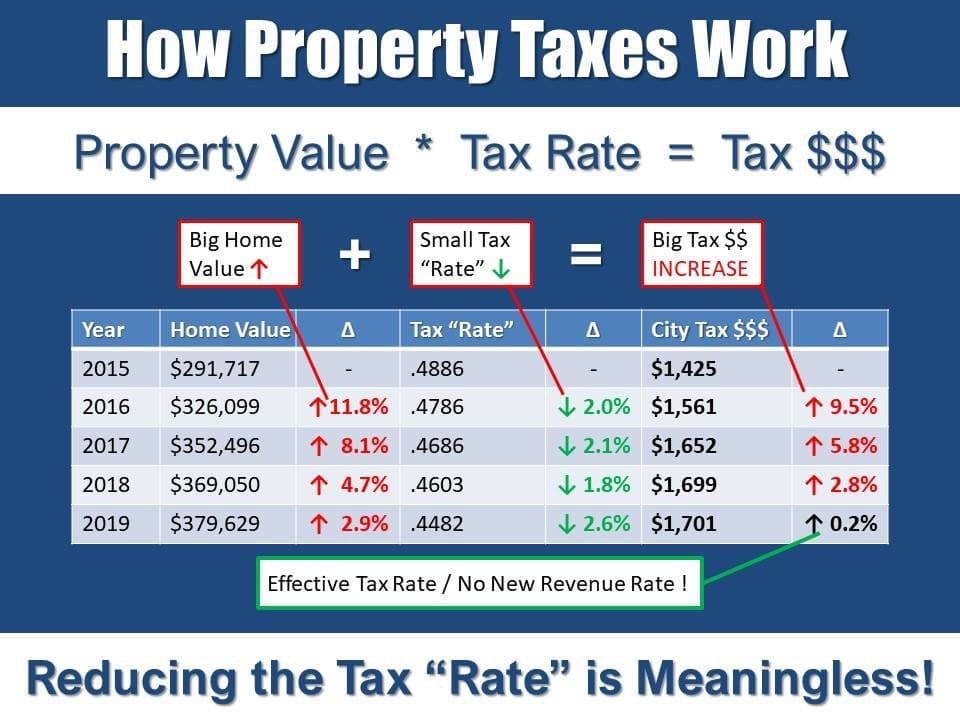

The tax “rate” is a meaningless number on its own. How many rates do you have in your bank account? How many loaves of bread can you buy with a rate? How many rates is it going to cost to put your kid through college?

That’s right: zip. The world runs on cold, hard cash. And, as you can see from this chart of Plano home values and city tax rates for the last five years, a reduction in the “rate” can still mean a tax increase.

I’m very proud to say that both the City of Plano and Collin County will bring you the Effective Tax Rate/No-New-Revenue Rate for 2019-20, meaning that on average, your actual city and county property taxes—in dollars—will not increase*!

*Your mileage may vary. The tax calculation is done across the whole city or county, so individual home value changes (and protest success) may mean your taxes go up a bit or down a bit or stay the same.

This is a commentary submitted and published with the author’s permission. If you wish to submit a commentary to Texas Scorecard, please submit your article to submission@texasscorecard.com.