Last September, Plano City Council voted 5-3 to raise our city property taxes again. As a result, the average Plano homeowner has seen a 40 percent increase in their city tax bill in just five years. These increases are simply unsustainable.

It’s true that most of our total property tax bill—roughly 65 percent—is paid to Plano’s school district, and city officials have no control over this. That’s why we asked city officials to hold the line on what they do control: our city tax bill.

The simple fact is that city tax bills in Plano are rising because council is not lowering the city tax rate enough to offset skyrocketing home values.

Some will say they “lowered the tax rate” for the third year in a row, implying they haven’t raised your tax bill. But that’s wrong: Council has forced the average Plano taxpayer to pay a higher city tax bill while blaming everyone else but themselves.

The “effective tax rate” is the rate at which taxpayers in total will pay the same amount in property taxes overall as they did the previous year, even though their property values increased. Every year, each taxing entity—including the city—calculates its effective rate, as required by Texas’ Truth in Taxation laws.

This is the tax rate we asked council to adopt in 2018. It’s adjusted for growth and would still allow the city’s overall budget to grow. (By the way, Plano’s population has only grown about 1 percent each year over the past decade.) Contrary to what the city claims, adopting the effective rate would give the city additional revenue from new properties added to the tax rolls. In 2018, new properties added $5 million over and above last year’s tax revenue.

On top of new revenue collected each year from property tax hikes, our Citizen Budget Committee discovered the city runs huge budget surpluses. Plano will routinely under-forecast its revenue and over-forecast its expenses, generating $13 million to $20 million in surplus revenue each year. At the same time, the city spends far less than what is budgeted, yet they base the next year’s budget on the previous budget rather than what was actually spent.

This creates a huge surplus that is never returned to taxpayers. Never.

This excess revenue rolls into the next year’s budget or into surplus accounts, which is why we have more than $500 million across dozens of surplus fund accounts. It’s also why our committee asserted the city could adopt the effective rate in 2018 without cuts to any program or department. No spending cuts. Zero.

After four years of city tax hikes, we asked the city not to raise the average tax bill again for the fifth year in a row. If the wishes of our budget committee and more than 1,000 residents who signed a petition had been granted, the previous four years of tax hikes would still be maintained in the budget we supported.

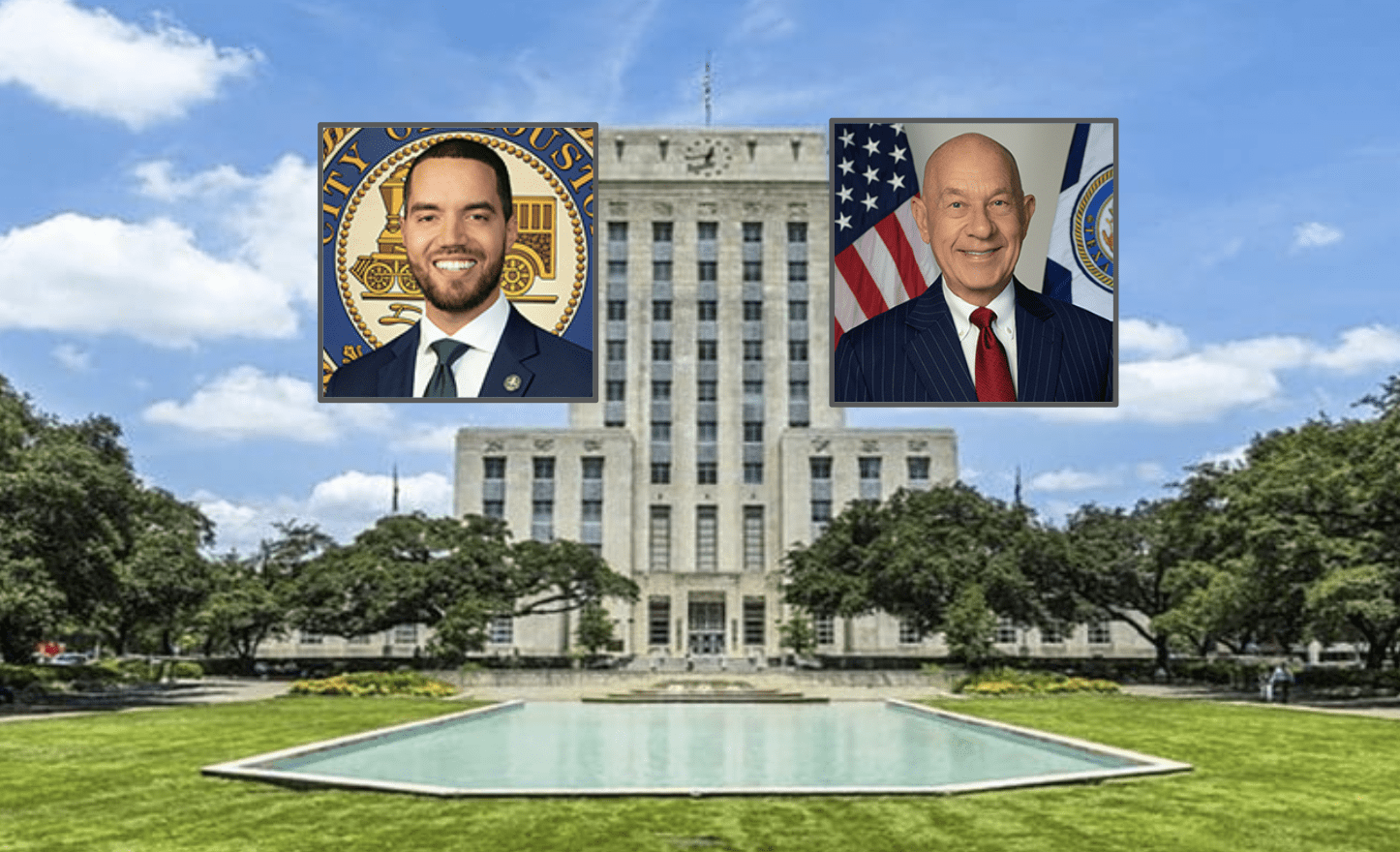

All we asked council to do was hold the line and grow the budget at a slower rate than what staff wanted. Three council members—Anthony Ricciardelli, Rick Smith, and Tom Harrison—agreed.

If the vote had been 4-4, Plano taxpayers would have won, because state law requires a 60 percent majority of council to raise taxes in any given year. The 4.5 percent tax revenue increase passed 5-3, with support from Mayor Harry LaRosiliere and council members Ron Kelley, Kayci Prince, Rick Grady, and Angela Miner. Kelley and Grady are running for re-election this year.

Collin County, Colleyville, Wylie, and Rockwall all adopted the effective tax rate in 2018, while Keller actually went below their effective rate. These are just a few examples.

Simply put, it can be done. On May 4, Plano voters have an opportunity to elect new city council members who will respect taxpayers.

This is a commentary submitted and published with the author’s permission. If you wish to submit a commentary to Texas Scorecard, please submit your article to submission@texasscorecard.com.