Despite a booming economy and rising appraisal values, Ector County commissioners are planning to increase property taxes and their budget, all while giving elected officials a 10 percent raise.

The proposed property tax rate for the new fiscal year, $0.397 per $100 valuation, is a 7.3 percent increase over the effective tax rate and is only $0.000298 shy of the county’s rollback rate “trigger” that would require voters to approve the increase per state law.

The county’s effective tax rate ($0.370074 per $100 valuation) is the rate that generates the same amount of revenue from the same properties as the prior fiscal year, taking into account changes in property valuations. This is the most important number to consider when determining whether a taxing entity is raising taxes. If the proposed tax rate is higher than the effective rate, it is, effectively, a tax increase.

In addition to increasing taxes on existing property owners, Ector County will also be collecting additional tax revenue from new properties.

According to reports, newly elected County Judge Debi Hays says the decision to raise taxes is due to looming property tax reform in the state legislature that would lower the rollback rate, limiting the amount a taxing entity can raise taxes without voter input. The measure failed in the last legislative session but is being championed, again, by Gov. Greg Abbott and Lt. Gov. Dan Patrick. It is also listed on the 2018 Republican Party of Texas platform.

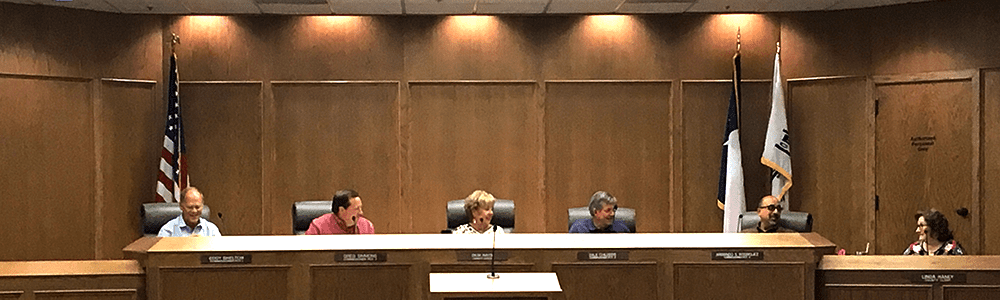

Commissioners held their second, state-mandated public hearing on the proposed tax rate Monday morning, where two residents voiced their opposition to the hike.

“When do the taxpayers get a break?” asked Larry Robinson, a longtime Odessa resident and former business owner. “You next want a new courthouse … a county sales tax … the college has their hand out … the city has their hand out … the hospital has both hands out,” he continued. “Please listen to the veteran taxpayers of Ector County … I am here to make a plea, do not raise taxes again this year.”

Montie Algood Bryan was the second person to speak and, like Robinson, is retired. “I really cannot afford on my retirement to pay any more in taxes,” she stated.

Several residents, including a local high school teacher, also spoke out against the tax increase at the first public hearing on August 23.

One of the most notable voices to make their opposition known, however, was the Odessa American.

In an opinion piece titled “Our View: Some elected officials just don’t get it” the OA, while applauding the county for giving long-due pay increases to county workers, chastised county commissioners for voting themselves “a whopping 10 percent raise,” calling it “ridiculous.”

The article explains how the recent move by commissioners is likely to hurt the county’s ability to pass a new sales tax, which is slated for November’s ballot – again.

The two reasons listed boil down to distrust: “Voters don’t believe the Commissioners’ Court will use the funds for things that voters want,” and “Voters perceive that sometimes poor decisions are made with tax dollars.” The court’s desire to fund a new courthouse with sales tax dollars, despite voters rejecting the idea, was one example listed. Another included the commissioners’ self-imposed raise, despite the perception that they are already overpaid. It goes on to quote Judge Hays, saying, “she ‘took a pay cut to take this job,’” after being asked whether the pay raise was appropriate.

Between the failed ballot initiatives last year – including the county sales tax, school bond, and school tax increase – as well as the citizen-led petitions on the city level, it’s clear Odessa voters are making their voices heard. Whether or not the county chooses to listen during this budget cycle could signal major repercussions come November.

County commissioners will vote to finalize the 2018-2019 property tax rate by September 24. The new fiscal year begins October 1.