UPDATED August 24.

While touting a 2-cent tax rate decrease, Fort Worth officials are planning to increase residents’ city property tax bills to pay for a double-digit increase in spending—and even though the proposed tax hike exceeds the voter-approval limit, the city doesn’t have to put it to a public vote.

Officials in Fort Worth and cities across Texas will meet over the next few weeks to finalize city budgets and the tax rates needed to pay for their planned spending.

Fort Worth’s recommended tax rate for 2022-23 is lower than last year but more than 4 cents higher than this year’s no-new-revenue rate—the rate that collects the same total revenue from properties taxed the previous year, adjusting downward to offset rising property values.

Fort Worth’s recommended tax rate for 2022-23 is lower than last year but more than 4 cents higher than this year’s no-new-revenue rate—the rate that collects the same total revenue from properties taxed the previous year, adjusting downward to offset rising property values.

Any tax rate higher than the no-new-revenue rate is a tax increase.

Fort Worth’s proposed tax rate is also higher than the voter-approval rate—a rate that collects 3.5 percent more maintenance and operations revenue from the same properties taxed the previous year.

Any tax rate higher than the voter-approval rate triggers a public vote to approve the excessive tax increase.

But property tax reform passed in 2019, which lowered the vote trigger from 8 to 3.5 percent for cities with more than 30,000 residents, also allows cities to bank a three-year rolling total of “unused” tax hikes—the differences between each year’s adopted tax rate and the voter-approval rate. Those “unused increments” can then be added to the current year’s voter-approval rate, without requiring a vote.

Fort Worth tax rates for 2022-23 (per $100 assessed valuation):

- Proposed tax rate = $0.7125

- No-new-revenue rate = $0.6668

- Voter-approval rate = $0.7099

- Voter-approval rate with unused increments = $0.7998

The city’s taxable property value grew by 14.5 percent over the past year, to $100 billion.

At the proposed tax rate, the city expects to collect $664 million in property taxes, an 11.4 percent increase over last year.

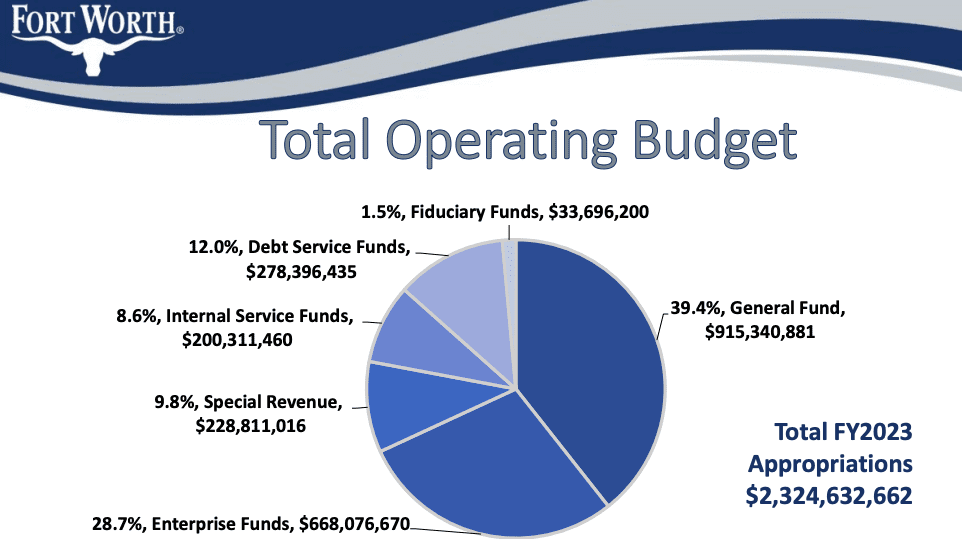

Fort Worth’s proposed $2.3 billion budget for FY2023 spends 79 percent of property tax revenue on “general fund” operations and maintenance expenses (including 10 percent for “pay as you go” capital projects) and 21 percent on debt service.

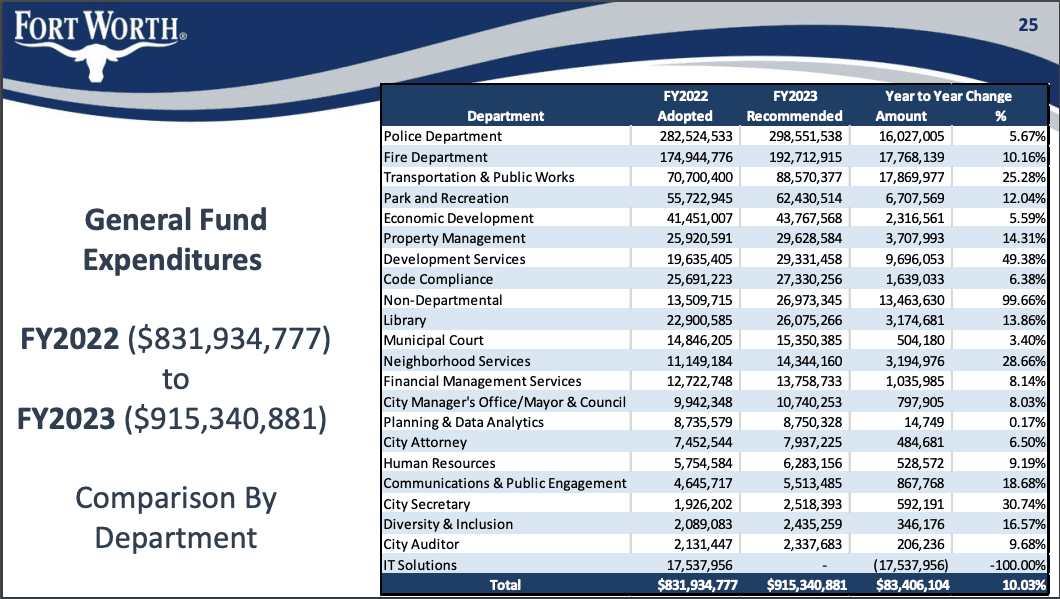

The city’s proposed general fund operating budget is $915 million, a 10 percent increase over last year.

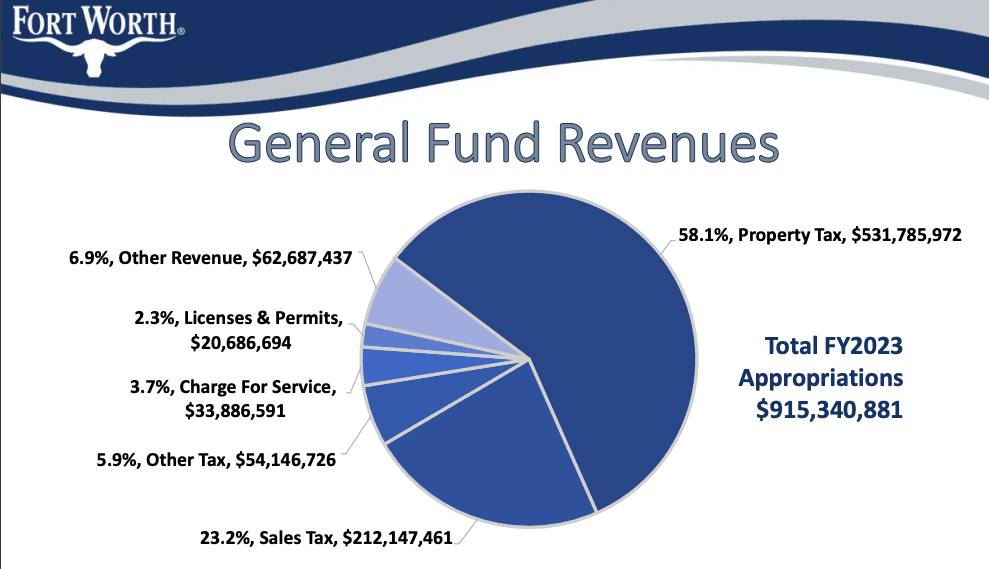

Just over 58 percent of general fund revenue ($531 million) will come from property taxes. The rest comes from sales tax and other taxes and fees.

Spending drives taxes, so the way to limit taxes is to control spending.

To lower property owners’ tax bills, city officials would need to spend less on general fund expenditures.

The top expense by far is police, budgeted at $298 million. An additional $117 million for policing is projected to be generated by the city’s controversial Crime Control and Prevention District, reauthorized by voters in 2020 for another 10 years.

The fire department comes in second at $192 million.

The city is holding budget work sessions during August and September that are open to the public, along with several “engagement meetings” where the public can make comments and ask questions.

On August 23, council members adopted the proposed rate of $0.7125 as the maximum tax rate for the city’s FY2023 budget. Councilmember Alan Blaylock cast the lone vote against the tax increase.

A public hearing on the budget will be held on September 13, followed by a public hearing on the tax rate on September 27.

The Fort Worth City Council will vote on the final budget and tax rate on Tuesday, September 27.