Two years after local voters turned down a property tax hike, Frisco’s school board may ask again this November for an increase in the district’s operating tax rate, along with a major bond package. Both would require voter approval.

Frisco Independent School District trustees are considering a plan presented at last Thursday’s school board meeting to lower the district’s overall property tax rate from $1.46 to $1.44 per $100 of assessed taxable value.

The tax rate “swap and drop” proposal calls for a 13-cent increase in the district’s maintenance and operations (M&O) rate, offset by a 15-cent decrease in the debt service or interest and sinking (I&S) rate — dropping the total tax rate for 2018 by two cents.

The swap would raise the operations portion of the rate from $1.04 to $1.17 — the maximum allowed by state law. The debt repayment portion of the rate would drop to $0.27 for 2018. Voter approval through a Tax Ratification Election (TRE) is required for a school district to raise its operating tax rate above $1.04.

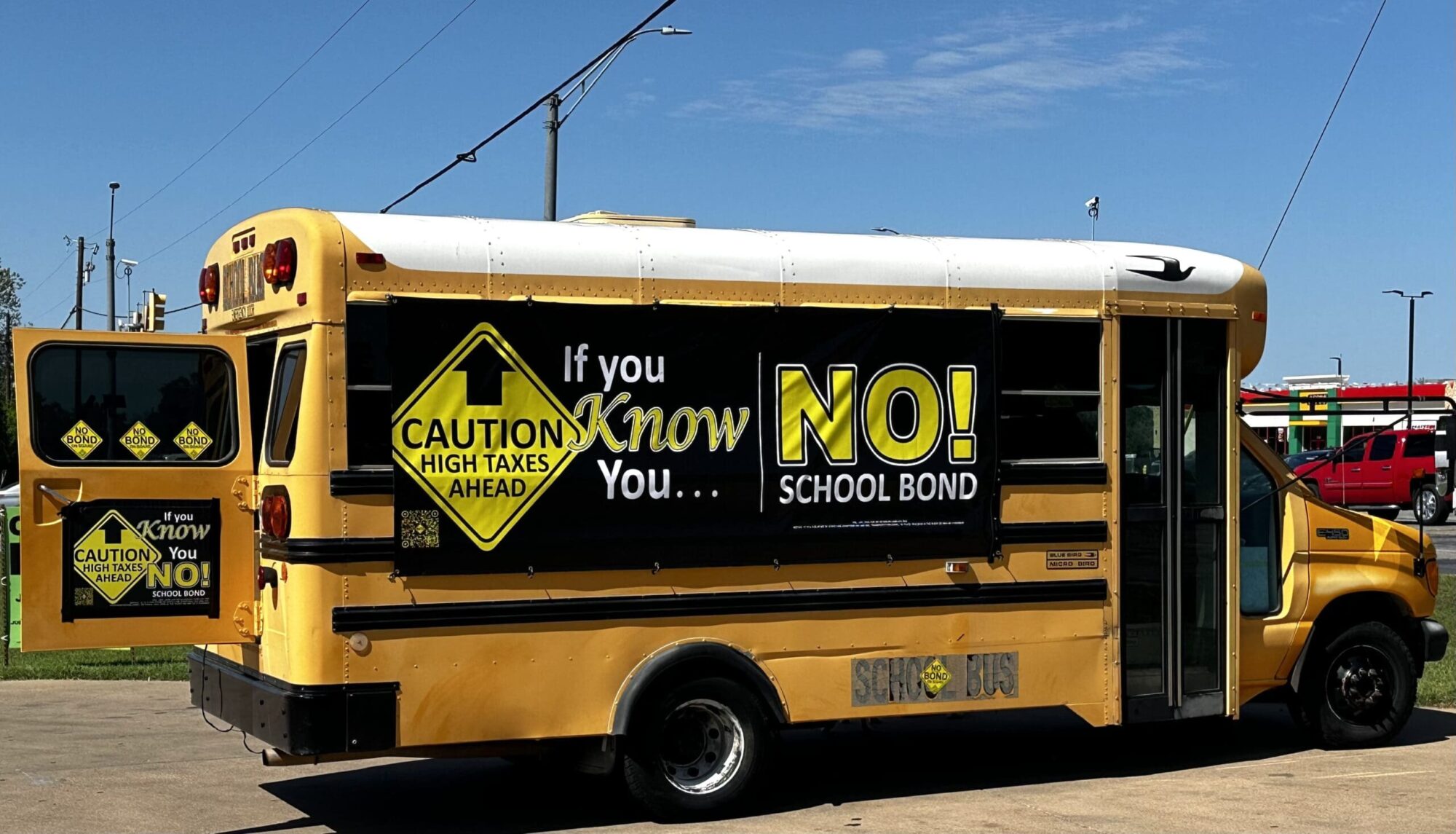

The district’s last TRE, in August 2016, failed by a 58-42 margin after citizens organized against passage of the 13-cent property tax increase.

Frisco ISD CFO Kimberly Smith said the tax swap would give local taxpayers “the second lowest school district tax rate in Collin County and the fourth lowest school district rate in Denton County.” The district said it expected to keep the tax rate the same for the next two to five years, though trustees are considering taking on more debt.

A bond package totaling $695 million — over $11,000 per student in principal alone — was also proposed at the August 2 meeting. The bond funds would be spent on building four new schools, acquiring land for future expansion, and renovating older facilities. The district’s Facilities and Programs Evaluation Committee co-chair Debbie Pasha said the projects are needed to accommodate the district’s growth.

FISD taxpayers owed $3.26 billion in debt principal and interest as of 2017, according to the Texas Bond Review Board. That’s about $54,000 per student.

In June, the board approved a 2018-19 operating budget of $515 million — approximately $8,480 per student, based on a projected 60,697 students. The budget, which assumes the current M&O rate of $1.04, estimates collecting an additional $38 million in operating revenue and allocates almost $14 million to pay raises and adjustments.

All FISD teachers and staff are budgeted to receive a three-percent increase in salary or base wage. The starting salary for teachers will increase from $50,500 to $53,000 a year for 187 contract days. With additional pay scale adjustments, the average pay raise for teachers will be 4.9 percent.

If the board decides to move forward, both the tax rate change and the bond proposition could be on the November 6 general election ballot. Trustees have until August 20 to call an election. The next board meeting is scheduled for August 13.