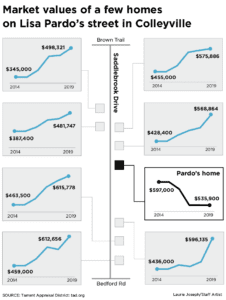

While her neighbor’s property values, and thus property taxes, have skyrocketed, Grapevine-Colleyville Independent School District President Lisa Pardo’s haven’t since 2014.

Every year for the past five years, the appraised value of Pardo’s home either remained unchanged or fell, decreasing a total of 10 percent since 2014. Meanwhile, other homes in her neighborhood saw increases from 24 to 44 percent.

Source: Dallas Morning News

Interestingly, local taxing entities like GCISD appoint members of the board of TAD, but Pardo says her home’s value changes are the result of her successful petitioning at the Tarrant Appraisal District (TAD) with the help of a consultant, not the result of any special consideration.

“I protested. Just like all residents have the right to do,” Pardo replied to an inquiry from Texas Scorecard. “We hired a company[,] North Texas Tax Service[,] out of Dallas. They went to the hearing and won and continue to monitor our property taxes.”

“I think all residents should protest if they are not happy. The answer is always ‘no’ if you don’t try.”

However, not all residents have the power and influence of an elected official. And this situation has caught the eye of two high-profile elected officials in Texas.

“GCISD President home’s market value dropped from $597,000 in 2014 to $535,900 this year,” tweeted State Sen. Kelly Hancock (R–North Richland Hills). “Every one of her neighbors’ appraisals went up. #funnybusiness”

Gov. Greg Abbott also jumped into the fray while retweeting Hancock. “This helps explain how the Texas property tax system is unfair to us all and must be reformed,” he wrote. “We want to reform appraisals, limit how much taxing authorities can raise property tax rates, and reduce your property tax rate. Call your legislator tomorrow for property tax reform.”

Earlier this month, several residents of Colleyville and the surrounding area received notices from TAD informing them how much their home values had increased since 2014, prompting many to post screenshots and complain on Facebook. “89 [percent] change since 2014 and the house is 14 years old!” posted Chuck Baudrau.

“[O]urs is 173 [percent], if that makes you feel better,” replied Marla Mundheim.

Colleyville resident Christie Reed posted one appraisal increase of an outrageous 1,075 percent since 2014!

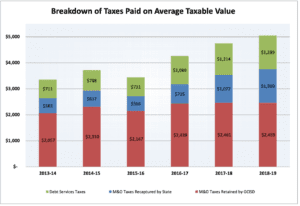

In addition, according to TAD, GCISD’s average property tax bill for homeowners shot up over 40 percent since 2013. The property tax rate was increased from $1.3201 per $100 valuation to $1.3967, and in 2018 was one of the highest average property tax bills in Tarrant at almost $5,000. And in 2018, the Dallas-Fort Worth metroplex, of which GCISD is a part, posted an increase in property taxes much higher than the national average.

And, according to the budget passed by GCISD for 2018-2019, property tax revenues to the school district have steadily increased since 2015, which would not happen if GCISD passed the effective tax rate—the rate at which, if adopted, taxpayers would pay no more in property taxes than they did the previous year.

Pardo, however, has not faced anywhere near the kind of pain as her neighbors, considering how her home’s value stayed the same or went down as theirs went up.

Taxpayers deserve to know why what’s good for them isn’t good for Pardo.

Early voting for the May 4 election begins April 22.