A small North Texas school district is accusing people of “spreading misinformation” about a big bond proposition on the May 6 ballot, while hiding the bond’s true cost to taxpayers.

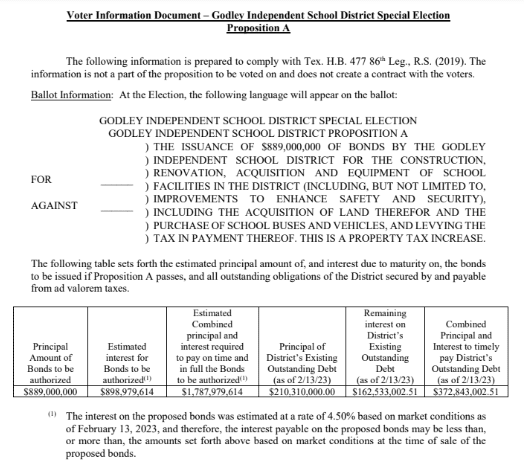

Godley Independent School District is asking voters to approve $889 million in new bond debt. All of the borrowed bond money would have to be repaid with property taxes.

With interest, though, the bond package would cost local property taxpayers $1.79 billion—more than double the dollar amount voters see on the ballot.

The true amount of the proposed tax burden is also missing from the school district’s bond marketing materials that were produced and distributed at taxpayers’ expense.

Details about the real cost of the bond are in a Voter Information Document that local governments are required to publish. But that document is not found on the special website the district created for the bond, also at taxpayers’ expense.

Instead, the document is buried in the “Elections” section of the district’s main website, hidden on page 15 of an embedded document titled “Notice and Order of Election.”

The elusive document also shows that Godley ISD currently owes $373 million in outstanding debt principal and interest. The proposed bond would add almost five times that amount to local property owners’ tax burden.

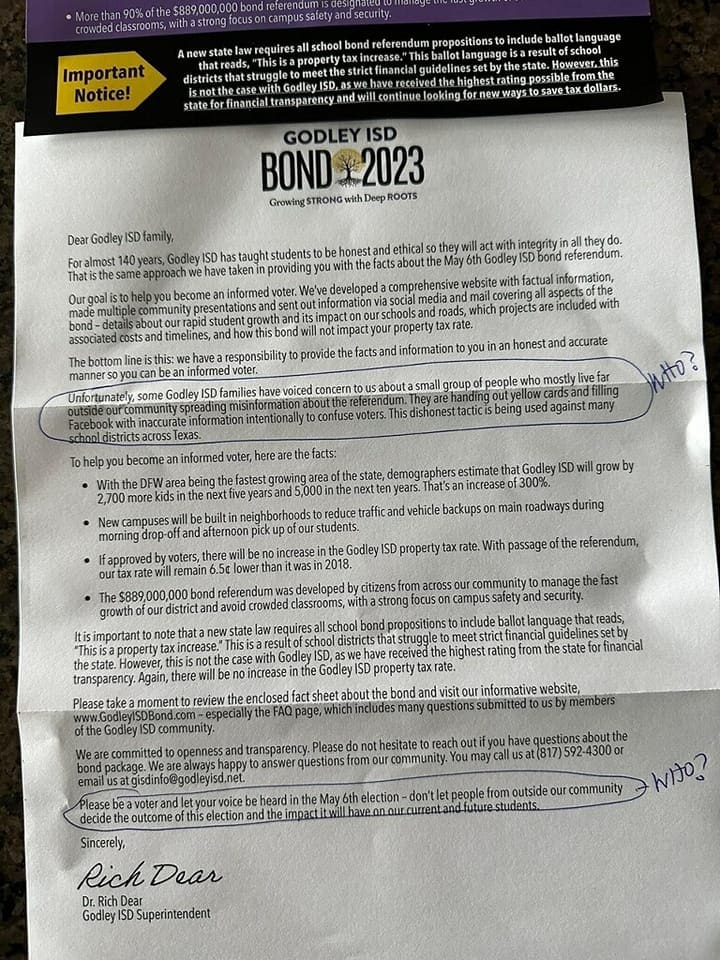

Yet when citizens raised concerns about the district’s spending plans and their impact on local taxpayers who are already struggling to make ends meet, school officials spent even more taxpayer money to complain about the pushback.

Superintendent Rich Dear sent a letter to district residents on “Godley ISD Bond 2023” letterhead claiming to provide “the facts” about the bond. The letter accuses “people from outside our community” of “handing out yellow cards” and “spreading misinformation.”

In fact, the “yellow cards” referenced by Dear—door hangers that are being distributed in the district—clearly show they were created by the campaigns of Nova Olson and Kayla Lain, two candidates for Godley ISD school board.

The door hangers accurately state that the $889 million bond will “INCREASE GISD debt exponentially” and note that “our students are performing dismally.”

According to the latest performance reports from the Texas Education Agency, less than half of Godley ISD’s 2,800 students read at grade level, and only a third perform at grade level in math.

Dear’s letter also says that passing the bond won’t raise the property tax rate used to repay the bond debt.

That’s because the district is already taxing residents the maximum allowable rate for repaying debt: 50 cents per $100 of valuation.

But as property values rise, property owners’ tax bills increase even if the rate stays the same—a tax increase.

And regardless of the rate, borrowing and spending money that must be repaid with property taxes necessarily increases local property tax burdens.

Godley ISD officials say the huge bond is needed to accommodate 5,600 new students projected to enroll in the next 8-10 years, bringing the district’s total enrollment to about 8,400.

Though the bond money can be used for any general purpose stated on the ballot proposition, projects in the district’s $889 million spending plan include three new elementary schools projected to cost from $74 million to $100 million, a $171 million middle school, and a $50 million performing arts center.

The district passed a $168 million bond in 2021.

Concerned residents in several other school districts have organized “Vote NO” campaigns against bloated bonds on the May ballot, including Bonham, Dripping Springs, Hays, Irving, Leander, Mabank, Maypearl, Midlothian, Red Oak, and Waxahachie.

“This is not a struggle between neighbors,” said Mabank mom Cindy Hinds, who created a Facebook page to help inform her community about their district’s $119 million bond package. “This is a struggle between a small town and a behemoth machine that knows how to get every penny off our backs to enrich themselves.”

Yet across Texas, more than 100 school districts are asking voters to approve a total of $25 billion in property tax-backed bond debt, and most face no organized opposition from taxpayers.

In addition, 10 Texas cities have put a combined $1.7 billion in bond propositions on the ballot.

Election Day is Saturday, May 6.

No ads. No paywalls. No government grants. No corporate masters.

Just real news for real Texans.

Support Texas Scorecard to keep it that way!