A taxpayer in Highland Park is calling out “misleading” language used to promote a school bond on the November ballot that suggests the bond will not raise property taxes—even though the bond must be repaid, with interest, from property taxes.

Local taxpayer Spencer Siino calls the suggestion “a mathematical impossibility” and points to school district officials conflating the tax rate and actual tax bills.

Highland Park Independent School District trustees placed a $137 million bond proposition on the November ballot.

With interest, district officials estimate the bond would cost taxpayers $214 million—56 percent more than the amount voters will see on the ballot.

While the total cost to taxpayers isn’t disclosed on the ballot, state law requires school districts to warn voters of the tax impact of bonds by including in the ballot language “THIS IS A PROPERTY TAX INCREASE.”

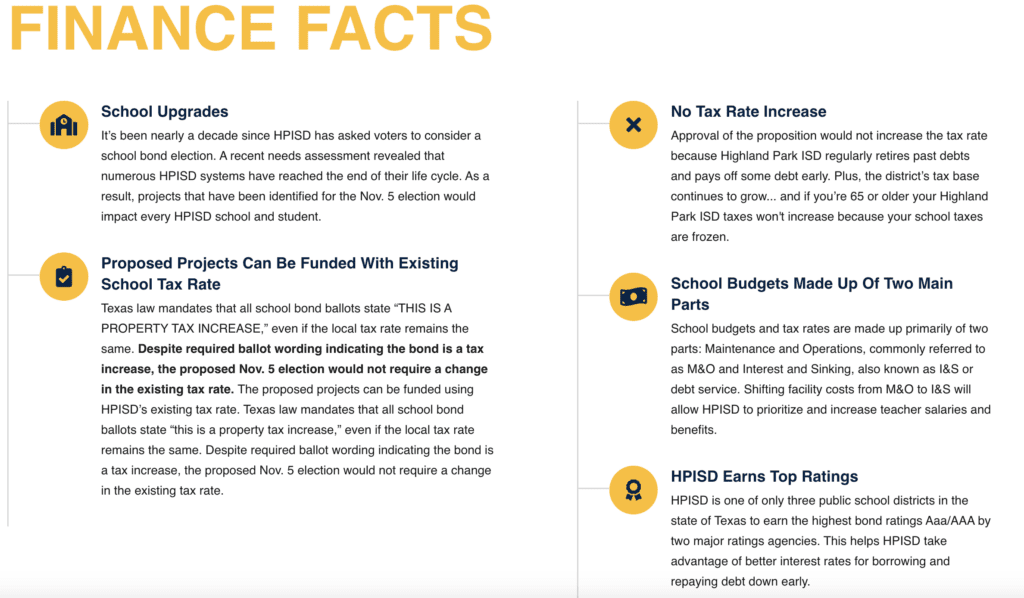

Yet a dedicated bond page on the district’s taxpayer-funded website repeats that the proposed bond “will not increase the tax rate” and would “not require a change in the existing tax rate.”

Siino points out the problem.

“Highland Park ISD is falling over themselves to advertise the bond as ‘not a tax RATE increase,’” Siino told Texas Scorecard.

This is extremely misleading. With property values rising, the Park Cities don’t need to raise the rate in order to raise property taxes/“revenue”. Therefore, in the absence of this bond, HPISD would either pay down the debt on their previous $361 million bond faster, which would also save interest costs, or eventually reduce the rate charged against ever increasing property values.

“More importantly, I know from speaking with fellow Park Cities residents that most view that marketing language as meaning the bond won’t increase their taxes, which is a mathematical impossibility,” added Siino.

Multiple school districts use this language when promoting their bonds to voters.

But Highland Park ISD acknowledges on the bond webpage that the district can maintain the “same” tax rate and still pay off more bond debt in part because “the district’s tax base continues to grow.”

In the “Frequently Asked Questions” section of the page, the district explains that Highland Park ISD collects additional tax revenues “due to rising property taxable appraised values.”

In other words, even at the same tax rate, tax bills increase.

The district’s bond website also notes that “if you’re 65 or older your Highland Park ISD taxes won’t increase because your school taxes are frozen.”

However, what Highland Park and other districts fail to mention is that while the “senior freeze” keeps homeowners’ property tax bills from going up when school taxes are increased, seniors’ tax bills will be lowered if school taxes are decreased.

Voters will find school bond propositions at the bottom of their ballot.

Early voting is underway now through November 1. Election Day is Tuesday, November 5.