Data from the four appraisal districts in the Dallas-Fort Worth metroplex shows the vast majority of cities’ and counties’ property tax bills for average homeowners have grown, not shrunk, despite the passage of property tax reform in 2019.

“The important part for property taxpayers is that property tax relief is going to continue,” tweeted State Sen. Paul Bettencourt (R–Houston) regarding discussion of the state budget.

But many homeowners in the four counties that make up the DFW metroplex have yet to see this “relief.”

“From 2019 to 2020, an alarming number of North Texas cities and school districts raised taxes in a major way,” James Quintero of Texas Public Policy Foundation told Texas Scorecard after reviewing the appraisal district data. “Some even hiked taxes by double-digit percentage points. The accumulated weight of these tax increases—which came at the worst possible time—threatens our most vulnerable and least fortunate.”

“It is disappointing to see what TFR has been sounding the alarm on for years,” said Tim Hardin, executive director of Texans for Fiscal Responsibility. “The supposed tax reform we received last legislative session gave no relief to Texans. Capping tax increases simply slows the growth of out-of-control property taxes.”

The property tax reform passed in 2019 requires voter approval in most cities and counties if local officials attempt to increase property tax revenues by more than 3.5 percent year to year.

Each year, local officials must calculate their no-new-revenue rate (NNR), the property tax rate that would keep property tax bills stable in the aggregate. Actual reductions in property tax bills would require picking a rate below the NNR.

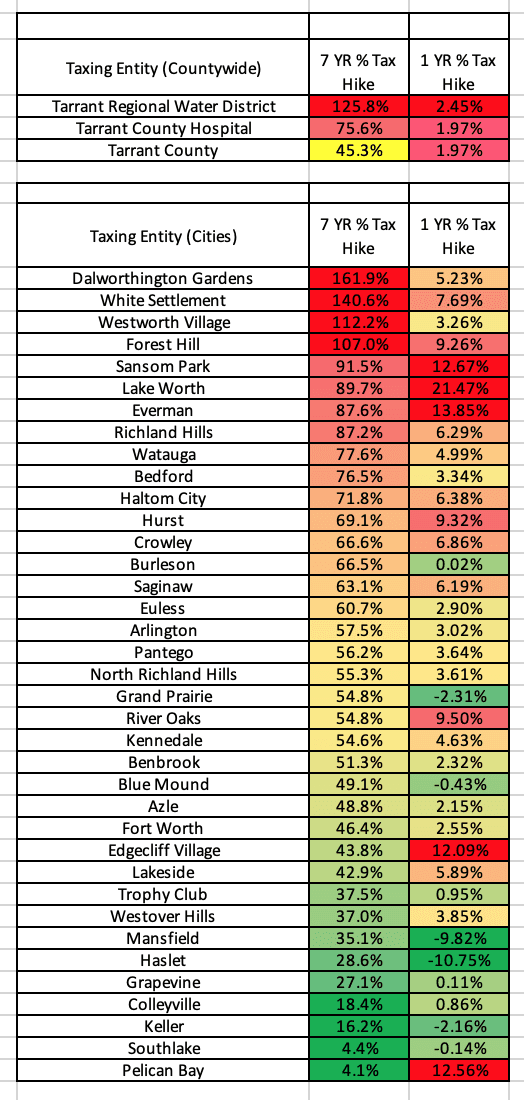

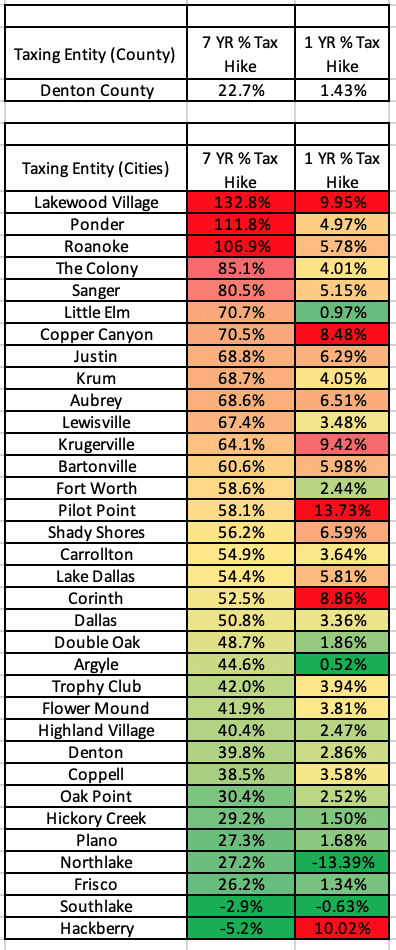

Data from the four appraisal districts in DFW showing property tax bill changes from 2013 to 2020 (7 years) and 2019 to 2020 (1 year) are below.

Tarrant County

According to data from the Tarrant Appraisal District, board members of the Tarrant Regional Water District—which oversees the $1.2 billion real estate redevelopment boondoggle called Panther Island—have consistently raised tax bills for the average homeowner. These tax bills are now more than 125 percent higher than they were in 2013.

Tarrant County commissioners and the Fort Worth City Council have increased their tax bills by more than 45 percent and 46 percent, respectively, compared with 2013. Commissioners and the council also voted for one-year increases close to 2 percent and more than 2 percent, respectively.

The Colleyville City Council continues to keep average homeowners’ bills steady, approving a one-year increase of less than 1 percent.

Realtor Chandler Crouch compared the Tarrant County data with his own research on individuals’ income growth.

“Over the past seven years, there was a 12 percent increase in income, but a 50 percent increase in property tax,” he said. “This isn’t sustainable. The system is broken.”

Citizens can see a more detailed report of TAD data here.

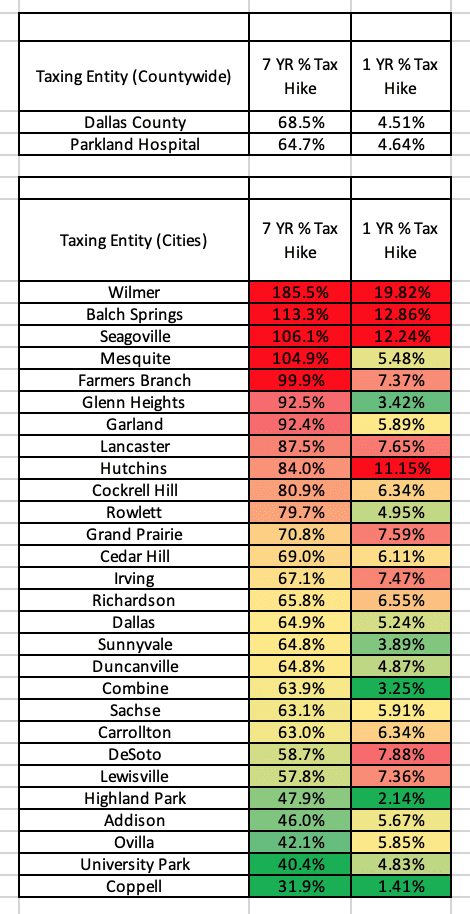

Dallas County

Data from the Dallas Central Appraisal District reports none of the countywide governments or city councils Texas Scorecard tracked had any reductions in property tax bills for the average homeowner in 2019-2020 or 2013-2020.

Dallas County commissioners and the Dallas City Council approved more than 4 and 5 percent increases in one year, and their consistent actions have resulted in property tax bills for the average homeowner being 68 and 64 percent higher from 2013.

Citizens can see a more detailed report of DCAD data here.

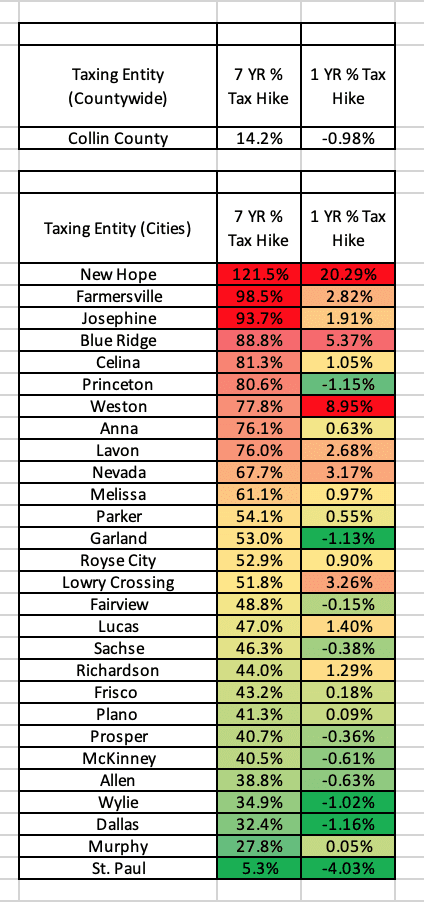

Collin County

The Collin Central Appraisal District reports 10 city councils in Collin County approved one-year reductions in their property tax bill for average homeowners in the 2019-2020 period. The biggest decrease was from the St. Paul Town Council, at more than 4 percent.

Plano City Council voted for a 0.61 percent decrease, while Frisco City Council approved an increase of more than 1 percent.

No reductions are shown in a comparison of 2013 and 2020 tax bills. Consistent action from past Plano and Frisco city councils resulted in property tax bills for the average homeowner being 40 percent and 44 percent higher, respectively.

Citizens can see a more detailed report of CCAD data here.

Denton County

The Denton Central Appraisal District shows from 2019-2020, the Denton City Council voted for an increase of 2.86 percent, while Denton County commissioners delivered a 1.43 percent hike. Compared to 2013, the county’s property tax bill for its average homeowner is 22.7 percent higher, and the city’s is 39.8 percent higher.

Citizens can see a more detailed report of Denton CAD data here.

“This is not the relief that Texans have desperately needed for years. Skyrocketing taxes continue to push many Texans out of their homes, especially the elderly on fixed incomes,” Hardin said. “Sadly, this legislative session will not provide any relief, either. The question is whether voters will respond to the failures of their elected officials next election cycle.”

“Today’s tough times require our local officials to do better. Instead of raising taxes, cities and school districts should seize every opportunity to reduce the tax burden, cut spending, and delay going further into debt,” Quintero added. “Let’s give family budgets a chance to recover.”

“We have a crisis, and we need to behave like it,” Crouch said. “This must stop. We must stand up and do something about it. The government isn’t paying attention. We must act now to get their attention before it’s too late.”

The Texas legislative session ends on May 31.

Concerned citizens may contact their state representative and state senator. Early voting for the May 1 local elections in North Texas runs April 19-27.