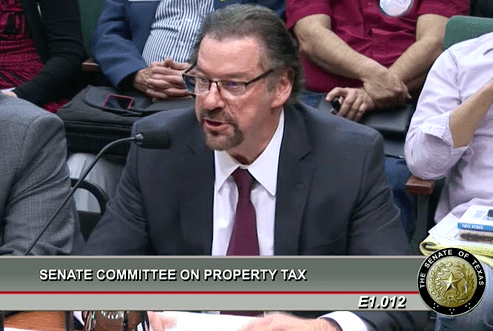

For a second time in one week, McKinney Mayor George Fuller spoke against property tax reform legislation that would give local voters more control over their skyrocketing tax bills.

Fuller testified Wednesday before the Senate Property Tax Committee against Senate Bill 2, a measure that would protect his city’s taxpayers from excessive hikes in their property tax bills.

SB 2 and its companion House Bill 2 would trigger automatic tax ratification elections for tax hikes that exceed a 2.5 percent increase in tax revenue — dramatically lower than the current 8 percent “rollback” or “voter-approval” rate. The rate calculation excludes taxes collected to pay off debt and new tax revenue from growth. The proposal puts all tax ratification elections on November ballots.

Fuller told lawmakers he opposes “restricting” the city’s ability to raise revenue via the voter-approval trigger, as it “has the potential to downgrade our bond rating.”

“I have a concern that this cap could actually increase taxes paid by my residents,” he said.

In a contentious exchange, State Sen. Paul Bettencourt (R–Houston), who chairs the committee, emphasized that SB 2 does not apply to bond debt taxes.

Fuller’s testimony followed similar comments he made Monday at a Collin County Commissioners Court meeting, where he advocated opposing the pro-taxpayer reforms.

“The voters elected us to make those decisions,” Fuller told commissioners, adding that the city’s fire and police services would be “compromised and jeopardized” by limiting McKinney to the voter-approved tax hikes — a threat he and other local officials perpetuated before Bettencourt’s committee.

Fuller claimed in both forums that last year, the average McKinney homeowner “paid 35 cents more a month” than if the cap had been in place. “That’s not really tax relief,” he said.

Available data from the Collin County Appraisal District shows that, from 2013 to 2016, the average McKinney homeowner’s city tax bill went up 30.7 percent, from $1,269 to $1,659, and those numbers continue to climb. The city’s tax rate has gone down slightly, but not enough to offset rising property values. This means the city is choosing to collect more and more tax revenue from existing homeowners each year — driving some city residents out of their homes.

Bettencourt noted McKinney had the highest property tax revenue increase “of any city that has testified today” — 61.8 percent over the four-year period 2014-2017. “This is $43 million more in just four years… A non-compounded 15 percent increase in per-year taxes,” Bettencourt said.

Fuller responded that a significant portion of the city’s annual revenue increases are attributable to growth. Yet new tax revenue from growth is not included in calculating the voter-approval rate — revenue from growth is added on top of voter-limited tax increases.

SB 2’s trigger is designed to slow the surge in revenue collected from existing property owners for maintenance and operations to 2.5 percent a year, unless voters approve a higher amount. Even without voter approval, cities and other taxing entities will continue to collect more tax revenue, resulting in larger budgets, not cuts.

Through growth and higher levies on existing taxpayers, McKinney’s property tax collections have skyrocketed, and each increase sets a higher baseline for the next year’s calculations.

“Your taxpayers have already paid it,” Bettencourt said. “They’re continuing to pay it now. They’ll continue to pay it in perpetuity. Once they go up, those rates don’t come down. We’re trying to limit the growth, not cut it back.”

Fuller has made it clear he doesn’t want limits. If McKinney taxpayers are looking for a champion who has their best interests in mind, they should look to someone other than their own mayor.

Mayor George Fuller

Tel: 972-547-7507

Email: gfuller@mckinneytexas.org