McKinney residents got their first look at the city’s spending plans for the coming year at a city council budget workshop held Friday morning. During the meeting, it was revealed the city’s administrative expenses would grow faster than any other spending category.

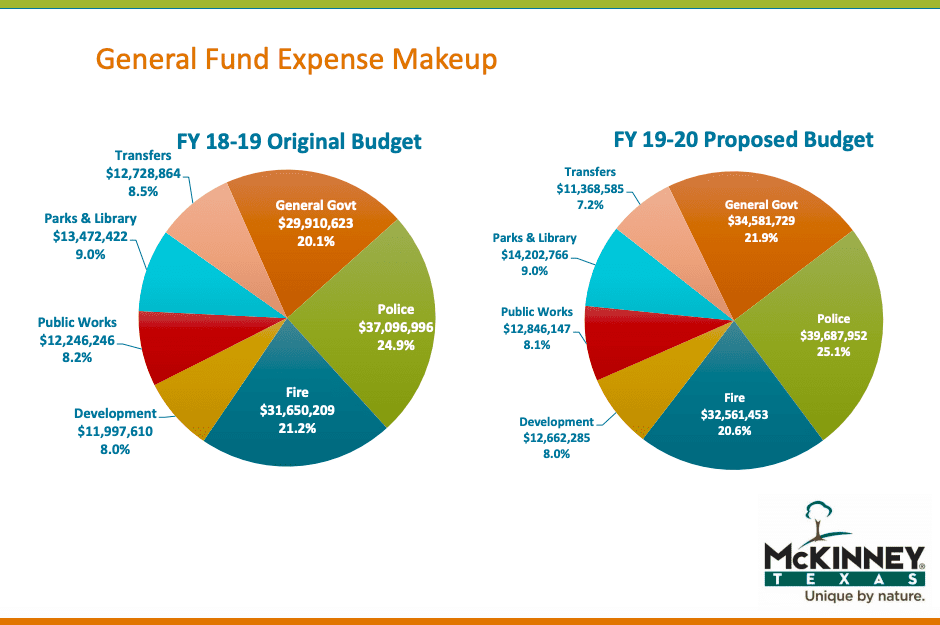

The city proposed a general fund budget for Fiscal Year 2019-20 of $157.9 million—an increase of 5.9 percent ($8.8 million) over last year’s budgeted spending. The general fund finances much of the city’s operating expenses, including administrative or “general government” spending. General government spending will experience the biggest increase—15 percent more than last year—exceeding $34.6 million and comprising 21.9 percent of the city’s operating budget.

Total combined expenditures from all funds are budgeted at $585.8 million, a 25 percent increase over last year.

The budget is based on a property tax rate that exceeds the effective or “no-new-revenue” tax rate by 1.25 percent, which City Manager Paul Grimes noted is less than the consumer inflation rate of 1.5 percent. Grimes said it is the lowest property tax increase “in recent memory.” McKinney City Council adopted a higher tax rate ceiling on August 5, but the budget recommends a rate of $0.5156 per $100 of assessed valuation.

At the proposed rate, the average homeowner’s city property tax bill would go up by about $5, to $1,802. Since 2010, the average McKinney homeowner’s city property tax bill has increased 48 percent.

Revenue

Property taxes make up about half (53 percent) of the general fund revenue and are budgeted to bring in $84.6 million, a 7.7 percent ($6 million) increase over last year. Much of the increased revenue comes from new additions to McKinney’s tax base. The city said Friday that growth in new construction set a record this year, exceeding $1 billion for the first time, with almost $300 million in new commercial value. Existing property values increased 3.4 percent.

McKinney’s property tax collections have been significantly boosted by double-digit growth in the city’s tax base each of the past five years, along with skyrocketing property values. This year, growth slowed to 8.1 percent, while the average home value increased by just 2 percent.

The remaining general fund revenue is budgeted to come from:

- Sales taxes: $28 million (18 percent) – up 3.8 percent over last year ($1 million)

- Franchise fees: $16.9 million (11 percent) – up 6.3 percent ($1 million)

- Licenses and permits: $11.9 million (8 percent) – down 1 percent

- Charges and fines: $8.3 million (5 percent) – down 5.1 percent

- Transfers/Other sources: $8.2 million (5 percent)

McKinney Mayor George Fuller made a point of stating Friday that McKinney plans to collect more in taxes from the same properties taxed last year instead of budgeting based on the effective tax rate as Plano did this year, in part due to revenue percentage differences between the cities, and because Plano has a larger commercial tax base than McKinney. The city itself failed to include the information in its budget presentation, but Plano’s proposed 2019-20 budget shows 47 percent of that city’s general fund revenues coming from property taxes and 27 percent from sales taxes.

Fuller accused “publications like Texas Scorecard” of being “intellectually dishonest” for reporting on how property taxpayers are impacted by tax rate changes in their own cities, without including such comparisons to other cities. Texas’ truth-in-taxation laws require local taxing entities to calculate their effective rate to ensure taxpayers are informed of any year-to-year increases in their property taxes. Budget documents like the one McKinney publicly unveiled Friday morning can give taxpayers added context regarding both taxes and spending—which is what drives taxes.

Fuller accused “publications like Texas Scorecard” of being “intellectually dishonest” for reporting on how property taxpayers are impacted by tax rate changes in their own cities, without including such comparisons to other cities. Texas’ truth-in-taxation laws require local taxing entities to calculate their effective rate to ensure taxpayers are informed of any year-to-year increases in their property taxes. Budget documents like the one McKinney publicly unveiled Friday morning can give taxpayers added context regarding both taxes and spending—which is what drives taxes.

Spending

Public safety accounts for the biggest share of McKinney’s general fund spending (45.7 percent), with police and fire budgeted at a combined $72 million—up 5.1 percent ($3.5 million) from last year. Fifteen of the 35 new positions in the general fund budget are fire and police employees.

The remaining general fund spending is allocated to:

- General government: $34.6 million (21.9 percent) – up 15.6 percent ($4.6 million)

- Parks and libraries: $14.2 million (9 percent) – up 5.4 percent

- Public works: $12.8 million (8.1 percent) – up 4.9 percent

- Development: $12.6 million (8 percent) – up 5.5 percent

- Transfers: $11.3 million (7.2 percent)

A new transparency law passed by the legislature this year required the city to disclose its plans to spend $125,000 on taxpayer-funded lobbying in FY 2020, the same amount as in FY 2019.

Dozens of governmental and proprietary funds are included in McKinney’s $585.8 million “all funds” budget. The general fund accounts for the largest chunk of the budgeted spending and receives about 69 percent of McKinney’s property taxes. The remaining property tax revenue is allocated to repay bond debt. The budget includes $48.8 million for the debt service fund; $37.9 million is for bond debt principal and interest. In May, McKinney voters approved $350 million in new bond debt that must be repaid, with interest, using property tax revenue.

Other budget highlights include:

- $189.6 million for capital improvement projects, financed primarily by bond debt

- $101.2 million for water and wastewater (with proposed rate increases of 2 percent for water and 6 percent for wastewater), and $10 million each for the airport and solid waste “enterprise funds”

- $25 million in dedicated sales tax revenue for McKinney’s Economic Development Corporation and Community Development Corporation

Residents unable to attend the Friday morning budget work session can find more information on the city’s website, including video of the work session, the budget workshop presentation, and the proposed FY 2019-20 budget.

Public hearings on the city’s proposed budget are set for September 3 and 17. Because McKinney chose a property tax rate higher than the effective rate, state law requires the city to hold two public hearings before adopting a final rate. Those hearings are set for August 20 and September 3. City council will adopt the final budget and tax rate September 17.

McKinney City Council 2019-20 Budget and Tax Rate Hearings

August 20: 1st Tax Rate Public Hearing

September 3: 2nd Tax Rate Public Hearing, 1st Budget Public Hearing

September 17: 2nd Budget Public Hearing, Council Approves Tax Rate and Budget