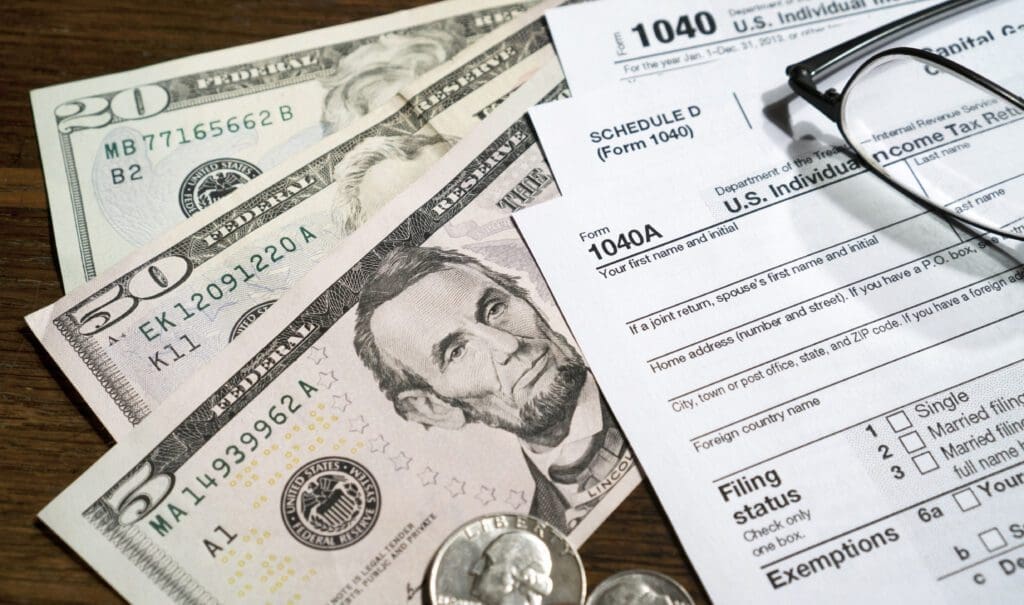

Local ballot initiatives failed across the board Tuesday as Ector County voters rejected a sales tax increase, school bond, and school district tax increase – sending a loud message to county and school district officials.

First up was the sales tax increase, a proposal which would have levied the tax through the creation of an Ector County Assistance District (ECAD). It failed with 64 percent of citizens voting AGAINST the proposition. If passed, the creation of an ECAD would have allowed Ector County to levy a 1.25 percent sales tax in a specified area to help “finance operations of the district” – increasing the rate to the highest allowed by the state, 8.25 percent.

Next were two tax increases proposed by Ector County Independent School District – Proposition A, which would have raised the interest and sinking rate to fund a $291 million bond and Proposition B which would have raised the maintenance and operations rate by $.13 per $100 valuation.

Both propositions were rejected by 62 and 60 percent of voters, respectively.

According to district officials, funds resulting from the bond would have been used for eight different projects in an effort to help with overcrowding issues. The list of projects included a new comprehensive high school, conversion of Ector Middle School to a high school, a new middle school to replace Ector MS, athletics facilities, a district-wide fiber network, fire and life safety upgrades, secure front entries where needed, and life cycle improvements at every campus.

If approved, the bond would have raised the interest and sinking (i.e., debt service) portion of the property tax rate by $.17, resulting in an approximate property tax increase of $230 annually for a home valued at $200,000.

Under Proposition B, ECISD targeted the maintenance and operations (M&O) portion of the property tax rate through a Tax Ratification Election (i.e., a tax increase election). If passed, the M&O portion of the rate would have increased to $1.17 per $100 valuation – the highest allowed by the state.

According to district officials, the increase would have allowed the district to generate approximately $20.3 million in additional revenue and would help offset a revenue decline resulting from a drop in oil and gas values.

Concerns, however, have been widely expressed over the district’s ability to effectively manage tax dollars which likely played a factor in election outcomes. In particular, poor planning during the last ECISD voter-approved bond in 2012 resulted in the district tapping into its own reserve funds to make up for overspending.

That decision hindered the district’s ability to use reserve funds during an economic downturn and played a factor in their decision to hold a tax increase election.

If both the ECISD bond and tax increase passed, a home valued at $200,000 would have seen a total increase on their annual property tax bill of $406. The large margin by which both initiatives failed demonstrates a clear disconnect between voters and local elected officials – an issue that must be addressed if ECISD hopes for voters to sign off on higher taxes.