Despite declines in student enrollment that are expected to continue into the foreseeable future, Plano Independent School District officials are asking voters to approve $1.5 billion in new bond debt that must be repaid, with interest, by local property taxpayers.

The bond package totals nearly as much as the district’s last five bonds combined.

Plano ISD school board members also want voters to approve a property tax rate that will increase the amount of tax revenue the district collects by $9 million a year.

A total of five propositions will be on the November ballot:

- Prop A: Voter Approval Tax Rate Election (VATRE)

- Prop B: $1.17 Billion Bond for School Renovations and Safety

- Prop C: $173 Million Bond for Instructional Technology

- Prop D: $130 Million Bond for an Event Center

- Prop E: $19 Million Bond for Safety and Maintenance at Stadiums

A state law passed in 2019 requires separate ballot propositions for bond debt that will be spent on non-academic facilities like stadiums and entertainment centers, as well as for computers.

State law also requires school districts to get voter approval of tax increases for operating expenses that exceed 2.5 percent, and the vote must take place on a regular May or November election date.

Declining District, Expanding Debt

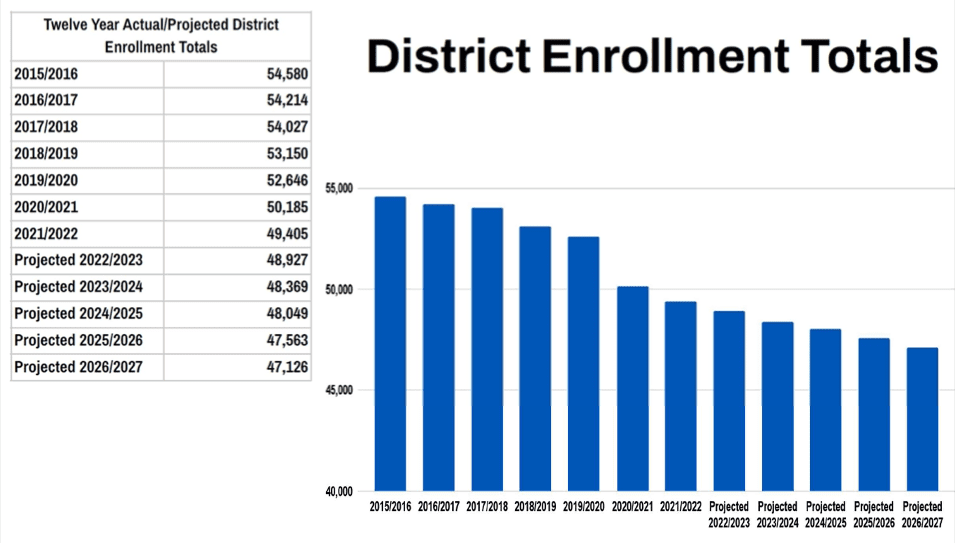

Plano’s student enrollment has declined by 10 percent since 2016, from more than 54,000 to about 49,000 in 2022, and the district is projected to lose another 2,000 students by 2027.

The district’s school accountability rating also declined last year to a B. Plano ISD received an A on the previous two report cards issued by the state (the Texas Education Agency didn’t give accountability grades for 2019-20 or 2020-21 due to education disruptions caused by COVID closures).

Yet the district’s spending is expected to grow.

If the ballot propositions pass, Plano ISD’s debt burden will also grow, to unprecedented levels—all at property taxpayers’ expense.

According to the latest data posted on Plano ISD’s debt transparency webpage, district taxpayers owed $799 million in bond debt principal plus interest as of June 2021. Using the district’s numbers, that’s $15,946 in bond debt per student.

Some of that debt has since been paid off, but the district’s plan for the 2022 bond is to issue another $550 million in debt in 2023, $400 million in 2024, $300 million in 2025, and $200 million in 2026. The district still has $50 million in unissued debt from its 2016 bond.

Plano ISD’s financial transparency page lists debt service as the district’s second-highest expense at $3,203 per student—20 percent of the $16,071 Plano ISD spent on each student in 2020-21.

Bond Spending: Needs versus Wants

The school board discussed the proposed spending package during meetings on August 2 and August 16.

Trustee Jeri Chambers said the district “needs this bond to be competitive and to not fall behind other districts.”

Plano ISD parent Semida Voicu, who served on the community’s bond committee, disagrees.

“At the beginning of the bond meeting, the discussion was about the critical needs, what we would like, and the wish list,” Voicu told Texas Scorecard.

“The bond package is everything,” she said. “In these economic times, we should have focused on the critical needs, which are many.”

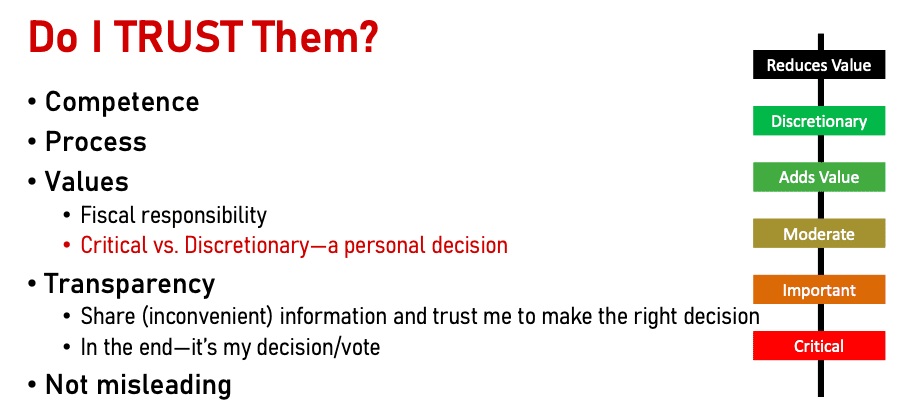

An analysis by former Plano ISD Trustee Yoram Solomon (the source of graphics featured in this article unless otherwise noted) concludes that voters will ultimately make personal decisions about which proposals they think are critical versus discretionary.

Solomon, who is an expert on building trust, said voters’ decisions often boil down to trust.

Speaking last week at an event hosted by Plano Citizens’ Coalition, he said people are more likely to vote for the bonds if they believe district officials are being transparent, not misleading, and are fiscally responsible.

During his term on the school board, Solomon pushed Plano ISD to adopt a policy for proactively dealing with debt, which included limiting bond repayments to 20 years and developing a multiyear capital improvement plan for the district’s 91 facilities. He also suggested closing schools that are below 50 percent capacity, an option he still supports.

Solomon said voters want to know how much they are going to have to spend to pay for what the district wants.

He said Plano ISD’s total taxable property value is approximately 50 percent higher now than in 2016.

“That’s how we can pay for a $1.5 billion bond without raising the tax rate,” he said, adding it’s misleading for school officials to say they are not raising taxes.

“I urge the district to stop using this phrase,” he said. “People are not dumb. It’s inaccurate, and to me that’s a major problem.”

“The key is to maintain a pragmatic ‘needs’ plan, not let the district, the board, or anybody else get completely runaway with all kinds of projects because we have the money,” Solomon added.

Solomon said he believes the proposed event center falls into the “discretionary” category.

“This is the kind of thing you do if your district is growing, not declining,” he said. “The prices in Plano are making it nearly impossible for people with young kids to move here.”

The district says a dedicated event center would save Plano ISD approximately $275,000 annually. But the Garland ISD facility the district uses as its example costs around $3 million to maintain while bringing in about $2.4 million in revenue—a $600,000 loss that would not be offset by Plano’s estimated savings.

A $67.5 million performing arts center was part of Plano ISD’s 2016 bond but has yet to be completed. It was originally expected to open in 2019. In 2021, “significant cracking” delayed opening yet again and prompted threats of a lawsuit by the district.

Lower Tax Rate, Higher Taxes

School districts collect two sets of property taxes. One is used to finance regular maintenance and operating (M&O) expenses—primarily salaries, but also things like instructional materials and utilities. The other, called interest and sinking (I&S), is used to repay bond debt.

Legislation passed in 2019 requires Texas school districts to lower (“compress”) M&O rates each year, saving local taxpayers money that the state replaces.

This year, Plano ISD was required to lower its M&O rate by 6 cents but is using the VATRE to reclaim 3 cents’ worth of savings meant for taxpayers.

In exchange, the district proposes lowering its I&S rate by 3 cents, which still leaves more money to spend on debt due to skyrocketing property values:

As Taxable Assessed Values have increased, it has created additional bonding capacity for Plano ISD. Plano ISD can afford to issue the $1.49 billion worth of bonds at the current Interest & Sinking (I&S) tax rate of $0.2374 per $100 valuation. This means that the tax rate will not increase as a result of voters approving the four bond propositions.

Home values in Plano are up more than 20 percent since last year.

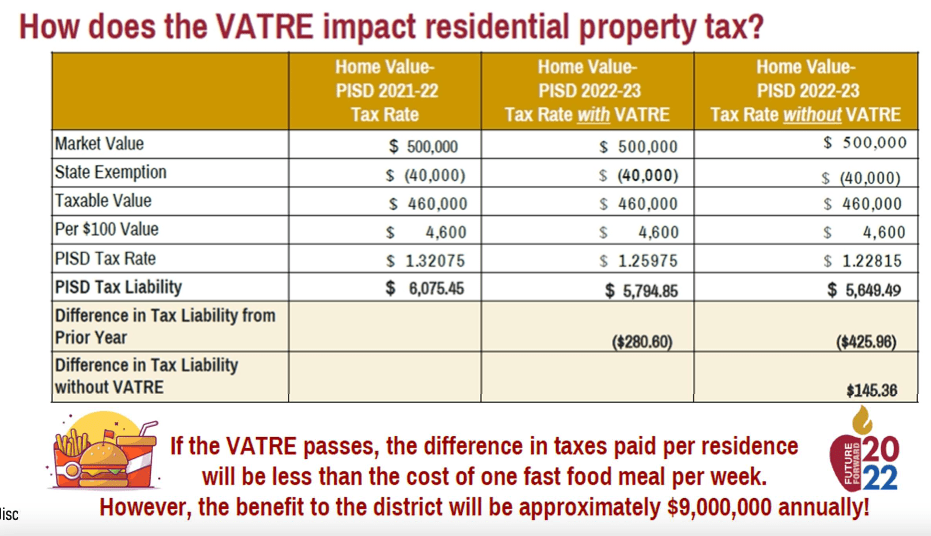

The district’s bond presentation shows an example of a $500,000 home (a bit below the median) with a taxable value of $460,000.

If the VATRE is approved, that homeowner’s property taxes will decrease by $280; but if voters reject the new tax rate, the homeowner will realize the full $425 savings intended by the state’s property tax reform—an additional $145.

The district notes the difference is “less than the cost of one fast food meal per week.”

In a 2019 ruling against disgraced former Lovejoy ISD Superintendent Ted Moore, the Texas Ethics Commission said school districts making these types of comparisons amounts to illegal electioneering.

“There’s no reason to divide the yearly cost of the tax increase by 52 weeks and compare it to a minor indulgence except to minimize the cost to taxpayers,” the TEC concluded in its order fining Moore for his ethics violations.

Plano ISD officials say they need the extra $9 million in M&O property tax revenue in part to help reduce the district’s $38.9 million budget deficit, as well as to make up for the “loss” of millions in federal relief funds that districts relied on during COVID.

Officials also note that 37 percent of Plano ISD’s M&O tax revenue goes to the state as “Robin Hood” recapture payments that redistribute school tax dollars from property-rich to property-poor districts (I&S tax revenue is not subject to recapture).

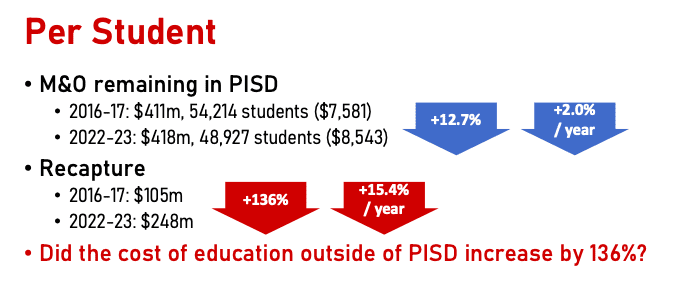

Solomon notes that the dollar amount of M&O property taxes remaining in Plano ISD has grown by about 13 percent since 2016, but the dollar amount of the district’s recapture payments has grown by 136 percent.

The district has set up a page for Plano ISD voters to submit questions about the tax rate and bond propositions.

Plano ISD’s last bond package, totaling $481 million, passed in May 2016 with 79 percent of the vote but just 5.2 percent voter participation. Turnout will be much higher in this year’s November general election.

Dozens of other cities and school districts across Texas are holding elections in November asking voters to approve bonds and/or tax increases.

Election Day is November 8. Early voting runs October 24 through November 4.