Monday’s Senate hearing on property tax reform included enthusiastic testimony from both local officials and taxpayers calling for structural reform and relief.

The Senate Select committee chaired by State Sen. Paul Bettencourt (R-Houston) met in Plano, a large suburb in Collin County where homeowners are saddled with the second-highest property taxes in the Lone Star State.

The committee opened by citing evidence showing how city and county officials failed to lower tax rates as property values skyrocketed. With rates staying flat amidst rising values, tax bills for the average Texan have risen dramatically.

Over one hundred and fifty citizens attended the Plano hearing, with dozens testifying in support of relief. Several local officials also supported reform.

Frisco Tea Party leader Tom Fabry gave compelling testimony. Although both Denton and Collin County chose to adopt their “effective” tax rates to prevent a tax increase, the City of Frisco, where Fabry lives, did not. Although Frisco ISD voters thwarted the district’s 13-cent rate hike, rising land values will still increase tax bills for those living in FISD.

Had FISD trustees had their way, property taxes on families and businesses would increase even faster than they already are.

So, while Fabry’s county sufficiently lowered their tax rates to help offset rising appraisals, the overall tax burdens on existing property owners in Frisco and Frisco ISD will increase by $61 million year over year! When taxes on new properties are included, that figure climbs to $86.7 million in increased revenue for government coffers.

Collin County Judge Keith Self expressed his strong support of the Senate’s proposal to lower the “rollback” rate—the rate at which local officials can raise taxes without voter approval. He also supported the idea of “creating uniform elections dates,” which would prevent local governments from holding debt and tax ratification elections (TREs) on their own ballot where turnout is extremely low.

Plano ISD trustee Yoram Solomon also asked the Senators to end the “Robin Hood” funding scheme, which he called a “statewide property tax.” He stated – that despite Plano ISD taxpayers paying ever-increasing property taxes – much of their funds are paid to the state and redistributed to other districts, totaling $1.7 billion since 1993.

Even worse, the state’s complicated funding formula punishes Plano for lowering property taxes. If the board chose to lower tax rates to help offset higher appraisals, the district would actually pay more in recapture via “Robin Hood” to the state, leaving them with less money per student.

Solomon asked the committee to have the legislature take on more of the funding responsibility, and provide local taxpayers with relief in the process.

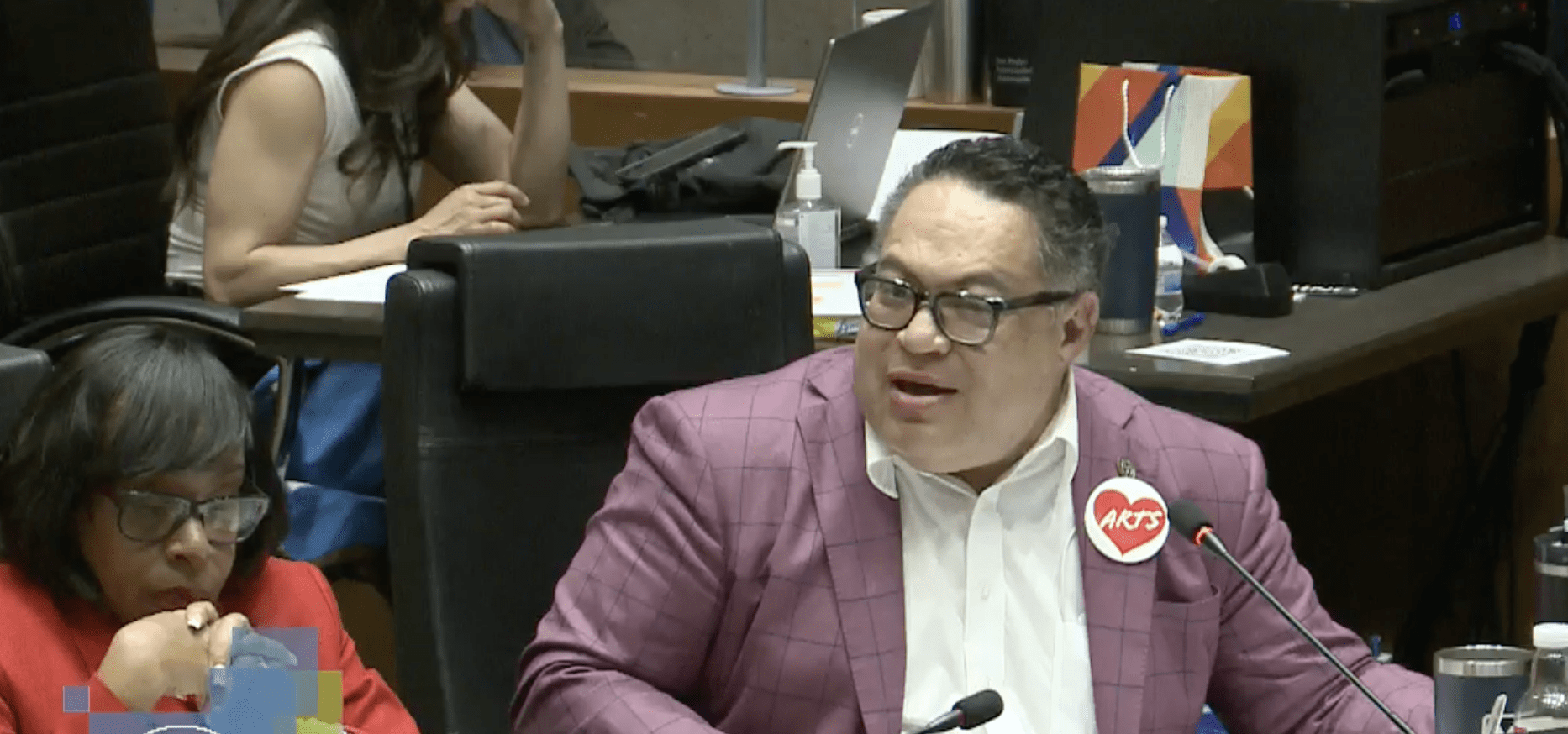

Mayor Pro Tem of Carrollton Anthony Wilder was one of the strongest pro-reform voices. He declared, “Local governments have a spending problem,” and too much money is “wasted by cities on corporate incentives and non-essential projects.” Wilder said this “scope creep” is being financed by higher property taxes and unnecessary debt. “Cities are competing with each other for new companies [to move to their city],” Wilder declared. “But in the end, everyone is losing.”

Texas homeowners overall pay the fourth highest property taxes in the nation – an amount 63% higher than the national average – and nearly the highest when compared to those in the nine states without a personal income tax.

But with strong support from taxpayers and fiscally conservative officials in North Texas, the prospect for tax reform is better than ever before.