Plano citizens struggling through months of government-ordered economic shutdowns in the wake of the Chinese coronavirus outbreak saw a preview this week of the city’s spending and tax plans for the coming year.

At a special Plano City Council meeting on Wednesday, City Manager Mark Israelson presented his recommended budget for 2020-21.

Israelson said the city plans to budget based on the “no-new-revenue” property tax rate—the rate that collects the same overall revenue from properties taxed the previous year, keeping tax bills stable.

He said a last-minute change delayed the city’s rate calculations, but they expect to have revised numbers at the August 10 city council meeting.

The preliminary budget presented Wednesday is based on the current tax rate of 44.82 cents per $100 of taxable appraised value. At that rate, the average homeowner’s city property tax bill would drop by $16, because the average home value fell from $379,629 to $375,000—a significant change following years of climbing values.

Last year, Plano budgeted based on the no-new-revenue tax rate for the first time in decades. Over the previous five years, the average Plano homeowner’s city property tax bill had skyrocketed by 40 percent. Prior councils lowered tax rates, but not enough to offset rising property values.

The city originally estimated the no-new-revenue rate for 2020-21 at 44.79 cents, slightly below the 2019-20 rate. The calculation excludes taxes collected on new construction or to repay debt.

Even at the no-new-revenue rate, the city collects more money year-over-year from growth. New construction added $829 million to the city’s $46 billion tax base this year; 90 percent of that growth was commercial property.

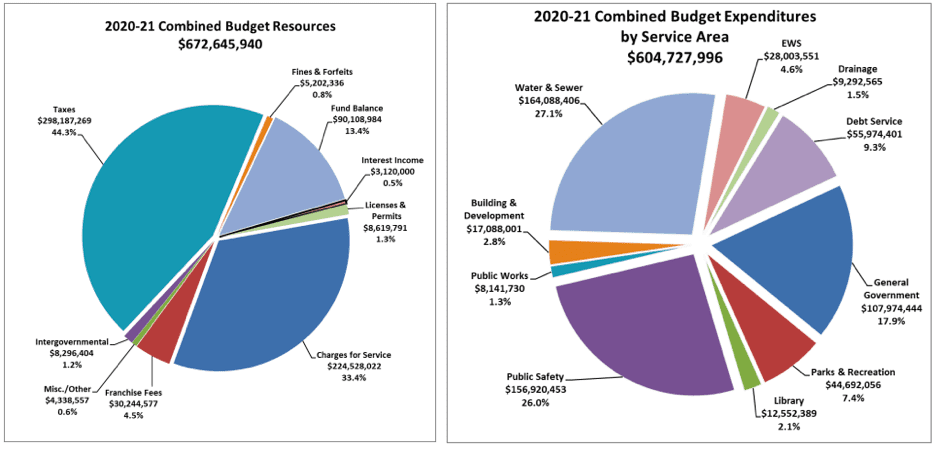

The city expects to collect $200 million in property taxes, with 75 percent going to the general operating fund and 25 percent allocated to repay debt.

Sales tax revenue is projected at $84.9 million—$1.2 million less than last year’s budget but more than the revised $82.3 million the city expects to actually collect this year due to cuts in consumer spending caused by coronavirus closures.

“My recommended budget shows that many city revenue sources have been impacted by COVID-19,” he added. “However, property tax revenue will not be impacted until the 2021-22 budget.”

Israelson said city staff has been making budget adjustments to account for decreased revenue since March, when the COVID-19 shutdowns started.

“The city took quick and decisive action to freeze positions, delay projects, cut expenses, and reprogram resources in recognition of the changed environment,” Israelson told the council.

According to his presentation, the city made 5 percent cuts across the board, totaling $2.67 million in savings, and no salary increases are included in the proposed budget.

Plano also received $5.5 million in federal CARES Act funds from Collin County to offset costs incurred this year related to the coronavirus.

Citizens impacted financially by the coronavirus closures are already struggling to pay their bills.

Unemployment has soared since March. Reports show Plano’s unemployment rate was 7.3 percent at the end of June, down from a high of 11.6 percent at the end of April but more than double the city’s 3.2 percent jobless rate at the same time last year.

Plano citizens will have multiple opportunities to voice their opinions on the city’s spending plans:

- August 10 – Public Hearing on Budget (City Council meeting)

- August 13 – Town Hall meeting on Budget

- August 15 – Council work session on Budget

Citizens can also contact their Plano City Council members with questions and concerns.

A public hearing on the tax rate will be held in August as well, with the final budget and tax rate set to be approved in September.