Despite having no accreditation, Texas’ last remaining county school district is not only collecting property taxes, but charging local independent school districts fees for placing at-risk students at any of its campuses.

The Harris County Department of Education operates alternative schools: Academic and Behavior Schools, Fortis Academy, Highpoint East School. Local ISDs can “purchase” seats at these alternative schools for their at-risk students who they deem unable to succeed within their district.

The problem is, none of these schools are accredited and no one seems too concerned about it.

The Texas Education Agency, the governmental agency overseeing public education in the state of Texas, is also tasked with accrediting public schools. However, HCDE claims it is not a public school district and, thus, TEA has no authority over it. A simple search on the TEA website doesn’t turn up any information for these campuses.

On the other hand, HCDE schools are not private schools, either, and are not accredited by the Texas Private School Accreditation Commission. Emails to HCDE asking about the lack of campus accreditation went unanswered, but a previously filed records request for copies of accreditations held by any campus in the district didn’t turn up any documents.

HCDE claims to be a “service provider” developed “in conjunction with 25 school districts” so they operate in a quasi-public school district realm, but do not have to meet the same state standards.

Despite the lack of accreditation and Title 2 of the Texas Education Code which states, “A school district that is not accredited may not receive funds from the agency or hold itself out as operating a public school of this state,” HCDE levies a property tax (they’re allowed up to a 1-cent tax) and also collects the fees derived from public funds from local ISDs that they receive when seats are “purchased” at any of their campuses.

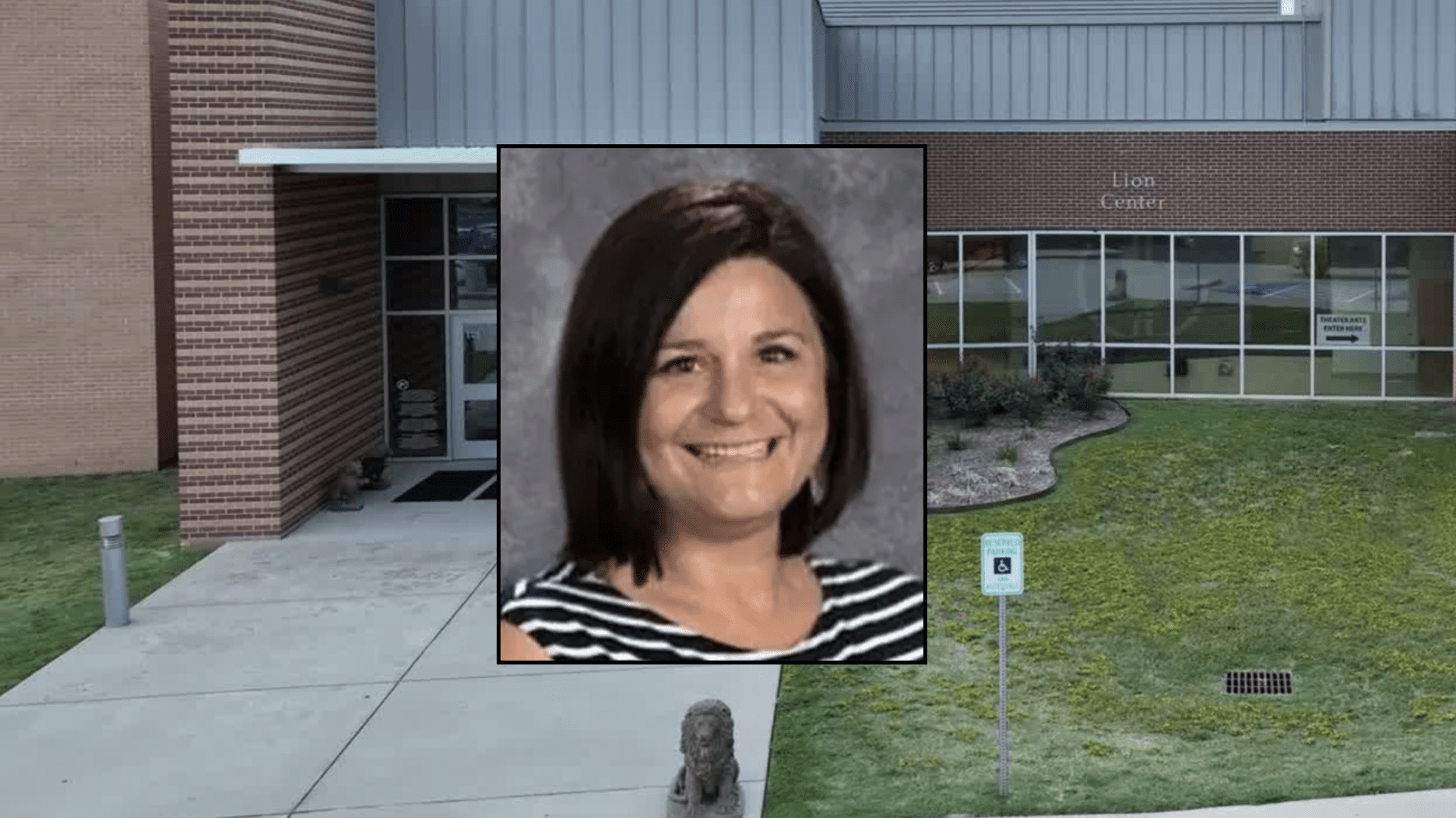

Eighty percent of HCDE’s budget comes from grants and fees paid by local ISDs, and the other twenty percent comes from the property tax levy. The average Harris County taxpayer pays $12 to HCDE every year. “That means our local ISDs are spending public funds to pass their troubled students off to unaccredited schools at HCDE, which have no oversight from anyone,” says Colleen Vera, a longtime advocate for abolishing HCDE.

The ultimate problem is, whether permitted by state law or not, HCDE is getting all of the benefits of a public school district without any of the oversight or accountability standards. The students sent to alternative schools within the district are the most at-risk and unable to be served by their local ISD, so why should tax dollars be used to send them to an unaccredited campus?