UPDATE 6/26/20 11:43 AM: Dallas ISD third-grade teacher Brittnay Connor contacted Texas Scorecard regarding her quote in this article and clarified her stance as strongly supporting the use of taxpayer-backed school debt for supporting the LGBTQ agenda.

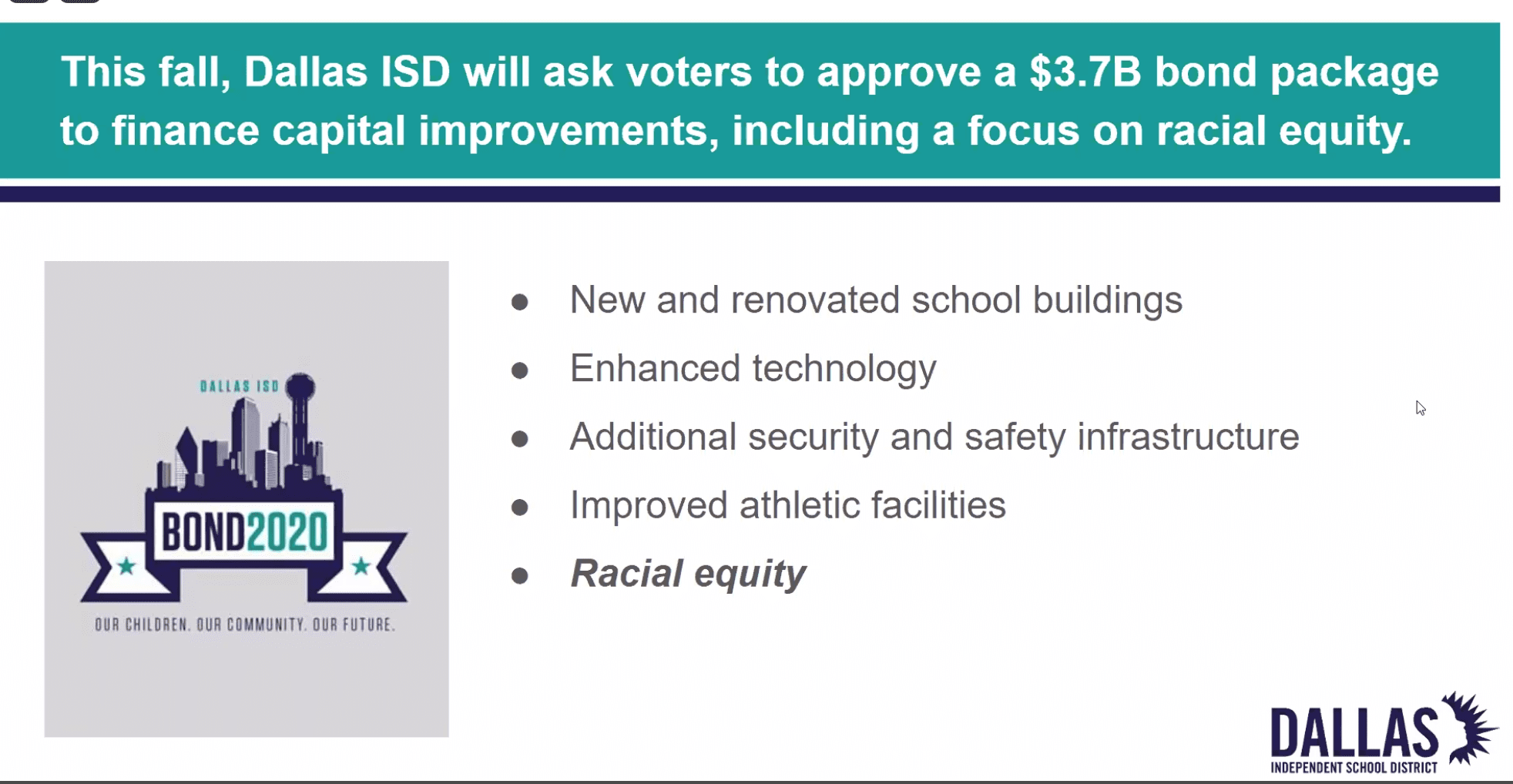

This November, the Dallas Independent School District will ask voters to approve a shocking $3.7 billion bond—on top of their outstanding $2.5 billion debt, which they haven’t finished using yet. They propose spending $40 million of this not in the classroom, but to support Democrat policies like “immigration services.”

Monday evening, members of Dallas ISD, its Racial Equity Office, and the Child Poverty Action Lab (CPAL) held an online digital meeting for the community of H. Grady Spruce High School in Pleasant Grove. They discussed the goals of the upcoming mega-bond that will be put to voters this year and plans for spending this taxpayer-backed debt.

All bonds are debt that taxpayers must repay. The more debt a local government has, the higher taxes must be, or it is less likely that tax bills can be lowered. This can affect your home property tax bills and rent.

“It is our responsibility to use the 2020 bond funding to right the wrongs of our past,” said Michelle Prudhome-Coleman, director of Dallas ISD’s Racial Equity Office. The district’s presentation mentioned “unfair distribution of financial, educational, and material resources” in the past.

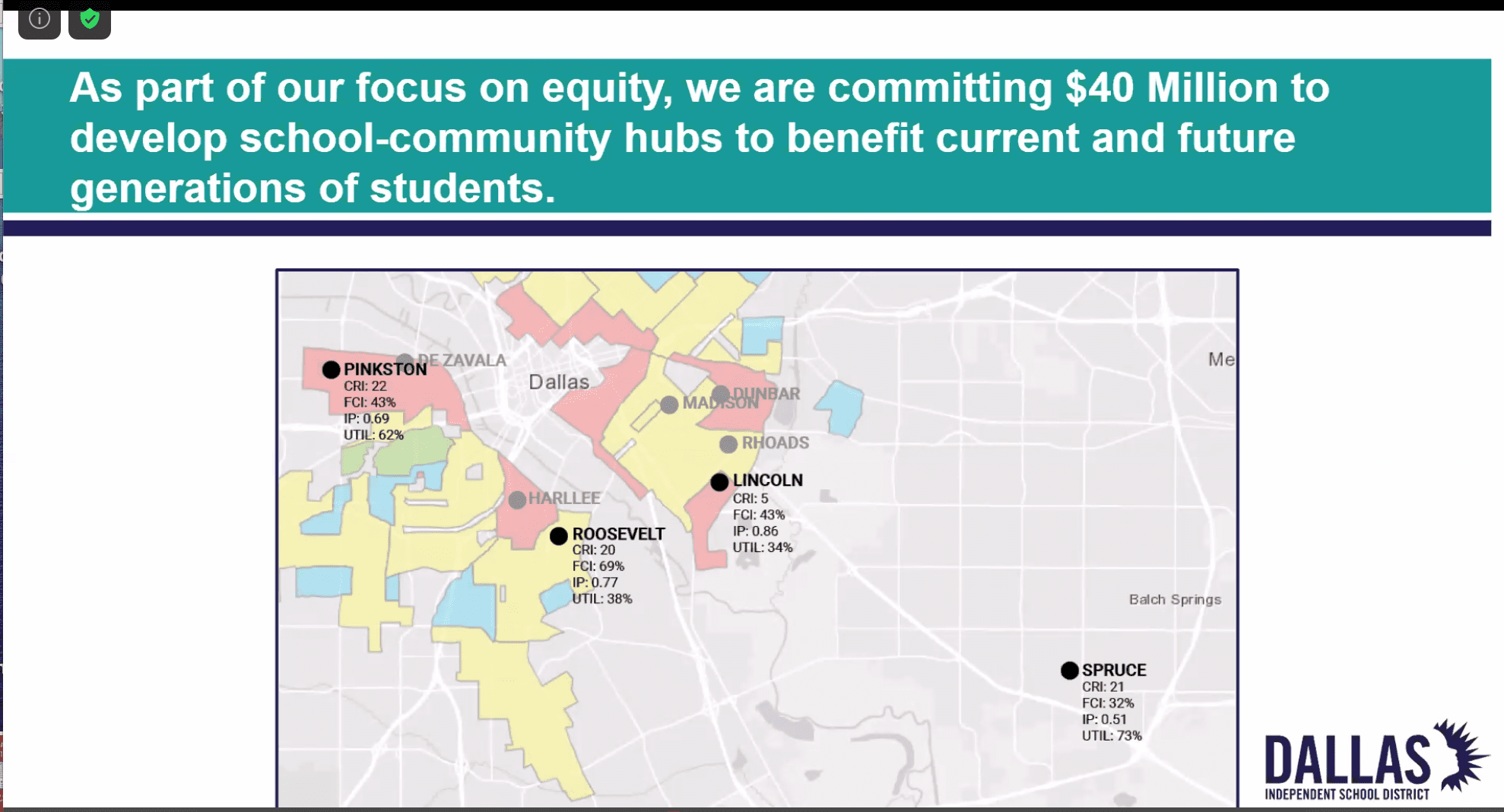

This bond is unique because, unlike other bonds, the school district isn’t even claiming all of it would go to the classroom or students. Instead, $40 million of this taxpayer-backed debt would be used for projects like building infrastructure for grocery stores, clinics, or therapists in the area near the schools, as well as addressing an alleged “digital divide.”

The school district refers to this as developing “school-community hubs.”

During Monday’s meeting, two of the possible priorities to use this taxpayer-backed debt on were “Access to Public Benefits” and “Immigration Services”—items that have nothing to do with education.

“If parents need help, they can go and get it,” said Rosemond Beacham, a Dallas ISD staff member at Comstock Middle School, in regards to the “Immigration Services” and “Access to Public Benefits” line items.

Texas Republican Party Platform planks 272-295 oppose open borders and call for tough measures to secure the border and end illegal immigration, while plank 236 supports welfare reform.

Dallas ISD third-grade teacher Brittnay Connor also expressed a desire to use these funds to further the LGBTQ agenda. “There seems to be a huge amount of disconnect there,” she said.

Texas Republican Party Platform 121 opposes pushing such sexual politics in education.

This “school-community hub” narrative is being used to increase taxpayers’ debt burden to agenda items that have nothing do with education.

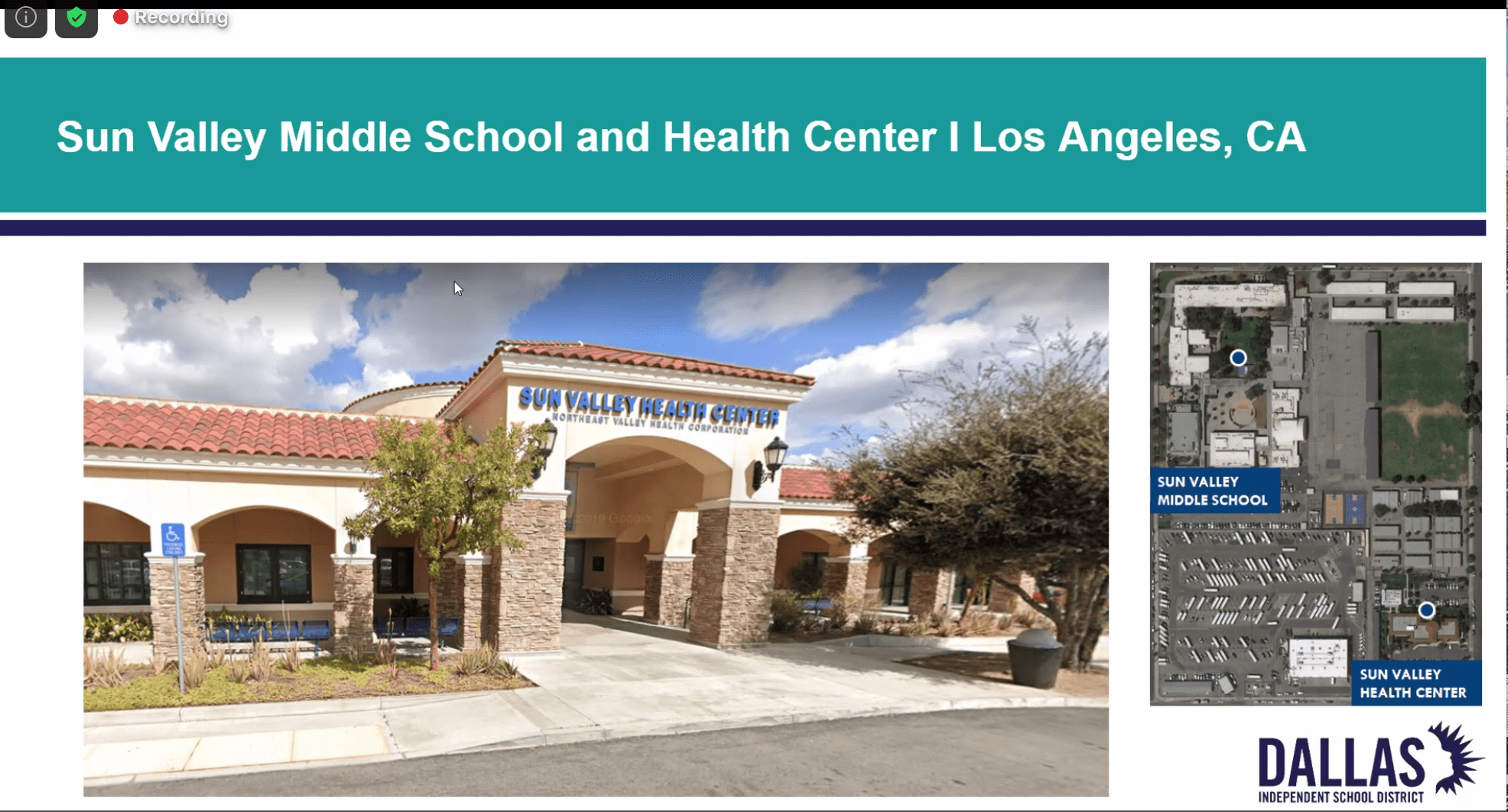

In Monday’s meeting, Dallas ISD staff mentioned Sun Valley Middle School and Health Center in Los Angeles, California, and the Baker Ripley Neighborhood Center in Houston, Texas, as examples of what they’re trying to create.

This is being proposed during a time when millions of Texans are unemployed due to the government-mandated economic shutdown in response to the Chinese coronavirus.

Dallas ISD taxpayers’ burden is already heavy.

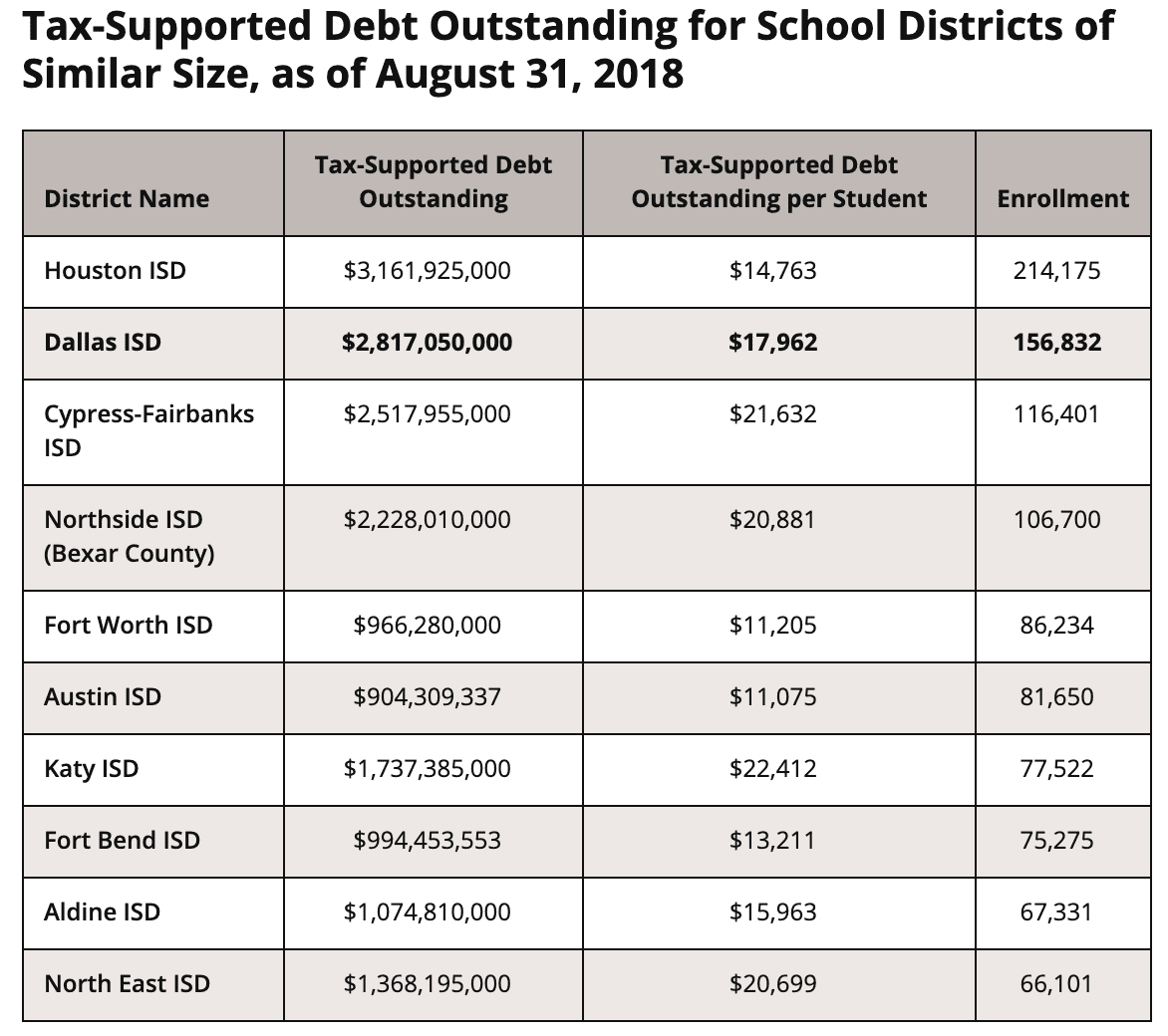

According to the Texas Comptroller website, as of 2018, Dallas ISD still has over $2.5 billion “voter approved tax-supported debt” outstanding, second only to Houston ISD for districts of similar size in the state.

It was reported in January that they still have $600 million worth of debt from their 2015 bond they still haven’t issued.

What’s more, the proposed $3.7 billion bond is reported to be the largest bond ever in the history of Texas and could result in a tax rate increase. “There’s nothing that says we can’t have a tax rate increase,” Superintendent Michael Hinojosa said.

Facing an economic downturn and record statewide unemployment numbers, a higher tax bill is probably not what Dallas ISD homeowners are hoping to have added to their burden at the moment. According to the Dallas Central Appraisal District, the average homeowner’s tax bills from the district exploded over 67 percent from 2013 to 2019—$1,758 to $2,949.

Sandy Kress—who studies education reform and accountability—would like to know what exactly the benefits are that parents and students have obtained from higher debt and taxes.

“Do you think voters will care that the DISD’s NAEP (National Assessment of Educational Progress) scores plummeted in recent years, students were poorly educated in the spring, few will catch up in the summer, few will be accelerated next year, and the bond plans are more sophisticated than those for recouping learning loss?” he asked.

“This is, in my opinion, the last, best chance to go to the voters with something like this,” Hinojosa said.

Voters will have their own say this year. Early voting starts on Monday, October 19, and Election Day is Tuesday, November 3.

Concerned taxpayers may contact their Dallas ISD board member.

This article has been updated since publication.