After helping tens of thousands of homeowners fight their rising property taxes—for free—a North Texas realtor finds himself and his freedom of speech the target of apparent revenge by Randall Armstrong, a local government employee.

Texas Scorecard made multiple attempts to contact Armstrong for comment about items in this article. He declined, citing “an ongoing matter in the office” and saying, “I just prefer not to make any comments about anything.”

Now, Chandler Crouch is responding to Armstrong’s allegations.

It was widely reported that on June 30, the TAD board of directors will meet to discuss firing Armstrong and his boss, Chief Appraiser Jeff Law.

Recap

As Texas Scorecard previously reported, Armstrong, the director of residential appraisal at the Tarrant Appraisal District(TAD), filed four complaints last year against Crouch to the Texas Dept. of Licensing and Registration.

This happened after Crouch helped outgoing State Rep. Matt Krause (R–Haslet) change state law in 2019, which banned Armstrong’s conflict of interest at the time.

Until then, it was perfectly legal in Texas for someone to set homes’ taxable values at an appraisal district while also working as an elected public servant to set the tax rates by which those values would be multiplied.

In Armstrong’s case, until December 2019, he had been working at TAD while also serving as an elected board member of the White Settlement Independent School District. This stopped being legal after the passage of Senate Bill 2 in 2019, and Armstrong resigned from the school board that December.

Since 2017, Crouch has helped tens of thousands of homeowners in half of the process that results in their total property tax bill: protesting the taxable values TAD subjectively assigns to their homes.

As previously explained, there are two steps that lead to the creation of your property tax bill. First, your local appraisal districts set the taxable value of your property (these have been criticized as being a “subjective valuation”). Second, your local public servants set the tax rate for your property based on these values.

Those two numbers multiplied equal your total property tax bill.

While this process involves two steps, local officials can stop these tax bills from increasing despite the appraisal district setting higher values. These same officials also appoint the voting members of the TAD board of directors. (Tax Assessor-Collector Wendy Burgess (R) is a nonvoting member of the board.)

More reporting on Armstrong, Crouch, and TAD has come out since our initial reporting.

After we published records of his communications with TDLR, Armstrong confessed to the establishment-backed Fort Worth Report that he had filed the complaints against Crouch in his official role at TAD, and that Law, his superior, wasn’t involved.

He also expressed his desire to “speed” TDLR’s process up.

Armstrong also told the Fort Worth Report he had not heard from TDLR after receiving confirmation they received his complaints. This contradicts records we obtained showing multiple communications with TDLR about his complaints as late as April, 2022.

Armstrong claimed he filed the complaints after conversations with other staff at TAD about affidavits Crouch filed. In response to open records requests from Texas Scorecard, TDLR reported the only complaints they had received against Crouch at TAD from 2020 to present were from Armstrong. They reported no records of complaints filed against Crouch by anyone at TAD from 2017 (the year Crouch started protesting) to 2019.

Furthermore, batches of communications we received that had been in Armstrong, Law, and the board’s possession that mention Crouch from September 1-December 22 in 2021 did not contain any complaints from other TAD employees about Crouch. We obtained these through open records requests to TAD.

There were also questions about whether Armstrong had used taxpayer resources to gather the documentation he had sent to TDLR when he filed his complaints. As previously reported, TAD found no open records requests from him seeking information regarding the properties he listed in his complaints. He also utilized his TAD email address to communicate with TDLR.

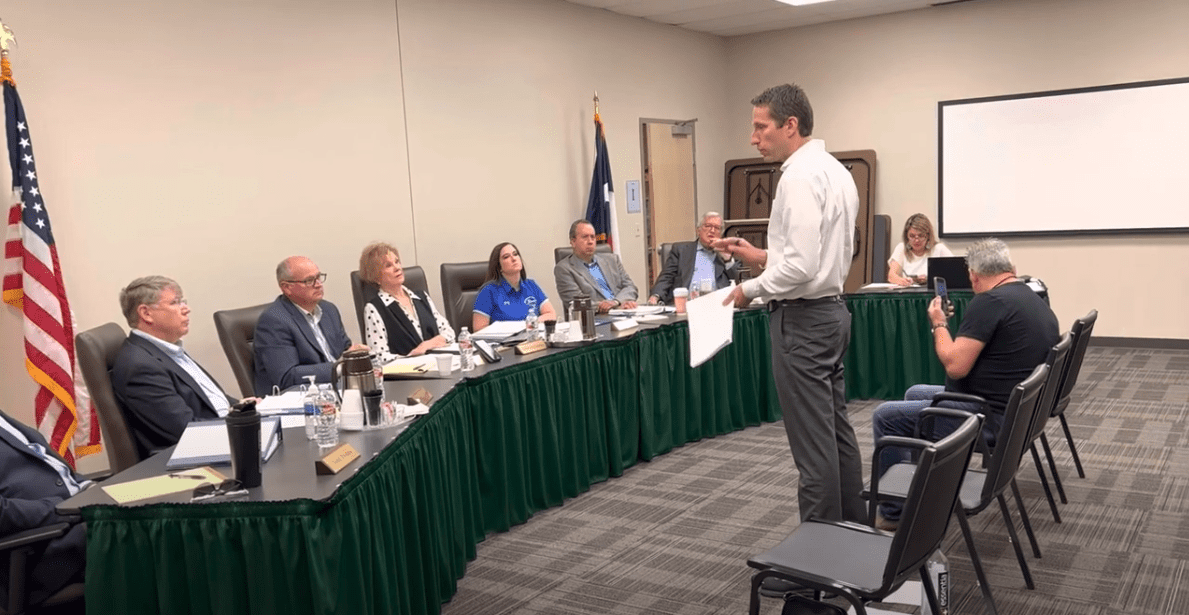

At the June 10 TAD board meeting, where Crouch confronted the board and Law, it was mentioned how Law is “responsible for managing and overseeing the employees of the appraisal district.” It was also mentioned Law himself is accountable to the TAD board of directors.

To defend himself, Crouch has stepped into the light and publicly responded to all the allegations Armstrong made against him.

Attorney Melissa Lowery Gallagher of the Gallagher Firm, also reviewed these complaints, offering her perspective as an attorney on property tax issues.

The Allegations

There’s an important matter to remember: According to Crouch, protesting your home’s taxable value doesn’t affect what you can sell it for—”unless you might make the case that it lowers the tax burden for a potential buyer, which might enable them to pay even more for the property.”

Additionally, for these allegations, when TDLR contacted Crouch, they did not make him aware of all of Armstrong’s complaints. It was through our interview process with him that he became aware of all of the allegations.

Disturbingly, Armstrong had targeted Crouch’s First Amendment rights in these complaints.

“Mr. Crouch’s actions do in fact create equity issues and inconsistent market values for all taxpayers in Tarrant County,” Armstrong wrote. “These tactics and his continued mockery and criticism of the property tax system should not be allowed.”

“It’s concerning that he is suggesting that any government entity suppress free speech,” Gallagher told Texas Scorecard.

“It’s not an equity issue for any other homeowner; it’s only an equity issue for the appraisal district,” Crouch stated. “This whole protesting process is an act of free speech.”

Repeatedly, Armstrong accused Crouch of “misrepresentations of fact … to achieve unwarranted value reductions” and said that he “continues to intentionally mislead Tarrant County taxpayers and members of the Tarrant Appraisal Review Board” (TARB) in his property protests.

“I have protested more than 60,000 times,” Crouch replied. “I’ve never received a complaint, ever, from anybody—not a client, not an employee of TAD, not anybody in the appraisal review board department. Nobody.”

Armstrong also claimed Crouch “cannot possibly responsibly and properly represent” the more than 20,000 homeowners he served in 2021. He went on to complain that Crouch personally protested only 730 of the homeowners he represented that year and “filed sworn affidavits containing more than 191,000 pages of evidence” for the rest of the homeowners.

Gallagher pointed out that, according to Armstrong’s numbers, that would equal roughly nine pages of documents per property for the roughly 21,000 properties Crouch did not personally protest. In comparison, she showed that TAD would be presenting five pages of evidence for their value of her property. “Nine pages per property is not a ludicrous amount of evidence.”

But even there, Armstrong didn’t paint the entire picture. “I didn’t submit affidavits on only the 21,326 properties. I submitted affidavits on every single property,” Crouch said. “This fact alone proves that I have gone above and beyond for the homeowners that I represent.”

Continuing on the subject of Crouch’s affidavits, Armstrong complained they accused TAD of “violating Uniform Standards of Professional Appraisal Practice (USPAP) Standards.”

Armstrong wrote that TAD was in compliance, and again targeted Crouch’s First Amendment rights. “Should Mr. Crouch be allowed to advertise that TAD is ‘violating Uniform Standards of Professional Appraisal Practice (USPAP) Standards?’”

“Maybe it’s because I’ve filed so many protests, it shows that maybe the system isn’t as accurate as what everybody thinks,” Crouch said.

These were general complaints Armstrong made. He went on to make specific allegations regarding properties Crouch represented.

7308 John McCain Road

The first complaint was against Crouch’s June 16, 2021, protest for 7308 John McCain Road.

“In the [Tarrant Appraisal Review Board] hearing Mr. Crouch, the Property Tax Consultant, testified under oath that the ‘market value’ of the property was $882,000,” Armstrong wrote. He claimed Crouch “never once disclosed” he had listed the home for sale at more than $2.5 million, compared with TAD’s assigned value of more than $1 million.

“He’s leaving out very significant facts,” Crouch said. “The address at 7308 John McCain, before it was sold, contained two different Tarrant Appraisal District accounts.” He said the first account was for 2.5 acres and had an agricultural exemption, while the other was 1.75 acres and had a 4,871-square-foot house. Both properties have the same address, but Crouch only protested the latter’s value.

He said when he listed the land for sale at $2.53 million, that was for both properties, as well as land adjacent to it that had a nearly 2,000-square-foot house.

Armstrong’s complaint may be moot anyway, as the property had not been sold by January 1, 2021. “If it were listed after January 1, then that has no relevance to the protest hearing whatsoever, because we’re valuing the property as it stood on January 1 of 2021,” Gallagher said. “If it’s sold between January 1 of 2021 and March 31 of 2021, that’s more of a gray area, because those sales can be considered.”

Armstrong also wrote that because the McCain property would sell for much more than $882,000, it could harm TAD when the Texas comptroller does its “annual property value performance study.”

“That’s not Chandler’s problem,” Gallagher retorted.

Armstrong went after Crouch’s protest of 11913 Bexley Drive for similar reasons.

On January 1, 2021, TAD had assigned the property a value of $273,045, while Crouch argued it should be lowered to $267,819. Armstrong accused Crouch of being “shady” because he had not disclosed he was the realtor for the property, and it had sold for $352,000 that May.

Gallagher said she didn’t “see any reason why that would need to be disclosed” because it happened after January 1, and outside the “gray area” of January 1-March 31.

For the McCain property, Armstrong also alleged Crouch gave “misleading testimony” that the property value should be lowered due to more than $31,000 in “water damage.” In Armstrong’s opinion, the damage occurred after the first of the year and therefore “should not have been presented or considered in the [Tarrant Appraisal Review Board] hearing.”

“When he makes the allegation that this evidence shouldn’t have been presented, that’s false,” Gallagher said. “When he says it shouldn’t have been considered, that is true. But that is the [TARB’s] job to determine what evidence falls within the purview of the Texas Tax Code and is appropriate for consideration in that protest hearing.”

Crouch said he presented the evidence because his client wanted him to do so. “If the homeowner gives me evidence that they feel like is relevant, and they asked me to present it at the hearing, then I’m going to present that evidence.” Gallagher said she also will “routinely present information” property owners provide to her. “My job is to present evidence.”

Crouch added that what he presented clearly showed the work was done after January 1. “I was not trying to hide anything,” he said.

The Last Allegation

Armstrong alleged a May 28, 2021, affidavit from Crouch falsely listed the property’s owner as W. P. Johnson. A month earlier, Johnson had sold the house to Crouch himself.

Texas Scorecard has redacted the address from the complaint file we received, to protect the Crouch family from any possible retaliation.

From January 1 until Crouch bought the house on April 28, Johnson had owned it. According to Crouch, “an estimated amount for the property tax” for the time that he owned it was built into the purchase price.

“Since he owned it on January 1, it’s within his right to protest,” Crouch said. “I don’t know of an obligation that I have to disclose [a sale] in a hearing where we’re trying to establish what the value was January 1 of 2021.” As proof, Crouch pointed to Armstrong’s own quote in his complaint from the state Property Tax Code:

Except as otherwise provided in this chapter, all taxable property is appraised at the market value as of January 1.

However, one part in this complaint gave Gallagher pause. Crouch’s affidavit for the property, which he signed on May 28, 2021, still listed Johnson as the owner. “If he did sign it on May 28, then this information would be false.”

Texas Scorecard sent this specific allegation to the Law Offices of Tony McDonald for review. “Mr. Crouch signed an affidavit for the 2021 tax year. The assertion that the affidavit is false is simply inaccurate,” attorney Garrett McMillan stated.

Crouch said this situation revealed a systemic flaw in TAD’s processes and system. He provided a letter from the Tarrant Appraisal Review Board regarding the protest for this house.

The document lists Johnson as the owner of record. It is dated November 19, 2021, months after Crouch’s purchase in April.

Aside from the fact that he had been retained to represent Johnson to protest the valuation assigned on January 1, 2021, Crouch said he has been told “numerous times” by TAD and the TARB that documents he submits to them must match what is recorded in their own records. “Even if I wasn’t representing [Johnson], I would still have to put that name on there because their own policy, due to flaws in their software system, requires me to put inaccurate information on there so that I can match up with the appraisal district’s inaccurate information,” Crouch said.

Gallagher has experienced similar issues. “If you submit something to TAD that doesn’t match their records exactly, it gets rejected,” she said. “TAD records don’t update immediately.”

We asked Jeff Law about TAD ownership records. He replied that “TAD receives deed information from the Tarrant County Clerk’s office” when properties change hands and said it can take TAD staff up to two weeks to update their records.

We also showed Law the TARB letter from Crouch and asked for comment. Law replied that TAD records show Crouch was the owner since May 20, 2021, and the protest records still listed Johnson as the owner. Law explained this and addressed the matter of Crouch protesting for the previous owner.

“When a protest is filed with the [TARB], the owner of record—at the time of protest—is captured and remains with the protest until the protest is closed,” Law wrote. “There are provisions in the law that allow a subsequent owner to continue the protest filed by [the] previous owner.”

As for Armstrong’s complaint that Crouch protested for a value beneath what he bought it for (the market value), Crouch replied that TAD doesn’t even follow that rule. He provided Texas Scorecard with a copy of his 2022 Property Value Notice from TAD, which shows the value assigned to his house is higher than what he paid.

“They are knowingly valuing my property [at] more than what I purchased it for,” Crouch said. “They don’t hold themselves to the same standard.”

Texas Dept. of Licensing & Registration

Out of all the allegations Armstrong made, TDLR investigator Robert Nino’s report and his communications with both Crouch and Armstrong suggest the state agency may only have considered the complaint regarding the John McCain property. In fact, Armstrong had to go back to Nino and fix “incorrect information” he had given.

The final lowered amount was higher than what Crouch had asked for. When prompted by Nino, Armstrong admitted Crouch didn’t appeal TAD’s decision.

Aaron Heath, a prosecutor in TDLR’s enforcement division, told Texas Scorecard on May 11 that their investigation is “an active case.”

Patterns, Not Isolated Incidents

Law and Armstrong appeared to be attempting, through the Fort Worth Report, to frame the Crouch complaint controversy as a unique situation, where Armstrong alone was responsible. However, Fort Worth Weekly’s editorial board pegged this as part of a pattern in a “culture of deception” within TAD, flowing from Law himself.

According to records we obtained, Armstrong has been employed at TAD since 2009. Taxpayers started paying him $104,752, and as of January 1, 2022, they’re now paying him $161,366.40 with an automobile allowance of $2,500.

Taxpayers also pay a 225 percent match for every participating TAD employees’ contribution into the Texas County and District Retirement system.

The first time Crouch can remember crossing paths with Armstrong was when he complained to TAD about bad advice he said they gave him. “He took exception to that, got very defensive and got loud with me and was very angry. Visibly angry,” Crouch recalled.

Crouch isn’t the only one who has reported issues with Armstrong. It was widely reported that when White Settlement citizen Daniel Bennett missed the deadline to protest his property value in 2016, he and Armstrong butted heads when he tried to get an extension.

“What happened was my 94-year-old WW2 veteran, Bronze Star grandfather had fallen in Illinois,” Bennett told Texas Scorecard. “He was hospitalized for two weeks. We had to arrange transportation to Ohio.” Bennett said Ohio doctors found he had a fractured hip in two places. “The hospital in Effingham, Illinois, failed to correctly diagnose his condition.”

While working on transporting Bennett’s grandfather from Ohio, Bennett missed his due date to file his protest. Armstrong crossed Bennett when he came to try and get a protest hearing. “That’s when he told me if I didn’t like the law, change it.” Bennett said Armstrong gave him forms and told him he could do a “good cause hearing.”

“I figured my grandfather’s grave condition was ‘GOOD CAUSE’,” Bennett said. While standing in line on June 3 to file his “good cause” hearing, Bennett received a call informing him his grandfather had died.

When Bennett came to the hearing, he asked the three-person panel for their definition of “good cause” before the hearing began.

“They had to pull out the property tax book, which is thicker than the Gideon’s Bible, and start looking,” he said. As they continued searching, Bennett agreed to Armstrong being brought in to help define “good cause.” But, as Bennett recalls, Armstrong didn’t; instead, he declared to the panel he had told Bennett that “he shouldn’t be here.”

“Randy was saying that my grandfather’s death didn’t matter,” Bennett said. He lost the hearing in a 2-1 vote.

Gary Losada, a former TAD board member, recalled dealings he had with Armstrong during his time chairing TARB panels. “He tried to bully my panel on a couple of occasions, and I told him that’s not going to happen,” Losada told Texas Scorecard.

Bully them into what? Accepting the taxable values TAD had set for homes and rejecting values homeowners were arguing for.

“When he tried to strong-arm, he got pretty loud in a couple of meetings, and I had to calm him down,” Losada continued. He went on to say that in one particular meeting, he had to ask Armstrong to leave; he eventually calmed down, staying in the meeting and avoiding having a police officer escort him out.

We asked Crouch if he felt his own experience is a feature or a bug of the property tax system in Texas. “I think that what I’m experiencing here is very similar to what so many people have experienced, but they don’t have quite the level of proof,” he replied. “This is something that you will find in many different appraisal districts, this type of attitude.”

He added that he also knows of many good people who work at TAD—good people who could be in a hostile work environment, according to a widely reported allegation that “employees are terrified of Jeff Law.”

Yet Armstrong has somehow managed to stay on at TAD despite these reported antics and conflicts of interest.

Shoutout

Too often those in government engage in cover-ups when under investigation. It should be commended when they do the opposite.

Texas Scorecard sent multiple open records requests to TAD as part of this investigation. To Law’s credit, TAD has been fully cooperative so far.

“TAD has gone to great lengths to respond to your multiple requests and assure compliance with the Public Information Act,” Law replied to Texas Scorecard’s request for comment. “Based on communication with representatives of Mr. Crouch, TAD could have invoked an exception to release of the information you requested, but in the interest of transparency, I elected not to do so.”

Law also wrote he was “taking steps to assure an appropriate review” of the situation involving Armstrong and Crouch and, on advice from “outside legal counsel,” would not comment any further until “the review process” was finished.

The TAD board will hold a meeting on June 30 at 9 a.m., where they are scheduled to discuss the Crouch matter in executive session.

If you or someone you know has had a bad experience with the Tarrant Appraisal District, or any appraisal district in Texas, please contact rmontoya@texasscorecard.com.

No ads. No paywalls. No government grants. No corporate masters.

Just real news for real Texans.

Support Texas Scorecard to keep it that way!