At the bottom of Temple voters’ November ballots is a simple-sounding sales tax proposition that would have a complicated effect on city taxpayers, opening the door for the city to increase property taxes without voters’ approval.

“Want higher taxes? Vote FOR Proposition A,” says Temple-based policy analyst and government watchdog Lou Ann Anderson.

Anderson calls Prop A “an expensive proposition” that would “enable the city of Temple to alter its tax rate calculations and increase the average residents’ property tax liability.”

Temple currently imposes a one and one-half percent tax on sales within the city. One percent is a general revenue sales tax that is used to fund city services. The other one-half percent is a dedicated “additional” sales tax that is levied specifically to offset property taxes.

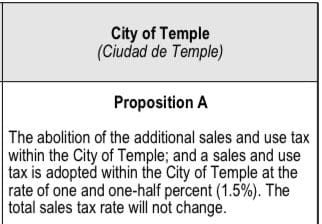

Prop A would abolish Temple’s half-percent “additional sales and use tax” and replace it with another half-percent “sales and use tax.”

The ballot proposition states that the “total sales tax rate will not change,” but does not explain to voters that the swap will change how the sales tax revenue is spent.

If Prop A passes, the half-percent additional sales tax currently dedicated to property tax relief will be re-designated as a general revenue sales tax, keeping the rate the same but eliminating the property tax offset.

The sales tax swap would also affect how the city calculates its no-new-revenue and voter-approval property tax rates, which are required by Texas’ Truth in Taxation laws so voters can asses the impact of taxes imposed by local governments.

Any property tax rate above the no-new-revenue rate is a tax increase. Any tax increase above the voter-approval rate requires a public vote.

Anderson notes that by moving the half-percent away from property tax reduction, the no-new-revenue rate and the voter-approval rate “are automatically higher, allowing for future city taxation without voter approval.”

According to the Texas Comptroller’s office, “If voters abolish the additional sales tax to reduce property taxes, the taxing unit adjusts its no-new-revenue tax rate upward by adding a sales tax loss rate.” The city’s recalculated voter-approval tax rate also increases.

“It’s a huge windfall to the city of Temple and its passage only needs voter approval or a lack of voter education,” adds Scot Arey of the Central Texans for Property Tax Reform Facebook group. “Abolishing the additional sales and use tax removes a constraint on how they set taxes and provides a higher base line for future taxes.”

Based on the city’s 2023 Tax Rate Calculation worksheet, Arey and Anderson say Prop A would increase Temple’s voter-approval rate by at least 15 cents next year.

Anderson says Arey’s point about voter education is especially on target as the ballot measure has received virtually no publicity—even from the government that called the election.

“If this measure is important enough to merit a special election, why isn’t it getting more attention?” asked Anderson.

Swapping the two types of sales taxes in a single ballot proposition may help it pass, as voters simply see that the total rate will not change.

Anderson found a 2021 memo from the Texas Municipal League, a taxpayer-funded lobbying group for city officials, advising members that combining the two measures “protects the city’s interest by eliminating the risk that one tax will be voted out by the citizens without the other tax being voted in.”

“Sadly, this is how government works,” said Anderson. “Taxpayer dollars are used to fund membership in this organization that advocates for endless expansion in the size and scope of government via its organizational guidance and lobbying efforts.”

James Quintero, a policy director for the pro-liberty Texas Public Policy Foundation, told Texas Scorecard the legislature needs to reform the way voters are approached with bond propositions “so that Texans understand the price of voting for or against any measure.”

“Across Texas, voters are being asked to approve or reject propositions that are unclear, misleading, or lacking important context,” said Quintero. “We cannot expect sound fiscal decisions to be made in this type of environment.”

Early voting runs through November 3. Election Day is Tuesday, November 7.