Taxpayer advocates are questioning the validity of Tatum Independent School District’s tax rate election based on what they allege are misleading claims made by the district about the impact of voting “no.”

The advocates say Tatum ISD placed incorrect information on materials promoting the district’s VATRE (Voter-Approval Tax Ratification Election), which is on the November 5 ballot.

School districts must conduct a VATRE when they want to raise property taxes above a maximum increase allowed by state law, known as the voter-approval rate.

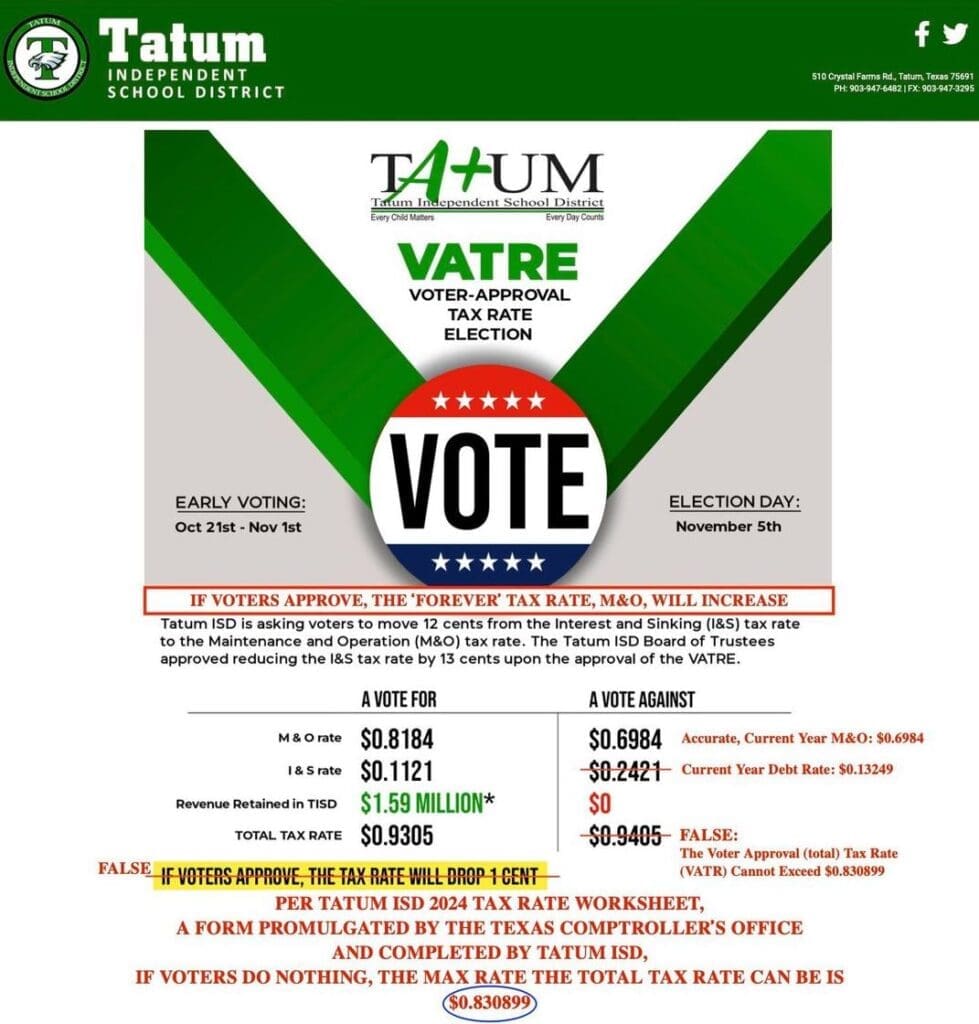

Tatum ISD trustees are proposing a tax rate “swap and drop”—a strategy to increase the taxes collected for maintenance and operations (M&O) while decreasing debt repayment (I&S) taxes, resulting in a lower total rate.

If the VATRE is approved, the district would increase its M&O tax rate by 12 cents, from about $0.70 to $0.82 per $100 of valuation.

District officials also passed a resolution to decrease the I&S rate by 13 cents, from $0.24 to $0.11, but only if the VATRE passes.

The district’s marketing materials claim the swap and drop would result in a net tax rate decrease of one cent compared to if the VATRE does not pass—$0.93 versus $0.94 per $100.

But the numbers on Tatum ISD’s VATRE ads don’t add up, according to citizen advocate Rachel Hale and Morgan Collier, a co-founder of government watchdog group Accountability Matters.

Collier and Hale also noticed that a tax rate calculation worksheet certified by Tatum ISD in August showed the district’s proposed I&S rate as $0.13 and the total voter-approval tax rate as $0.83 per $100.

The two pointed out the discrepancies to district officials.

The voter-approval rate is the default rate if a VATRE fails, meaning that according to the tax rate calculation worksheet, a “no” vote would result in a total tax rate 10 cents lower than the “one-cent drop” promised by the district if the VATRE passes.

The seemingly incorrect information was published on the district’s taxpayer-funded website and featured in promotional mailers and videos produced by the district at taxpayers’ expense.

Collier and Hale also believe district officials incorrectly filled out a legally required notice of public meeting to discuss the proposed tax rate, which was published in a local newspaper on July 31.

In correspondence obtained by Hale through an open records request, Superintendent J.P. Richardson stated that the public notice is “accurate as long as the top of the page is correct.”

District officials have not explained why they will only reduce the I&S rate if the VATRE passes. The VATRE results do not change the district’s debt repayment obligations.

One reason may be that districts can increase the I&S rate at any time as needed without further voter approval. All property taxes used to repay bond debt principal and interest are approved “without limit as to rate or amount” as part of bond propositions.

In other words, a “swap” to increase the M&O rate is permanent, while a “drop” in the I&S rate is temporary.

Other correspondence from the superintendent stated that district administrators had spent “two days stuffing envelopes and making labels” for a pro-VATRE mailing, which included the challenged information, and that videos promoting the VATRE would be played at district football games.

The correspondence also noted that Superintendent Richardson and Assistant Superintendent of Finance Brandon Milam had “presented” tax rate information to staff at “every campus” and planned to meet with “custodial, cafeteria, and maintenance” employees about the election.

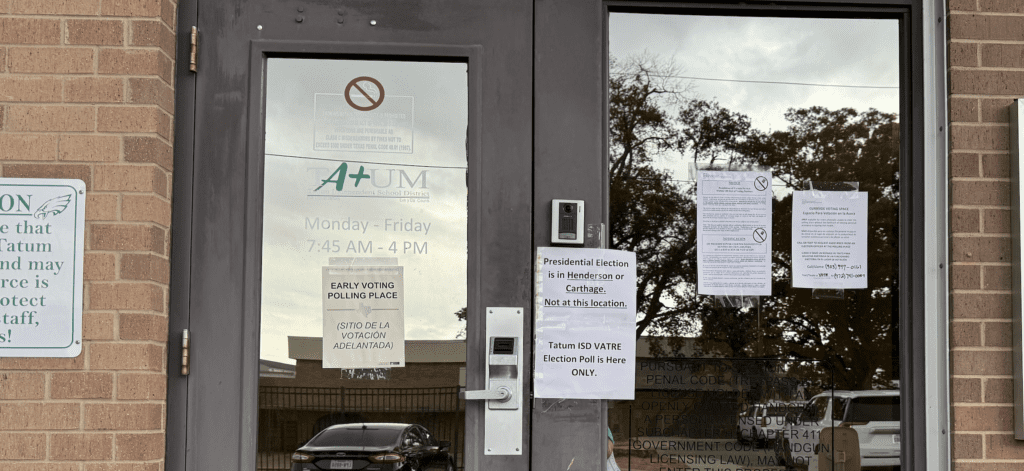

The district is conducting its own election, rather than contracting with the county elections office.

That means school officials are conducting the voting and counting the votes. It also means that voters must cast two separate ballots—one in the General Election and one in the separate school tax election.

Early voting was conducted at Tatum ISD’s administration building. District residents who voted early but only in the General Election can go to the polls on Election Day to vote in the VATRE. The district’s three Election Day polls are located at county polling places but are separate from the county’s.

Collier formed a PAC opposing the district’s proposed tax increase so she could appoint a poll watcher to observe the voting process.

When Collier went to the administration building to file her paperwork, Milam was overseeing the voting and called law enforcement to question her before allowing her poll watcher to observe.

Collier and Hale have already filed complaints with various state agencies and told Texas Scorecard they may file additional challenges to Tatum ISD’s VATRE after the election.

Election Day is Tuesday, November 5.

No ads. No paywalls. No government grants. No corporate masters.

Just real news for real Texans.

Support Texas Scorecard to keep it that way!