A North Texas city councilman has a warning for local taxpayers: Their city council wants to take on $2 million of new debt to avoid lowering their property taxes.

Place 2 Saginaw Councilman Patrick Farr posted on Facebook this week that on July 23, Saginaw City Council was advised by their city manager to increase the taxpayers’ debt load “to avoid lowering the [interest and sinking] tax rate.”

Local property tax rates are made up of two parts: the maintenance and operations (M&O) rate, which finances a local government’s general operating fund, and the interest and sinking (I&S) rate, which finances debt payments.

“This proposal would expose taxpayers to $140,000 in interest for a loan with no other purpose than to prevent the I&S portion of your tax rate from being lowered in [Fiscal Year 2020],” Farr posted.

“In essence, you the taxpayer will be paying $140,000.00 to have the privilege of NOT reducing your tax rate.”

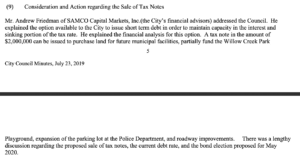

Minutes of the July 23 meeting show council members were informed of “the option available to the City to issue short-term debt in order to maintain capacity in the interest and sinking portion of the tax rate.” Council members were told the debt “can be issued to purchase land for future municipal facilities, partially fund the Willow Creek Park Playground, expansion of the parking lot at the Police Department, and roadway improvements.”

Data from the Tarrant Appraisal District shows the average Saginaw homeowner’s city property tax bill increased 41.2 percent from 2013 to 2018. The Texas Comptroller’s website shows the current outstanding debt born by Saginaw taxpayers sits at over $37 million.

The $2 million debt proposal passed 4-3, and a bond election is set for May of 2020. Saginaw voters will then decide if they want to increase their debt and not lower their property tax burdens.