The Fort Worth City Council is considering a budget that has lower spending, more police officers, and a smaller property tax increase than last year. Fort Worth citizens have until September 22 to weigh in with their council members about their tax burdens.

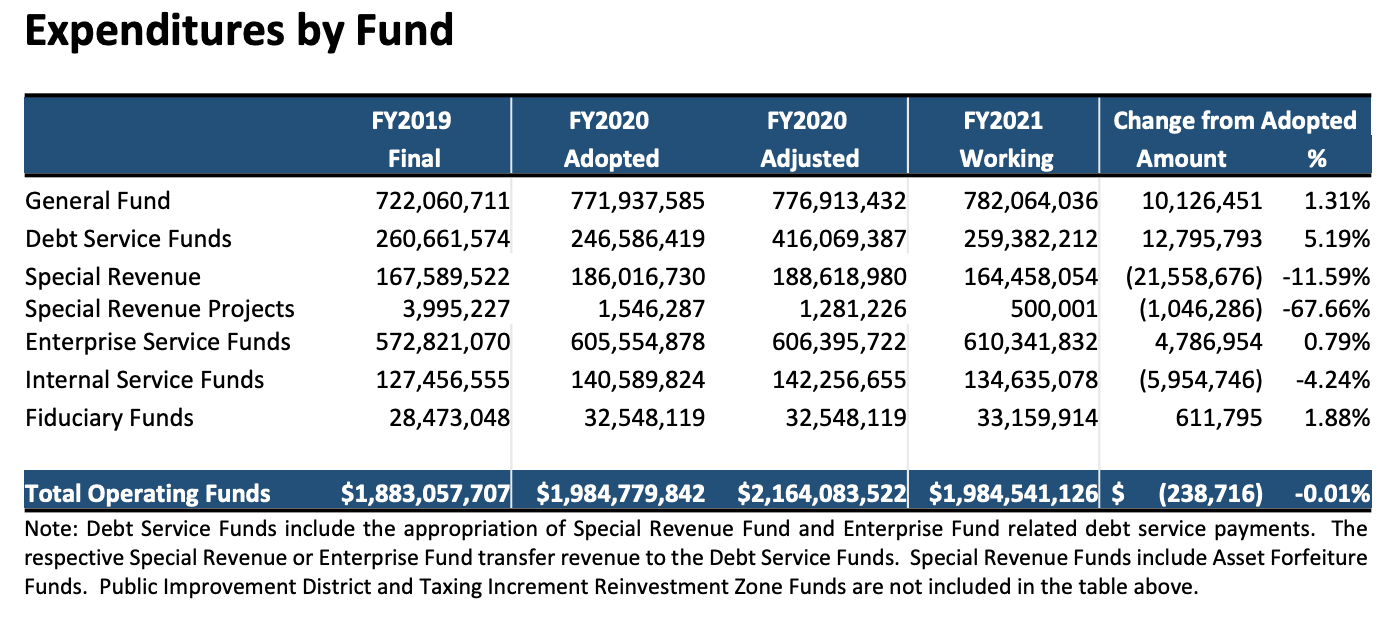

The budget proposed by city staff to the Fort Worth City Council would cut spending by less than 1 percent.

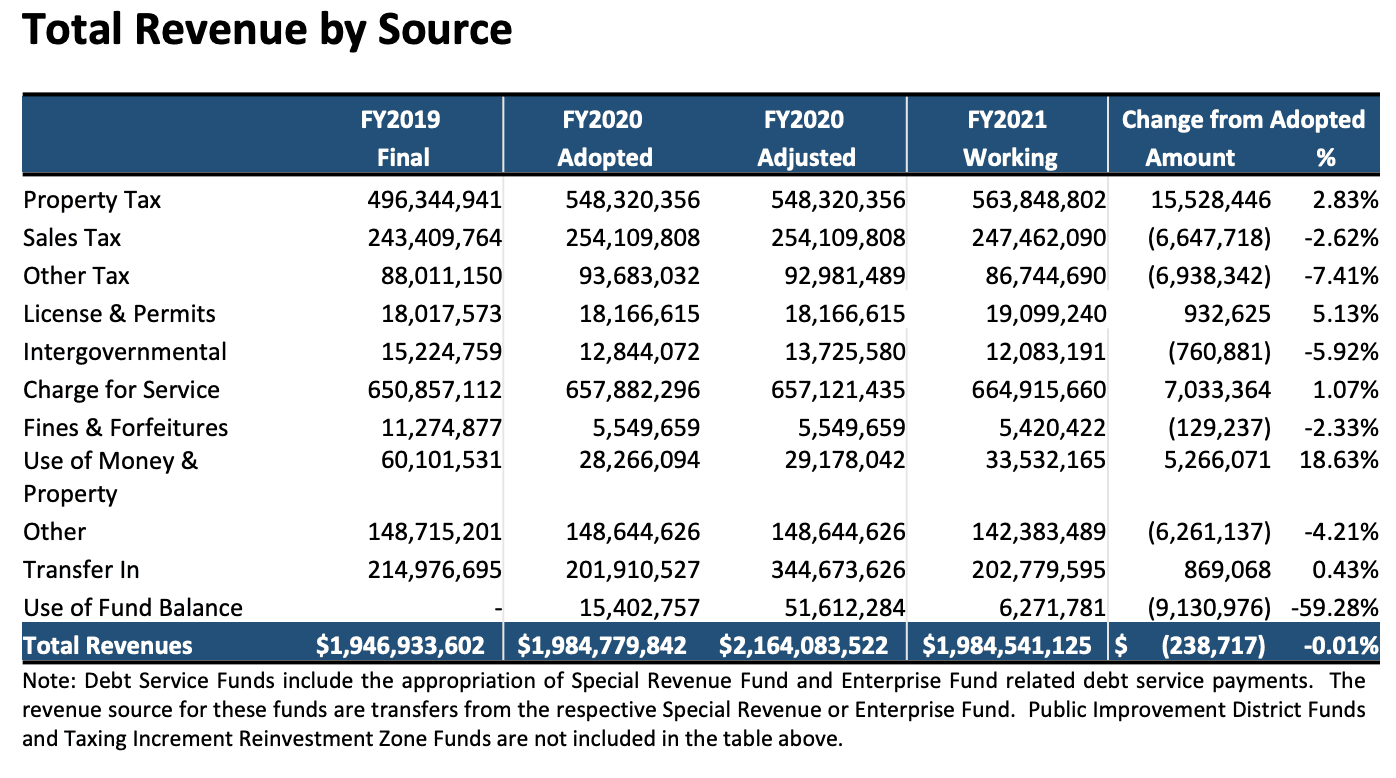

City officials are expecting roughly the same decrease in revenues.

They have also proposed a property tax rate below the no-new-revenue rate—the rate that would collect the same total amount of property tax revenue from the same properties taxed last year, both residential and commercial.

According to data from the Tarrant Appraisal District, Fort Worth’s proposed property tax rate would hike the average homeowner’s city property tax bill 2.46 percent over last year—from $1,193 to $1,222. This is lower than city council’s 4.76 percent tax hike of last year.

The city predicts $21 million in new property tax revenues from the proposed rate, $18 million of which would come from new construction.

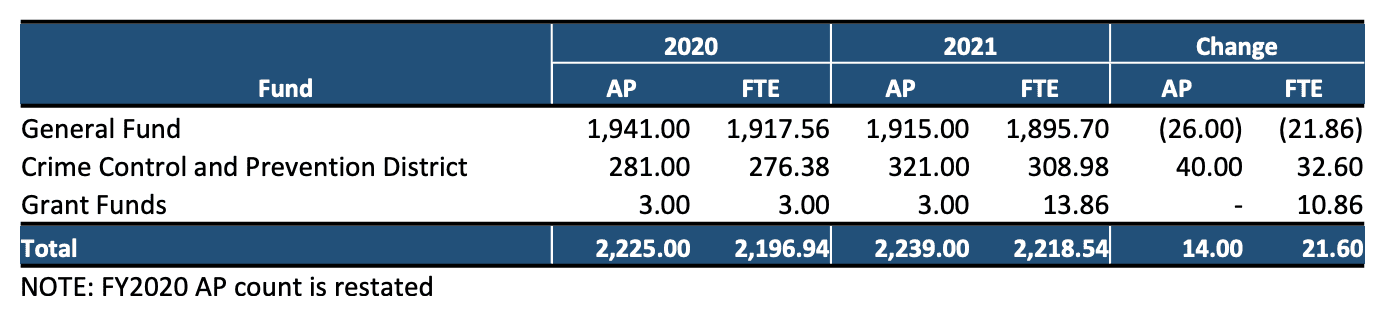

The proposed budget would also add 21 full-time employees to the Fort Worth Police Department, a positive development for citizens concerned about threats to public safety from riots that have swept America’s major cities, as well as the corresponding pushes to cut police funding. Fort Worth citizens rallied in July to support police.

About half of these new hires are being funded through the COPS Hiring Grant, while approximately 21 full-time employees are being shifted from being funded by the city’s general fund to being funded by the Crime Control and Prevent District sales tax.

Created in 1995, the CCPD levies a half-cent sales tax for “Crime Control and Prevention.” This tax keeps the total Fort Worth sales tax within its highest legal limit set by the state at 8.25 percent. Critics have argued the CCPD could be used by city council to paper over budget shortfalls, and that special taxes such as these allow local governments to spend more taxpayer dollars in the general fund elsewhere, while shifting the burden to fund core services of government onto the people through other taxes.

This year, voters approved renewing the tax for 10 years, and it was budgeted to bring in $81 million on top of the police department’s $267 million budget for the current year.

While these trends are encouraging, Fort Worth citizens who’ve suffered due to the government shutdowns in response to the Chinese coronavirus still have time to push for even lower spending and taxes.

City council will be voting on the tax rate and budget on September 28.

District 2 – Carlos Flores: 817-392-8802, District2@fortworthtexas.gov

District 3 – Brian Byrd: 817-392-8803, District3@fortworthtexas.gov

District 4 – Cary Moon: 817-392-8804, District4@fortworthtexas.gov

District 5 – Gyna Bivens: 817-392-8805, district5@fortworthtexas.gov

District 6 – Jungus Jordan: 817-392-8806, District6@fortworthtexas.gov

District 7 – Dennis Shingleton: 817-392-8807, District7@fortworthtexas.gov

District 8 – Kelly Allen Gray: 817-392-8808, District8@fortworthtexas.gov

District 9 – Ann Zadeh: 817-392-8809, District9@fortworthtexas.gov