While local bureaucrats and politicians wait for federal funding for Granger’s real estate redevelopment scheme in North Texas, the local water district can keep the project on long-term life support through taxpayer-backed bonds.

Panther Island, a massive taxpayer-funded government project to reroute the Trinity River via a 1.5-mile bypass—and redevelop prime Fort Worth real estate north of downtown—was conceived in 2003 under the guise of “flood control.”

The venture involves the U.S. Army Corps of Engineers (USACE), Texas Department of Transportation (TxDOT), Tarrant County, the Tarrant Regional Water District (TRWD), the City of Fort Worth, and the Trinity River Vision Authority (TRVA).

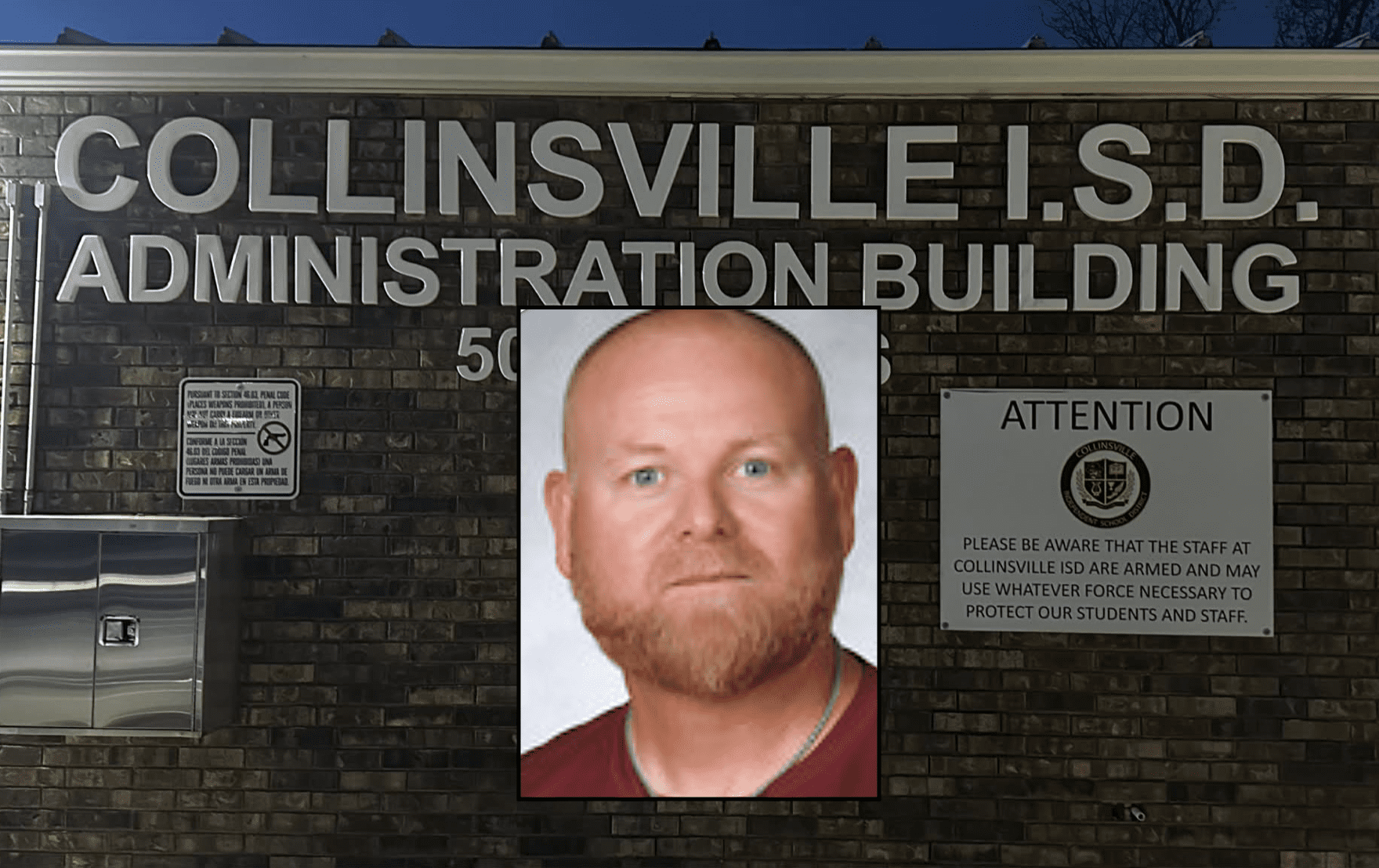

TRVA was tasked with coordinating the project and has been under the authority of J.D. Granger—son of U.S. Rep. Kay Granger—despite lacking any related education or work experience. TRWD General Manager Jim Oliver supported Granger’s hiring and has supported keeping him employed despite their mutual mismanagement of the troubled project.

Under Granger and Oliver’s watch, costs exploded from $435 million in 2006 to more than $1.17 billion in 2018. After 13 years and $383 million of federal, state, and local taxpayer-backed money spent, Panther Island is nowhere near completion—and costs kept rising.

The Trump administration froze federal funding in 2018, which has only totaled $50 million to date. Local stakeholders, in an attempt to restore confidence, had third-party firm Riveron perform a programmatic review. Afterwards, TRVA executed a number of actions, giving only the appearance of reform; one of these actions was hiring a former member of the USACE last November to serve as “program coordinator”—a position recommended nowhere in the review—while Oliver and Granger remained effectively in charge.

By December 2019, federal funding still had not been restored, and Panther Island was running out of money. Sandy Newby, TRWD’s chief financial officer, reported to TRVA’s board that Panther Island’s Tax Increment Reinvestment Zone (TIRZ) only had $73,900 remaining from TRWD’s $200 million loan to the project.

TRVA would face difficulty paying Panther Island bills past December 2019.

To keep the project afloat, Jim Oliver went to the TRWD board, who later voted to sell commercial paper.

“Commercial paper is considered to be a bond, because [TRWD] can’t do short-term loans,” Newby told the TRVA board at this month’s meeting.

$1 million worth of additional commercial paper was issued this month to cover costs for about three months.

Texas Scorecard asked Newby if more would be issued in the future. “It just depends on how the project goes and as we need the money,” she replied. “That’s the key about commercial paper—you only issue it as you think you’re going to expend it.”

When asked, Newby said TRWD could issue a maximum of $150 million of commercial paper for Granger’s Panther Island—all of which is backed by local taxpayers.

Taxpayers deserve a financial or forensic audit—which hasn’t been done yet—to disclose where the hundreds of millions of their money has already gone.

One of Riveron’s key findings has since been proven inaccurate. While the report claimed the project’s design phase was “100 percent complete,” agency officials now admit the project’s design is less than 60 percent complete.

Concerned Texans may contact the Fort Worth City Council and the Tarrant County Commissioners Court, both of which have contributed local taxpayer funds to the project. Congresswoman Granger, who has used her influence to fund the project with federal tax dollars, faces a challenge in the March Republican primary from former Colleyville City Councilman Chris Putnam.