NEWS

McAllen Demands New Leadership

Five candidates run for seats in the City of McAllen, where citizens are focused on the mayoral race.

Liberty County Commissioner Convicted for Personal Use of Taxpayer Dollars

Commissioner Mike McCarty is facing six months in jail and two years probation for using county employees and trucks for his ranch and company.

Huffines Passes Bill to End Vehicle Inspections

In passing the legislation, Huffines was joined by his Republican colleagues and seven Democrats.

Term Limits Are Indirectly on the City of Allen’s May Ballot

Politicians are fond of saying, “We have term limits. They’re called elections.” But elections haven’t limited the Allen mayor’s term, yet.

Texans Have a Say on How Sales Taxes Are Used: Choose Wisely

Special-purpose taxes are one of the few taxes that must be approved by the voters first, and with election day on May 6th, there’s a chance one could be on your ballot. Don’t miss an opportunity to make your voice heard, and know before you go!

Lawmakers Set to Fail Foster Care Children…Again

Reforming Child Protective Services has been a priority for many in the Texas Legislature this session, and...

House Beats Back Efforts at Greater Transparency In Ethics Debate

Cain’s amendment spurred lawmakers to come out of the woodwork, including those who rarely speak at the microphone, to oppose greater transparency.

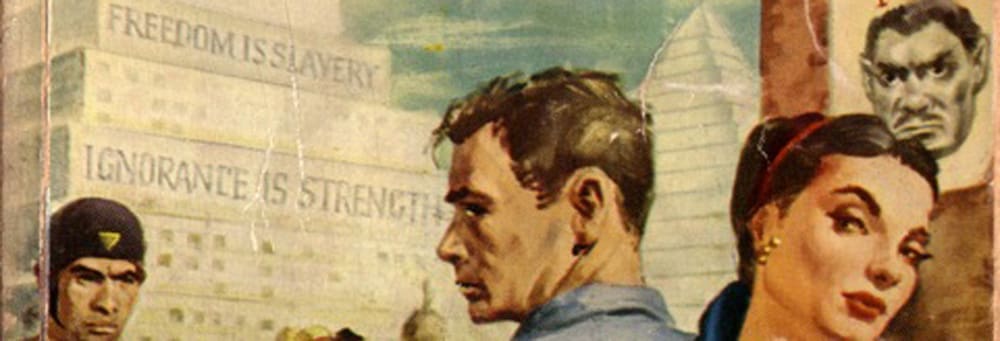

Texas Joins Call for a Convention of States

Texas becomes the eleventh of 34 states needed to call the convention.

Calendar Corruption

Bad legislation by State Rep. Hugh Shine exposes House leadership’s abuse of the “local and consent” calendar.

Lewisville ISD Promotes $737 Million Mega-Bond As a “Basic, No-Frills Package”

Another Texas school district is pushing a mega-bond “for the kids” that includes rising tax burdens, irresponsible debt levels, and excessive spending – all while enrollment is slowing.

Legislation to Ban Sanctuary Cities Passes to Abbott’s Desk

The legislation will now proceed to Abbott’s desk where he is expected to quickly sign it into law.

Poisoning CoS

House leadership weighs down Article V Convention of States resolution with poison pill language.