Citizens are celebrating as a court sided with taxpayers this week on a constitutional amendment which was proposed in 2021 and would allow counties to issue more taxpayer-backed debt. In its ruling, the Court set a rule ensuring voters are entitled to more information when proposals will impact taxpayers.

Proposition 2, which passed with 63 percent of the vote, would authorize counties to issue bonds—taxpayer-backed debt—to fund infrastructure and transportation projects in underdeveloped, unproductive, or blighted areas and to use increases in property taxes from those areas to pay off the debt. This is known as “tax increment financing” and is a tool currently reserved for cities.

Grassroots groups filed a lawsuit alleging the Proposition 2 ballot language that was put before voters failed to comply with common law requirements and was substantially misleading because it neglected to inform voters that the proposal involved debt and property taxes.

Courts have previously ruled that ballot propositions must be described with “such definiteness and certainty that the voters are not misled.” But the Proposition 2 language only said it would allow counties to “finance development,” and it neglected to mention debt or taxes.

In 2011, voters defeated an identical proposition when the state used proper ballot language that discussed the impact the proposal would have on taxpayers.

The lawsuit was brought by Texans Uniting for Reform and Freedom, Grassroots America – We The People, the True Texas Project, and the leaders of the three groups. While a lower court sided with those organizations, the state appealed the decision—leading to a hearing in the Seventh District Court of Appeals in Amarillo earlier this month. The state argued that voters could never challenge language proposed by the legislature, citing the Texas Constitution’s separation of powers provision.

While a decision wasn’t expected for months, on Thursday evening the Court of Appeals issued an opinion siding with taxpayers against the amendment.

The Proposition 2 ballot language approved by voters stated, “A constitutional amendment authorizing a county to finance the development or redevelopment of transportation or infrastructure in unproductive, underdeveloped, or blighted areas in the county.”

In its opinion, the Court noted that the language was facially misleading.

“As can be seen, nothing was said about how the ‘development or redevelopment of transportation or infrastructure’ would be financed or who would fund it. Hidden from view was the ultimate responsibility for payment and its positioning over the voter’s head like the sword of Damocles,” the opinion states.

The opinion went on to quote songs by The Beatles and Johnny Cash:

Whether it be “Taxation without representation” or “Should five percent appear too small, be thankful I don’t take it all” or “There goes the shirt off my back” or “I’m payin’ taxes but what am I buyin’?” each exemplifies the perennial interest of the citizenry in protecting the fruits of their labor from expropriation by the government. No doubt, a component of a constitutional amendment enabling the government to further appropriate money from one’s pocket would be a chief feature of the proposal. It matters not whether the appropriation is certain or a likelihood. The risk of additional loss made possible by adoption of the amendment remains, and it is a risk of historical and prime interest to the voting public.

Terri Hall, the founder and director of TURF, told Texas Scorecard she is glad to see the decision made swiftly.

“The lightning speed of the decision by the appellate court affirms our contention that the legislature unequivocally and quite deliberately sought to mislead voters by removing the language informing them about the potential property tax hit in Prop. 2,” said Hall. “Chief Justice Quinn is right. The threat of property tax increases are absolutely of vital importance to voters (and in such a down to earth manner, too, quoting Johnny Cash and the Beatles to make his point!). Shame on the legislature for their dirty tricks! We knew if they got away with it this time, taxpayers could count on it EVERY time.”

“We warned the legislature not to pass it without that the part about property tax increases, and Senator Bob Hall tried to get his Senate colleagues to insert it on the floor, but the Senate decidedly voted it down. So this very public smackdown by the court is squarely on them. They can’t claim ignorance. It’s time to clean up the Texas legislature, and return it to the people they’re elected to serve,” she added.

With the Court of Appeals siding with the lower court, the Attorney General’s office must now decide whether they will once again appeal the case to the Texas Supreme Court.

“While we sincerely hope that Attorney Geneal Ken Paxton and Secretary of State Jane Nelson will accept the Court’s decision and not appeal, the most important take-away from this effort is the power of an educated, courageous, strategic grassroots movement,” said JoAnn Fleming, the executive director of GAWTP. “Terri Hall is THE transportation subject matter expert of the Texas conservative grassroots movement. Terri and the other subject matter experts in our movement are the greatest defense Texans have to rogue state government. We thank Terri for her tenacious protection of taxpayers.”

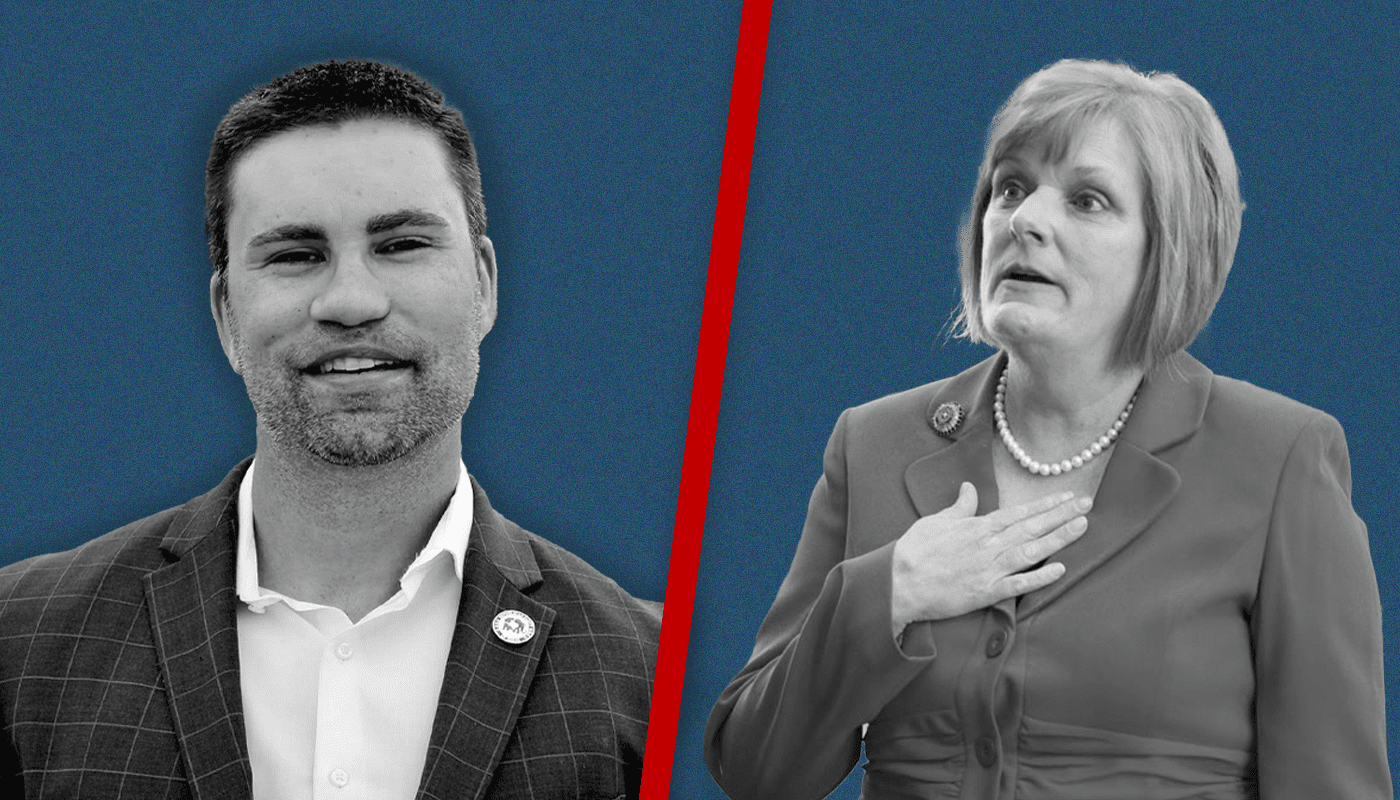

Julie McCarty, the founder and CEO of True Texas Project, says she is celebrating the win but cognizant that the fight may not be over.

“The win is exciting and taxpayers across Texas should be giddy! BUT … it’s not a done deal,” said McCarty. “We are hopeful Paxton and Nelson will accept the decision and not appeal. If so, we just axed a tax AND protected taxpayers from sneaky, tax-hiking ballot language forever! If not, we’re at least protected from that tax hike while they battle … and then we will still likely win!”

Tony McDonald, the attorney who argued the case on behalf of the grassroots organizations, agreed.

“Long before they were bureaucrats, Ken Paxton and Jane Nelson were taxpayer champions first. They have an opportunity to leave this opinion in place—setting in place a rule that will protect taxpayers and voters forever,” said McDonald.

As of publishing, the Office of the Attorney General had not commented on whether they will appeal the decision again.